Topic 2: Exam Pool B

Banking Ombudsman Scheme is:

A. Bank’s own scheme

B. IBA Scheme

C. Under Banking Regulation Act

D. None of the above

When there are more than one trustees for a trust the execution can be done by a single trustee instead of jointly

A. True

B. False

The CAPM is a model that:

A. Determines the geometric return of a security.

B. Determines time-weighted return

C. Explain return in terms of risk.

D. Explains systematic risk

Seigniorage is ____________

A. Cost of printing money

B. Value of money

C. Difference between value of money and cost to produce it

D. None of the above

What is ‘Gharar’

A. Ownership of goods

B. Speculative transactions

C. Consumer Needs

D. Islamic banking

The role of a wealth manager can be best defined as which of the following?

A. Make informed decision to the clients

B. Develop a sound financial plan

C. Review the financial plan

D. All of the above

Total risk equals:

A. Unique plus diversifiable risk

B. Market plus non diversifiable risk

C. Systematic plus un systemic risk

D. Systematic plus non-diversifiable risk

During “Building the foundation” life stage, we learn about _______

A. Budgeting

B. Five Fundamental of Fiscal Fitness

C. Three Fundamental of Fiscal Fitness

D. Seven Fundamental of Fiscal Fitness

Seven Fundamental of Fiscal Fitness

A. Index fund

B. ELSS

C. Floating rate debt fund

D. Arbitrage fund

Cheque truncation refers to the process by which:

A. Cheques are returned to customers after payment

B. Entry of stopped cheques into the computer system

C. Cheques payable at different cities / branches

D. Physical movement of cheques is curtailed, being replaced by electronic records of their content

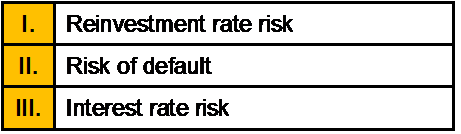

Sources of risk to investors who purchase government bonds include

A. I and II

B. I and III

C. II and III

D. All of the above

In ________, the values exchanged by the contracting parties may not necessarily be equal

A. Aleatory contracts

B. Conditional contract

C. Personal contract

D. Unilateral contract

| Page 29 out of 86 Pages |

| Previous |