Topic 2: Exam Pool B

Under which of the following steps does the wealth manager develops a SWOT chart for the client

A. Identifying Goals and Objectives

B. Identifying and Clarifying the Current Situation

C. Developing a Wealth Management Plan

D. Analyzing Financial Issues

The quantum of deduction allowed u/s 80U is:

A. Rs. 40,000

B. Rs. 50,000

C. Rs. 60,000

D. Rs. 55000

Income from which trust is added to the beneficiary’s taxable income?

A. Private trust

B. Charitable

C. Religious

D. None of the above

An AMC must explain the adverse variation between its expense estimates for the scheme on offer and actual expenses for past schemes in________

A. Financial newspapers

B. Business channels on TV

C. Offer document

D. AMFI Newsletter

Vishwajeet wishes to have a lump sum Retirement Fund of Rs. 25,00,000/- in 30 years time. Assuming that he can get 12% returns per annum, compounded annually, what amount he should save every year to reach his target?

A. 11254.24

B. 15432.12

C. 10359.14

D. 9845.47

The Society Registration Act of 1860 come into effect on

A. 21st June 1960

B. 21st May 1860

C. 23rd May 1860

D. 19th May 1860

HNWI stands for

A. High Non Work Individuals

B. High Net Worth Individuals

C. High Net Worth Industries

D. None of the above

Macro economics is the study at which level ?

A. Individual level

B. World at large

C. Company level

D. None of the above

Which is not the condition for getting superannuation fund approved?

A. All the benefits should be payable only in India

B. Employee should be contributor to the fund

C. Employer should be contributor to fund

D. Funds have to be invested as per income tax rules1962

Transfer of Property Act came into force on

A. July 01, 1882

B. August 01, 1882

C. September 01, 1882

D. October 01, 1882

Which one of the following Sections of the Transfer of Property Act defines “Transfer of Property”?

A. Section3

B. Section4

C. Section 5

D. Section 6

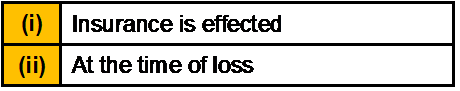

In case of fire insurance, insurable interest should exist at the time of

A. (i) only

B. (ii) only

C. (i) and (ii) both

D. None of the above

| Page 26 out of 86 Pages |

| Previous |