Topic 1: Volume A

You are an Estate Planner. Mr. Arun Mittal, a HNI client asks you to explain him the number of ways to dispose of his wealth. You explain to him about the three ways of disposing wealth. He further asks you to give ranking to the methods-from most preferred to least preferred. You tell Mr. Arun that the correct order is _________________.

A. Consumption, Inheritance, Philanthropy

B. Inheritance, Consumption, Philanthropy

C. Philanthropy, Inheritance, Consumption

D. None as he can dispose his wealth in any order.

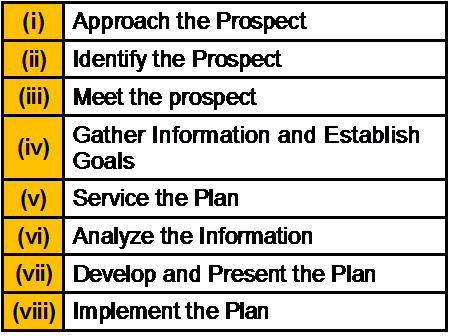

Estate Planning Process is eight-step procedure that a manager has to follow. The Eight

Steps are as given below (not in any order)

The correct order is

A. (i)-(ii)-(iii)-(iv)-(v)-(vi)-(vii)-(viii)

B. (ii)-(i)-(iii)-(iv)-(vi)-(vii)-(viii)-(v)

C. (ii)-(i)-(iii)-(iv)-(vi)-(vii)-(v)-(viii)

D. (ii)-(i)-(iii)-(iv)-(vi)-(v)-(vii)-(viii)

_________ is the most appropriate method for donors who prefer to make gifts at the end of their life and _________ is the most appropriate method for donors who prefer to give gifts during their lifetime.

A. Bequest and Outright Gift

B. Outright Gift and Bequest

C. Family Foundation and Life Income Gifts

D. Life Income Gifts and Family Foundation

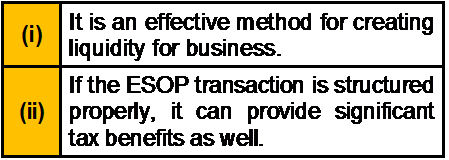

Which of the following statement(s) about ESOP is/are incorrect?

A. Both (i) and (ii)

B. Only (i)

C. Only (ii)

D. Neither (i) nor (ii)

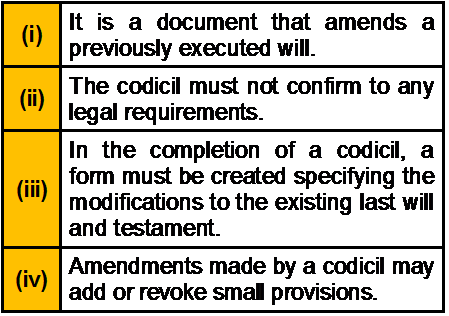

Which of the following statement(s) about codicil is/are correct?

A. Only (i)

B. Both (i) and (iv)

C. (i),(ii),(iii) and (iv)

D. (i),(iii) and (iv)

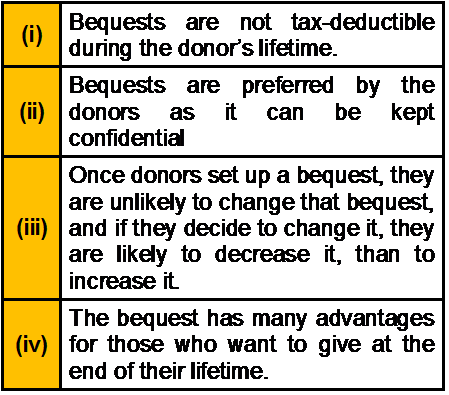

Which of the following statement(s) about Bequest is/are correct?

A. All except (iv)

B. All except (iii)

C. All (i),(ii),(iii) and (iv)

D. None of (i),(ii),(iii) and (iv)

Which of the following is essential for contract?

A. Free Consent

B. Witness

C. Signatory

D. Consideration

As per Employee Provident Fund, a member can withdraw________ of the amount of provident fund at credit after attaining the age of 54 years or within one year before actual retirement or superannuation whichever is later.

A. 100%

B. 90%

C. 75%

D. 50%

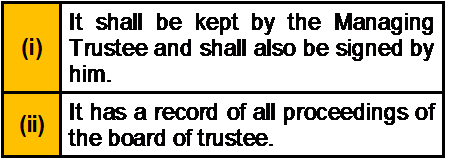

Which of the following statement(s) about Minute Book is/are correct?

A. Both (i) and (ii)

B. Neither (i) nor (ii)

C. Only (i)

D. Only (ii)

A__________ can bring significant gift and estate tax savings.

A. Granted Retained Annuity Trust

B. Family Limited Partnership

C. Intentionally Defective Grantor Trust

D. Buy and Sell Agreement

More than_______ in wealth classifies the person as “Ultra HNI”

A. $1 million

B. $10 million

C. $50 million

D. $100 million

___________ is a brief description of what you do and what you serve.

A. Personal Brochure

B. Elevator Speech

C. Public Persona

D. Direct mail

| Page 2 out of 40 Pages |

| Previous |