Topic 2: Exam Pool B

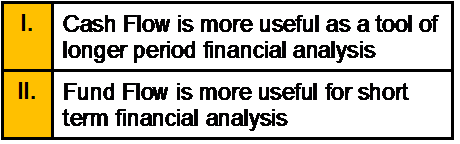

Which of the following statements are correct?

A. Only I

B. Only II

C. Both I and II

D. None of them

Investment made in a stock 2 years ago is Rs.1250; the current value is Rs.1300. The dividend received at the end of 2nd year is Rs.150. What is the CAGR?

A. 7.70%

B. 40%

C. 118%

D. 140%

Which of the following is not true?

A. The prices of zero coupon bonds fluctuate less than bonds with large coupons.

B. The concept of duration stresses when a bond will make its payments to bondholders.

C. The smaller a bond's coupon implies a longer duration.

D. A conservative investor will prefer a bond with a smaller duration even though it may have a longer term to maturity.

Expenditure incurred by an employer on medical treatment and stay abroad of the employee shall not be taxed in the case of ___________.

A. an employee whose gross total income before including the said expenditure does not exceed Rs. 2 lakhs.

B. an employee whose income under the head “Salaries” exclusive of all monetary perquisites does not exceed Rs. 2 lakhs,

C. an employee whose income under the head “Salaries” exclusive of allnon-monetary perquisites does not exceed Rs. 2 lakhs,

D. all employees irrespective of their amount of gross total income/the amount of income under the head “Salaries”.

What is the time limit for re-assessment made u/s 17

A. One Year

B. Two years

C. Five years

D. No time limit

The holding period return on a stock is equal to __________.

A. The capital gain yield over the period plus the inflation rate

B. The capital gain yield over the period plus the dividend yield

C. The current yield plus the dividend yield

D. The dividend yield plus the risk premium

The use of P/E ratios to select stocks suggests that

A. high P/E stocks should be purchased

B. low P/E ratio stocks are overvalued

C. a stock should be purchased if it is selling near its historic low P/E

D. a stock should be purchased if it is selling near its historic high P/E

Arun started a 20-year term insurance policy. Once established, when, if at all, is the insurer next entitled to ask him for proof of continuing good health?

A. At no point

B. After the end of the first 12 months

C. At the point when he changes occupation or retires

D. When a lapsed policy is revived

Disclaimers and assumptions are a part of

A. Wealth Plan

B. Research Notes

C. Data gathering

D. None of the above

Financial Independence usually occurs between _______

A. 40-55

B. 55-70

C. 70-85

D. None of the above

Every employer is obliged to ensure that his employees get a safe and secure workplace. In relation to the risks arising in the workplace which affects the employees, cover is provided through

A. Employees’ Provident fund

B. Workmen’s compensation insurance

C. Employees’ group life insurance

D. Employees’ personal accidents insurance scheme

Ratio of loading charge over the gross rate is called _________

A. Management fee

B. Expense ratio

C. Sharpe Ratio

D. Mortality ratio

| Page 38 out of 86 Pages |

| Previous |