Topic 1: Exam Pool A

Following is/ are the component(s) of Personal Financial Statements

A. Cash Flow Statement

B. Income Statement

C. Balance Sheet

D. All of the above

In the BASEL framework, first pillar stands for:

A. Minimum capital requirements

B. Market Discipline

C. Supervisory Review Process

D. Monetary stability

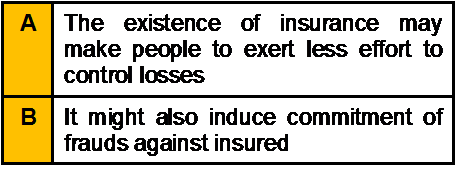

Which of the following is/are correct?

A. Both A and B statements are true

B. Statement A is true

C. Statement B is true

D. Both A and B are not true

Which of the following is true of mortgage?

A. Lender is mortgager

B. Typical of hypothecation

C. Possession handed over when charge created

D. Transfer of interest on specific immoveable property

Minimum number of investors in a scheme should be

A. 10

B. 15

C. 20

D. 25

Unabsorbed depreciation can be carried forward for ____________.

A. 8 Years

B. 4 Years

C. Indefinite

D. None

Customers with poor credit history due to defaulting payments is ………………

A. Sub prime borrower

B. Prime rate mortgage

C. Reverse mortgage

D. Balloon payment mortgage

The yield to call

A. Is important if interest rates have fallen

B. Is important if interest rates have risen

C. Equals the yield to maturity

D. Equals the current yield

Which of the following is true of Reverse Repo rate?

A. Determined by free market forces

B. Lower than repo rate

C. benchmark for long term rates

D. Part of funding cost for commercial banks

A muslim gentleman can leave his will, bequeathing all his properties to someone often than his legal heirs to the extent of…………….

A. His wish

B. A small portion

C. One third

D. One half

Which of the following is not true about traditional defined benefit plans?

A. A defined benefit plan provides a specified retirement benefit, and is funded based on actuarial assumptions

B. A defined benefit plan provides higher proportionate benefits for key employees when key employees as a group are older than rank and file employees

C. A defined benefit plan provides an individual account for each employee who participates

D. A defined benefit plan can provide benefits for service prior to establishment of the plan

Where one can open an account under the Public Provident Fund Scheme, 1968?

A. In any branch of the State Bank of India.

B. In any branch of the State Bank of India, and its subsidiaries.

C. In any branch of the State Bank of India, and its subsidiaries, or in any Head Post Office or any selected sub post office.

D. In any branch of the State Bank Of India, and its subsidiaries, or in any Head Post Office or any selected sub post office or in any of the nationalized banks.

| Page 3 out of 86 Pages |

| Previous |