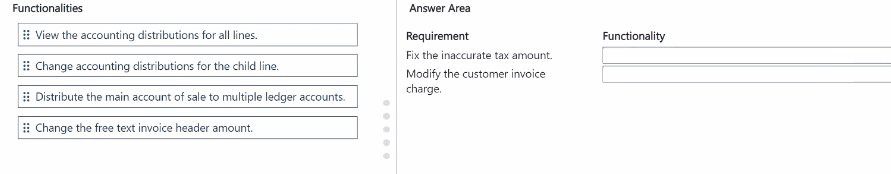

A company uses Dynamics 365 Finance.

A manager reviews a free text invoice. The manager observes that the tax amount and total invoice charges are inaccurate.

You need to change the free text invoice so the tax and charge are accurate.

Which functionalities should you use? To answer, drag the appropriate functionalities to the correct requirements. Each functionality may be used once, more than once, or not at all.

You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Explanation:

This is a classic "drag-and-drop" question testing knowledge of correcting financial transactions in Dynamics 365 Finance. The core issue is an inaccurate customer invoice charge, which directly impacts the tax calculation. In D365 Finance, charges are applied at the header or line level, and modifying them is the direct method to fix both the charge amount and its resulting tax.

Correct Pairing:

Requirement: Fix the inaccurate tax amount.

Functionality: Modify the customer invoice charge. Tax in D365 Finance is typically calculated based on the net amount, which includes charges. Therefore, the root cause of an incorrect tax is often an incorrect charge. Correcting the charge will automatically trigger a recalculation of the tax, fixing this inaccuracy indirectly.

Requirement: Modify the customer invoice charge.

Functionality: Modify the customer invoice charge. This is a direct match. The "Modify the customer invoice charge" functionality is the specific tool for adding, removing, or adjusting charges (like freight or fees) applied to a free text invoice.

Incorrect Options for These Requirements:

View the accounting distributions for all lines.

This is a diagnostic/read-only action. It allows you to see where amounts are posted in the ledger but does not allow you to change transactional values like charges or tax.

Change accounting distributions for the child line.

This refers to manually overriding the default ledger accounts for a specific sub-line (like tax or a charge), not changing the monetary value of the transaction itself. It affects where an amount is posted, not what the amount is.

Distribute the main account of sale to multiple ledger accounts.

This is about splitting the revenue amount across different financial dimensions or ledger accounts for detailed tracking. It does not alter the invoice total, charge, or tax.

Change the free text invoice header amount.

This is not a standard, safe practice. The header amount is a calculated total from lines, charges, and tax. Directly changing it would create inconsistencies. The proper method is to correct the underlying lines or charges, which then updates the header total.

Reference:

Microsoft Learn - "Work with accounts receivable in Dynamics 365 Finance" (Modules: Configure accounts receivable, Process free text invoices). Specifically, procedures for managing and adjusting charges on invoices, which are foundational for accurate tax calculation.

A company uses Dynamics 365 Finance and Power Bl.

The company wants to use Power Bl to create high-volume, near real-time reports.

You need to identify how the company can meet this requirement.

Which option should you use?

A. SQL Server Reporting Services (SSRS)

B. Microsoft Excel

C. Power Bl tiles

D. Entity store

Explanation:

This question tests knowledge of the optimal data storage architecture for high-volume, near real-time Power BI reporting in Dynamics 365 Finance. While several tools can display data, the requirement for high-volume and near real-time reporting dictates the need for a dedicated, performant analytical database that is automatically refreshed by the Finance application.

Correct Option:

D. Entity store.

The Entity Store is a purpose-built, Azure SQL Database provisioned by Dynamics 365 Finance. It is specifically optimized for analytical queries and is the recommended data source for Power BI when dealing with large Finance datasets. It supports incremental refresh, enabling high-volume data to be updated in near real-time (as frequently as every minute), meeting the core requirement.

Incorrect Options:

A. SQL Server Reporting Services (SSRS).

SSRS is used for operational, paginated reports (like invoices and statements) that are run directly against the transactional SQL database. It is not optimized for the high-volume, interactive visual analytics required by Power BI and can negatively impact the performance of the live transactional system.

