Topic 1: Volume A

The selling/ planning process has __________ steps.

A. Four

B. Five

C. Seven

D. Eight

Incase of Policies issued by the LIC, _______________ days of grace are allowed for monthly premiums.

A. 7 days

B. 10 days

C. 15 days

D. 20 days

There are______ key estate planning strategies to transfer wealth efficiently. In a Granted Retained Annuity Trust, annuity payments are determined in relation to IRS benchmark interest rate called ____________ rate.

A. Four, Section 7520

B. Six, Section 7520

C. Four. Section 7620

D. Six, Section 7620

Mr. Raj, the intestate, leaves no brother or sister but leaves his mother and one child of a deceased sister, Mary and two children of a deceased brother, George. How will the Estate be distributed?

A. Raj’s Mother will be receive all the Property.

B. Raj’s Mother will take 50% of the share while remaining 50% will be divided equally between the three children.

C. Raj’s mother will take one-third, Mary’s child will take one-third and the children of George will divide the remaining one-third equally between them.

D. Raj’s mother will take 50% of the share and remaining will be divided between George’s children

A person is deemed to have attained majority on completion of __________________ in case where a guardian of a minor’s property is appointed under the Guardian and Wards Act,1890.

A. 15 years

B. 16 years

C. 18 years

D. 21 years

Estate planning as a process includes?

A. Accumulation of an estate

B. Conservation of an estate

C. Distribution of an estate

D. All of the above

Public Limited Companies have a minimum paid up capital of ______________ or such higher capital as may be prescribed.

A. Rs 1,00,000

B. Rs.3,00,000

C. Rs.5,00,000

D. Rs10,00,000

_________________ can be used as an alternative to the outright gift and ___________ can be used as an alternative to a traditional short term pledge.

A. Virtual Endowment Model, Step-Up gift

B. Virtual Endowment Model, Philanthropic Equity Builder Model

C. Virtual Endowment Model, Family Foundation

D. Step-Up Gift, Family Foundation

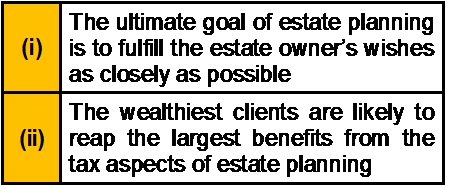

Which of the following statement(s) about Estate Planning is/are true?

A. Neither (i) nor (ii)

B. Both (i) and (ii)

C. Only(i)

D. Only (ii)

There are four general categories of charitable gifts for donors and non-profits to consider. Out of these________ and ____________ require no contracts, trusts, trustees or special income tax returns. On the other hand, for __________ and _____________most donors and non-profits will need significant level of financial sophistication.

A. Outright Gifts, Bequest, Life Income Gifts, Family Foundations

B. Outright Gifts, Life Income Gifts, Bequest, Family Foundations

C. Family Foundation, Bequest, Life Income Gifts, Outright Gifts

D. Family Foundation, Outright Gifts, Life Income Gifts, Bequest

There are_________ steps to implement Philanthropy Planning and the first step is__________.

A. Three, Gift Design

B. Three, Discovery

C. Four, Gift Design

D. Four, Discovery

Wills executed according to __________ of the _____________ are called Unprivileged Wills.

A. Section 8, Hindu Succession Act 1956

B. Section 63, Indian Succession Act 1925

C. Section 8, Indian Succession Act 1925

D. Section 63, Hindu Succession Act 1956

| Page 1 out of 40 Pages |