Topic 2: Exam Pool B

Which of the following is not true in respect of the conditions essential for taxing income under the head income from House Property?

A. The property must consist of buildings and land appurtenant there to

B. The assessed may or may not be the owner of such house property

C. The property may be used for any purpose, but it should not be used by the owner for the purpose of any business or profession carried on him, the profits of which are chargeable to tax.

D. None of Above

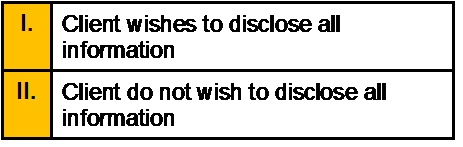

Fact needs analysis and product recommendation form has to be fulfilled if:

A. I only

B. II only

C. Both I and II

D. None of the above

Deduction under section 80C to 80U is allowed from:

A. gross total income

B. gross total income exclusive of long-term capital gain

C. gross total income exclusive of long-term capital gain as well as short-term capital gain

D. gross total income exclusive of long-term capital gain from any asset and short-term capital from the transfer of shares and units through a recognized stock exchange

What do you mean by Caveat Emptor?

A. of utmost good faith

B. Let the buyer be aware

C. Making good the loss

D. None of the above

Gift received is not taxable in hands of

A. Individual

B. HUF

C. Society

D. None of the above

Aditya’s father has given him general power of attorney what does this mean?

A. He has given Harish the right to appoint himself as the sole beneficiary of estate

B. He has given Harish the right to make decision in all matters and take action on his behalf should be become incompetent

C. He has given Harish the immediate right to make decision in all matters and take action on his behalf

D. None of the above

The capital budget’s components are of a...................

A. Short term nature

B. Long term nature

C. Fixed term nature

D. None of the above

The operatives Guidelines for Banks on Mobile Transactions in India were issued

A. 2008

B. 2009

C. 2010

D. 2011

Deposit in cash in SB Accounts can be in minimum of:

A. Rs. 10

B. Rs. 20

C. Rs. 30

D. Rs. 50

Investment in FCNR may be made through ________.

A. Remittance from abroad

B. Transfer from NRE

C. Either of the above

D. Both of the above

Bonus share are

A. Issued free to current stockholders

B. Issued at a discount to current stockholders

C. Issued at a premium to current stockholders

D. Issued to promoters only

Deduction under section 80RRB is allowed to the extent of:

A. 50% of royalty or Rs. 3,00,000 whichever is less

B. 100% of royalty or Rs. 3,00,000 whichever is less

C. 100% of royalty or Rs. 2,00,000 whichever is less

D. 100% royalty or Rs. 5,00,000 whichever is less

| Page 31 out of 86 Pages |

| Previous |