B. Microsoft Excel.

While Excel can connect to Finance data via OData or Analyze in Excel, it is not a scalable solution for high-volume, near real-time enterprise reporting. Excel workbooks have size and refresh limitations and are not designed for the performance or governance needs described.

C. Power BI tiles.

Power BI tiles are the visual elements (like charts and graphs) placed on a dashboard. They are the output of a report, not a data source or architecture. The question asks how to meet the requirement, which relates to the underlying data infrastructure, not the visualization component.

Reference:

Microsoft Learn - "Introduction to analytics and reporting in finance and operations" (or "Configure the Entity store for Power BI reporting"). Documentation explicitly states that the Entity store is the analytical database designed to enable real-time, interactive reporting in Power BI without impacting transactional system performance.

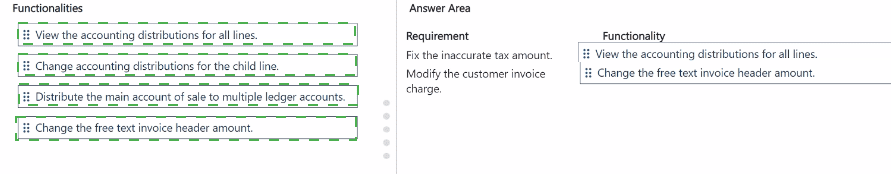

For each of the following statements, select Yes if the statement is true. Otherwise, select No.

NOTE: Each correct selection is worth one point.

Explanation:

This question tests foundational knowledge of the Dynamics 365 application suite and the specific capabilities of its Finance module. It requires distinguishing the broad scope of the overall Dynamics 365 platform from the precise functions of one of its applications, Dynamics 365 Finance.

Correct Option Explanations:

Statement 1:

Yes. This is the core value proposition of the Dynamics 365 platform. It is a unified suite of modular, interconnected applications (like Finance, Supply Chain Management, Sales, and Customer Service) that together can cover end-to-end ERP and CRM processes for a business.

Statement 3:

Yes. This accurately describes the primary purpose of Dynamics 365 Project Operations, which is closely integrated with (or an extension of) Dynamics 365 Finance. It is specifically designed for project-driven businesses to connect project management, resourcing, and sales with the financials managed in Finance.

Incorrect Option Explanation:

Statement 2:

No. This statement describes the core function of Dynamics 365 Supply Chain Management, not Dynamics 365 Finance. While Finance integrates with Supply Chain, it focuses on general ledger, accounts payable/receivable, budgeting, and fixed assets—not the detailed planning and execution of manufacturing operations.

Reference:

Microsoft Learn - "Explore Dynamics 365 applications" and "Explore Dynamics 365 Finance." The learning material explicitly defines Dynamics 365 as a suite of integrated apps for both ERP and CRM, clarifies that manufacturing is handled by Supply Chain Management, and identifies Project Operations as the solution for project-centric financials.

A company purchases Dynamics 365 finance.

Which two features can the company implement? Each correct selection presents a complete solution.

NOTE: Each correct selection is worth one point.

A. Accounts receivable

B. General ledger

C. Omnichannel

D. Manufacturing

E. Payment fraud prevention

Explanation:

This question tests fundamental knowledge of the functional scope of the Dynamics 365 Finance application. It is a standalone application focused on the core financial management modules of an ERP system. The correct answers are the features that are native, central components of this specific application.

Correct Options:

A. Accounts receivable:

This is a primary, native module within Dynamics 365 Finance. It manages all aspects of customer invoicing, payments, credit, collections, and cash application, forming a core part of the financial operations.

B. General ledger:

This is the foundational, central module of any financial management system, including Dynamics 365 Finance. It is where all financial transactions are ultimately recorded and is essential for financial reporting and compliance.

Incorrect Options:

C. Omnichannel:

This is a feature of the Dynamics 365 Customer Service application. It enables customer service across multiple channels like chat, social media, and phone. It is a CRM capability, not a core finance ERP feature.

D. Manufacturing:

Production planning, scheduling, and shop floor control are the primary functions of the Dynamics 365 Supply Chain Management application. While Finance integrates with it for costing and inventory valuation, the manufacturing execution features themselves are not part of the Finance app.

