Topic 2: Exam Pool B

Under _________ working capital limits are determined based on financial projections.

A. Cash credit

B. Overdraft

C. Bill Purchase

D. Bill Discount

International Development Association is an agency of _____

A. IMF

B. World Bank Group

C. United Nations

D. None of the above

While granting a bank license, RBI considers all of the following, except ________."

A. Ability to pay depositors

B. Price of equity share of company

C. Character of proposed management

D. Whether public interest will be served by grant of license to the company

Trading horizon is ______________

A. Is stated in money terms

B. Is calculated as the opportunity lost

C. Is calculated in number of days

D. None of the above

Endorsements modify

A. Life & Health Insurance contracts

B. Property & Liability Insurance contracts

C. Both of the above

D. None of the above

A portfolio consists of 50% of investment ‘X’ that earned 15%, 25% of investment ‘Y’ that earned 8% and 25% of investment ‘Z’ that earned 11%. Compute the weighted average return?

A. 13.75%

B. 14.25%

C. 14.50%

D. 14.75%

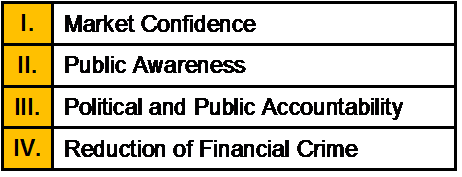

Which of the following is/are not the statutory objectives of Financial Service Authority(FSA) of UK?

A. Only IV

B. III and IV

C. Only III

D. None of the Above

Principal vectors of an active portfolio strategy are:

A. Market timing.

B. Sector rotation.

C. Security selection.

D. All of the above

If an investor's excess return is negative,

A. the realized return was less than the return earned by the market

B. the required return exceeded the realized return

C. the investor constructed a poorly diversified portfolio

D. the investor's portfolio had excessive diversification

Which of the following is not a part of scheduled banking structure in India?

A. Money Lenders

B. Public Sector Banks

C. Private Sector Banks

D. Regional Rural Banks

Maximum no .of members in case of public company is

A. 0

B. unlimited

C. 50

D. 100

Wealth Enhancement is _____________

A. Ways to maximize tax efficiency of current assets and cash flows while achieving capital growth and preservation goals

B. Using insurance to ensure wealth is protected

C. Legally structuring the future disposition of current assets to minimize the benefits to chosen beneficiaries

D. None of the above

| Page 41 out of 86 Pages |

| Previous |