E. Payment fraud prevention:

While financial systems may have related controls, advanced payment fraud detection and prevention is typically a feature of specialized fraud management services or is a capability more closely associated with banking and payment gateways, not a core, headline module of the D365 Finance application.

Reference:

Microsoft Learn - "Explore Dynamics 365 Finance." The learning path and documentation list the core modules, which explicitly include General ledger and Accounts receivable, while Omnichannel and Manufacturing are listed under other applications like Customer Service and Supply Chain Management.

A company is evaluating the capabilities of Dynamics 365 Supply Chain Management for its new research and development projects.

The company plans to use only core functionality natively built into the application to replenish inventory for its new prototype products.

You need to identify the capability in Dynamics 365 Supply Chain Management.

Which capability can you use?

A. Internet of Things

B. Dynamics 365 Project Operations

C. master planning

D. general ledger

E. Power Apps

Explanation:

This question asks for a core, native functionality within Dynamics 365 Supply Chain Management (SCM) specifically used to replenish inventory. The key is that it must be built into the SCM application and be the primary process for calculating and triggering replenishment (purchase orders, production orders, or transfers) based on demand and supply.

Correct Option:

C. Master planning:

This is the correct, core capability. Master planning (specifically Master planning or MRP - Material Requirements Planning) is the native engine in D365 SCM that automatically calculates net requirements for items. Based on demand (like sales orders or forecast) and current inventory, it generates planned purchase, production, and transfer orders to replenish stock, which is exactly the described need.

Incorrect Options:

A. Internet of Things (IoT):

While D365 SCM can integrate with IoT intelligence (e.g., for predictive maintenance or asset monitoring), IoT is an extension or connected service, not the core, native functionality for calculating inventory replenishment.

B. Dynamics 365 Project Operations:

This is a separate application focused on project-based service delivery, connecting to finance and resource management. It is not a core, native module of SCM for inventory replenishment planning.

D. General ledger:

This is a core module of Dynamics 365 Finance, used for financial accounting and reporting. It is not a Supply Chain Management function for planning inventory replenishment.

E. Power Apps:

Power Apps is a separate, low-code application development platform used to build custom apps that extend Dynamics 365. It is not a native, built-in feature of the SCM application for inventory planning.

Reference:

Microsoft Learn - "Get started with Dynamics 365 Supply Chain Management" or "Master planning overview". The documentation defines master planning as the core process for determining required materials and generating planned orders to fulfill demand.

A company implements Dynamics 365 Finance.

The company needs to improve its reporting capabilities.

The reports must be near-real-time and provide interactive capabilities.

You need to recommend an integration that will meet the requirements.

Which tool should you recommend?

A. Business documents

B. Electronic reporting

C. Microsoft Power Bl Embedded

D. Microsoft Excel

Explanation:

This question focuses on selecting a reporting tool that satisfies two key requirements for Dynamics 365 Finance: near-real-time data and interactive capabilities. The correct choice must provide advanced analytics, live dashboarding, and the ability to connect directly to the Finance data infrastructure for timely updates.

Correct Option:

C. Microsoft Power BI Embedded.

While Power BI Service is the common answer, Power BI Embedded is the correct and more precise technical choice here. It refers to the capability of embedding Power BI's interactive reports and dashboards (with near-real-time refresh via the Entity store) directly into other applications or portals, which is the standard integration pattern for Dynamics 365 Finance. It fulfills both the interactivity and near-real-time requirements.

Incorrect Options:

A. Business documents:

This refers to SSRS-based, paginated documents like invoices, purchase orders, and financial statements. These are static, print-oriented documents and do not offer the interactive, exploratory analytics required.

B. Electronic reporting (ER):

ER is a tool for configuring electronic document formats (like EDI, XML, or tax filings) for regulatory compliance and data exchange. It is not an interactive, analytical reporting tool for business intelligence.

D. Microsoft Excel:

While Excel can connect via "Analyze in Excel," it has limitations in handling near-real-time, high-volume data interactively at an enterprise scale. It is a personal productivity tool, not the recommended platform for centralized, interactive, and embedded enterprise reporting.

Reference:

Microsoft Learn - "Introduction to analytics and reporting in finance and operations" and "Power BI integration overview." The documentation specifies Power BI (and by extension, Power BI Embedded for integration) as the tool for interactive, real-time analytics and visualization, while differentiating it from operational reporting (SSRS/ Business documents) and electronic document configuration (ER).

Which two modules are included in Dynamics 365 Supply Chain Management? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

A. Product information management

B. Project management and accounting

C. Service hub

D. Dynamics 365 Remote Assist

E. Master planning

Explanation:

This question tests knowledge of the core functional modules that are part of the Dynamics 365 Supply Chain Management (SCM) application. The correct answers must be native, central components of the SCM product, not separate applications or modules belonging to other Dynamics 365 apps like Finance or Field Service.

Correct Options:

A. Product information management:

This is a foundational module within D365 SCM. It is responsible for creating and maintaining the master data for all products and their variants, including definitions, dimensions, bills of materials (BOMs), and routes, which is essential for all supply chain and manufacturing processes.

E. Master planning:

This is the core planning engine of D365 SCM. It runs Material Requirements Planning (MRP) to calculate net requirements and generate planned purchase, production, and transfer orders to fulfill demand, making it indispensable for inventory replenishment and production scheduling.

Incorrect Options:

B. Project management and accounting:

This is a core module of Dynamics 365 Finance (and is central to Dynamics 365 Project Operations). It is used for managing project costs, revenue, billing, and profitability, not a standard component of the Supply Chain Management application.

C. Service hub:

This is a primary module within Dynamics 365 Customer Service, which is a CRM application. It manages customer service cases, knowledge articles, and service-level agreements, and is not part of the SCM suite.

D. Dynamics 365 Remote Assist:

This is a separate, mixed-reality application designed for remote collaboration using HoloLens or mobile devices. It integrates with Field Service and SCM for scenarios like remote expert guidance but is not an included module within the Supply Chain Management application itself.

Reference:

Microsoft Learn - "Explore Dynamics 365 Supply Chain Management." The module lists for Supply Chain Management explicitly include Product information management and Master planning, while Project management, Service hub, and Remote Assist are documented under Finance, Customer Service, and Mixed Reality applications, respectively.

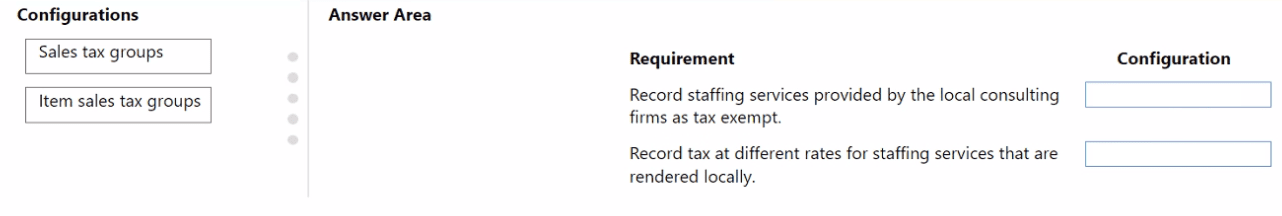

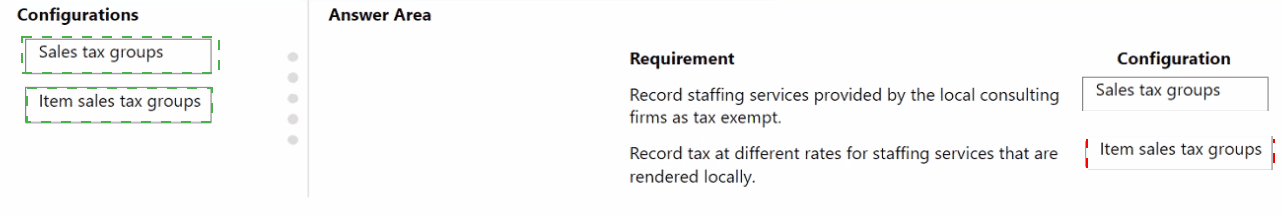

A recruitment company is implementing Dynamics 365 Finance. The company hire sservice providers from local and foreign consulting firms to fulfill local staffing demands.

Services that are rendered locally are taxed at different rates based on regional laws.

Goods and services purchased from foreign companies are exempt.

The company requires tax code groups to comply with reporting requirements.

You need to set up the tax code groups.

What should you configure? To answer, drag the appropriate configurations to the correct requirements. Each configuration may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Explanation:

This drag-and-drop question tests the understanding of two fundamental tax setup concepts in Dynamics 365 Finance: Sales tax groups and Item sales tax groups. The key is to map the business requirement about who or what is being taxed to the correct group type.

Correct Pairing:

Requirement:

Record staffing services provided by the local consulting firms as tax exempt.

Configuration:

Sales tax groups. A Sales tax group is attached to a customer or vendor and defines the tax obligations of that party. To record a foreign consulting firm's services as tax-exempt, you would assign a Sales tax group to that vendor that links to a tax code with a 0% (exempt) rate for the relevant transaction type and location.

Requirement:

Record tax at different rates for staffing services that are rendered locally.

Configuration:

Item sales tax groups. An Item sales tax group is attached to products or services (items) and defines how those specific items are taxed. To apply different tax rates to the "staffing services" item based on regional laws, you configure an Item sales tax group for staffing services. This group is then associated with the tax codes for the different local rates.

Why This is Correct:

The setup follows a matrix logic:

The applicable tax code for a transaction is determined by the intersection of the Sales tax group (assigned to the vendor/customer) and the Item sales tax group (assigned to the service/item). This allows you to define that Staffing Services (Item group) from a Foreign Vendor (Sales tax group) use a 0% tax code, while the same Staffing Services from a Local Vendor (Sales tax group) use a standard local tax code.

Reference:

Microsoft Learn - "Set up sales tax in Dynamics 365 Finance." The documentation clearly explains that Sales tax groups are used for legal entities (vendors/customers), and Item sales tax groups are used for products/services. The tax calculation uses the combination of both to find the correct tax code.

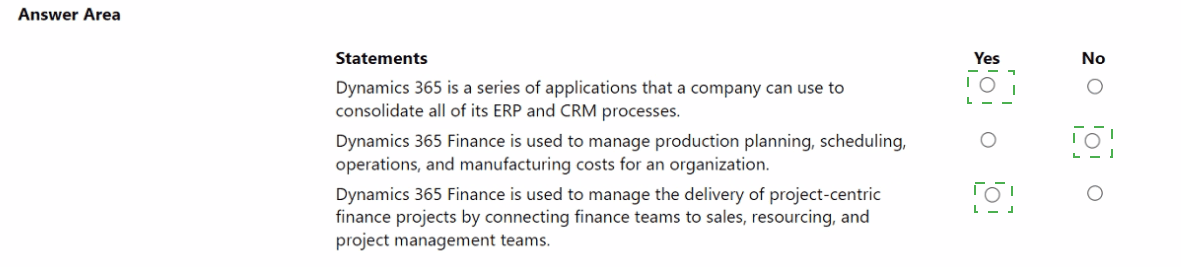

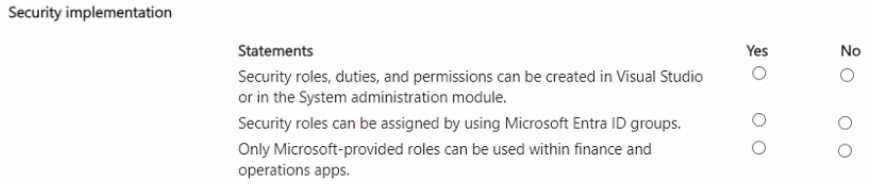

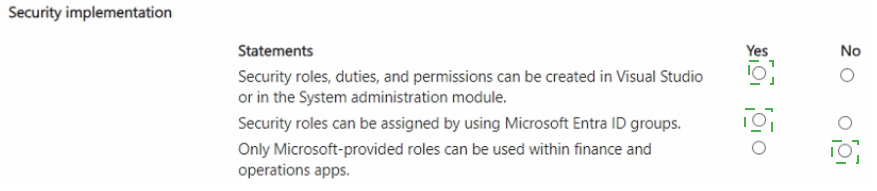

For each of the following statements, select Yes if the statement is true. Otherwise, select No. NOTE: Each correct selection is worth one point

Explanation:

This question assesses core knowledge of the security model in Dynamics 365 Finance and Operations apps. It covers the tools for creating security elements, modern assignment methods, and the flexibility of the role-based security system.

Correct Option Explanations:

Statement 2:

Yes. This is a modern best practice. Security roles in D365 can be associated with Microsoft Entra ID (formerly Azure AD) groups. Assigning a user to an Entra ID group that is linked to a D365 security role automatically grants them that role, simplifying user lifecycle management.

Statement 1:

No. While security roles and duties can be modified in the System administration module, the core elements—privileges, duties, and roles—are primarily created and defined in Visual Studio as part of the development/implementation process. The admin module is for configuring and assigning existing roles.

Statement 3:

No. This is false. The security architecture is highly customizable. Organizations can copy and modify Microsoft-provided roles or create entirely new custom roles, duties, and privileges from scratch to meet their specific business needs.

Reference:

Microsoft Learn - "Role-based security in finance and operations apps." The documentation details that security artifacts (privileges, duties) are developed in Visual Studio, that roles can be assigned via Entra ID groups for streamlined administration, and that the system is designed to be extensible, allowing for custom security roles.

A construction services firm plans to standardize financial and payroll functions including the capability of adding timesheets to track work and costs for community improvement projects. You need to recommend a solution for the company. What should you recommend?

A. Power Platform

B. Dynamics 365 Project Operations

C. Dynamics 365 Supply Chain Management

D. Dynamics 365 Human Resources

Explanation:

This scenario describes a project-centric business (construction services) with a core need to track time and costs against specific community projects for financial and payroll purposes. The key requirement is linking timesheets directly to project costs and financials, which is the specialty of a project management and accounting solution.

Correct Option:

B. Dynamics 365 Project Operations.

This is the precise recommendation. Dynamics 365 Project Operations is designed for project-driven organizations. It seamlessly connects project management, resourcing, and time/expense tracking (via timesheets) with the core financial modules of Dynamics 365 Finance. This provides end-to-end visibility into project profitability, enables accurate payroll based on project time, and standardizes financial reporting for projects.

Incorrect Options:

A. Power Platform:

This is a suite of low-code tools (Power Apps, Power Automate, etc.) for building custom business applications and automation. While it could be used to extend a timesheet solution, it is not a pre-built, standardized application for core financials, payroll, and project cost accounting.

C. Dynamics 365 Supply Chain Management:

This application focuses on inventory, manufacturing, procurement, and logistics. It does not include native capabilities for payroll, project-based timesheet tracking, or the deep integration of project costs with financials and payroll that the scenario requires.

D. Dynamics 365 Human Resources:

While this application manages core HR functions and includes timesheet capabilities for employee leave and attendance, its primary purpose is not project cost accounting or integrating timesheet data directly with project financials and community improvement project tracking.

Reference:

Microsoft Learn - "Dynamics 365 Project Operations overview." The documentation explicitly positions Project Operations as the solution for companies that deliver project-based services, highlighting its capabilities for project planning, resource management, time/expense entry, project billing, and cost control.

A company wants to use sales, resourcing, project management, and expense tracking in a single application. What should the company implement

A. Dynamics 365 Project Operations

B. Dynamics 365 Finance

C. Dynamics 365 Business Central

D. Dynamics 365 Human Resources

Explanation:

This question asks for a single application that natively includes the integrated functionalities of sales, resourcing, project management, and expense tracking. While Project Operations is a strong candidate for project-centric work, the correct answer must be a standalone, all-in-one business management solution that inherently contains all these modules.

Correct Option:

C. Dynamics 365 Business Central.

This is the correct answer. Business Central is a comprehensive, all-in-one business management solution (ERP) designed for small to mid-sized companies. It natively integrates core financials with robust modules for sales, resource management, project management & accounting (including expense tracking and timesheets), and inventory in a single, unified application—exactly matching the requirement.

Incorrect Options:

A. Dynamics 365 Project Operations:

This is a specialized application for project-centric businesses and connects sales (via Dynamics 365 Sales), resourcing, and project management with the financials of Dynamics 365 Finance. It is not a "single application" by itself; it is an interconnected suite. The question implies a singular, self-contained system.

B. Dynamics 365 Finance:

This is an enterprise-grade financial management application. While it has a project management and accounting module, its native sales functionality is limited (it's primarily for order processing post-quote), and it does not have strong, native resourcing (staffing) capabilities like those found in Business Central or Project Operations.

D. Dynamics 365 Human Resources:

This is a specialized HR application focused on employee lifecycle, benefits, leave, and attendance. It does not include sales, project management, or expense tracking as core business modules.

Reference:

Microsoft Learn - "Introduction to Dynamics 365 Business Central." The product overview highlights Business Central as a unified solution that brings together financials, sales, service, and operations (including projects and resources) in one application, making it distinct from the more modular, enterprise-scale Dynamics 365 apps.

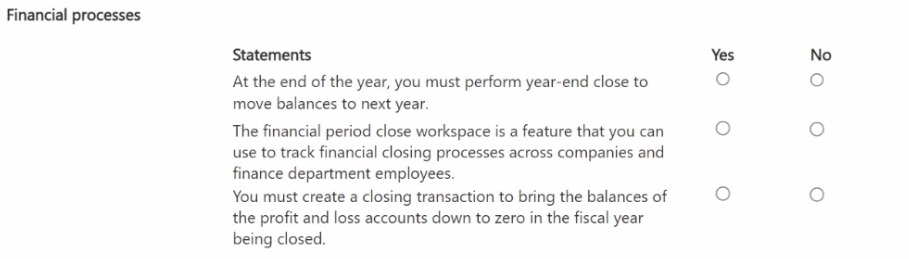

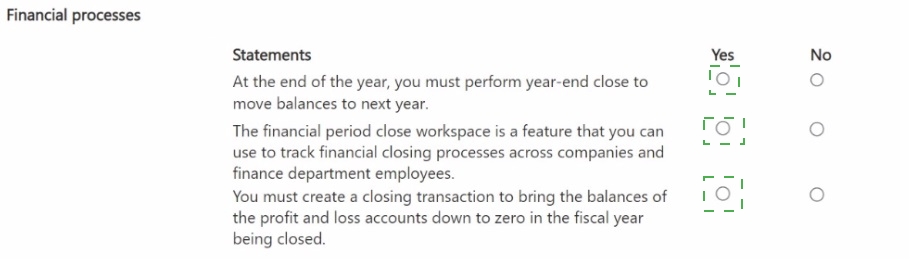

For each of the following statements, select Yes if the statement is true. Otherwise, select

No.

NOTE: Each correct selection is worth one point.

Explanation:

This question tests knowledge of year-end closing procedures and tools in Dynamics 365 Finance. It distinguishes between mandatory steps in the closing process and the functionalities of the administrative tools provided to manage that process.

Correct Option Explanations:

Statement 1:

Yes. This is a fundamental accounting principle implemented in D365 Finance. The year-end closing process is required to transfer the balances of income statement (profit and loss) accounts to retained earnings in the balance sheet, thereby resetting them for the new fiscal year and carrying forward the net result.

Statement 2:

Yes. The Financial period close workspace is a dedicated, native feature designed to help organizations plan, assign, track, and monitor the completion of closing tasks and checklists across legal entities and teams, improving the efficiency and control of the period-end close.

Incorrect Option Explanation:

Statement 3:

No. This statement is misleading. In D365 Finance, you do not manually create a "closing transaction." Instead, you run the year-end close process from the system. This automated process generates the necessary ledger transactions to transfer profit and loss account balances to retained earnings. Manual journal creation for this purpose is incorrect and would bypass the designed closing procedure.

Reference:

Microsoft Learn - "Year-end close in Dynamics 365 Finance" and "Financial period close workspace overview." The documentation confirms the use of the automated year-end close process and describes the workspace as a management tool for tracking closing activities.

| Page 1 out of 13 Pages |