Topic 1: Exam Pool A

Difference between coparceners & member is that coparcener can demand partition of an HUF

A. True

B. False

Which of the following is/are the basic classification of financial risk?

A. Speculative & Pure Risk

B. Pure and Personnel Risk

C. Static and Dynamic Risk

D. All of the above

If any expenditure is incurred by an Indian company wholly and exclusively for the purpose of amalgamation or demerger, the said expenditure is

A. Not allowable as a deduction in computing profits and gains of business or profession.

B. Fully deductible as revenue expenditure in the year in which it is incurred.

C. Not deductible but is eligible to be treated as an intangible asset in respect of which depreciation can be claimed.

D. Allowed as a deduction spread over five successive previous year beginning with the previous year in which the amalgamation or demerger takes place.

The market risk premium is defined as ___________

A. the difference between the return on an index fund and the return on Treasury bills

B. the difference between the return on a small firm mutual fund and the return on the Standard and Poor's 500 index

C. the difference between the return on the risky asset with the lowest returns and the return on Treasury bills

D. the difference between the return on the highest yielding asset and the lowest yielding asset.

______ serves as a bank for central banks

A. Institute of International Finance

B. IMF

C. Bank for International Settlements

D. All of the above

A person is said to be Cognate of another if the two of them are related by blood or adoption entirely or wholly through males.

A. True

B. False

A mortgage where the mortgagor delivers possession and binds himself to deliver possession of the mortgaged property to the mortgagee is called?

A. English Mortgage

B. Reverse Mortgage

C. Usufructuary Mortgage

D. Mortgage by conditional sale

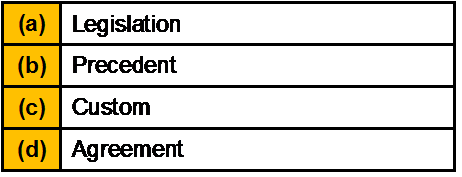

Which of the following are not the sources of Law?

A. a, b and c

B. b, c and d

C. a b c and d

D. None of the above

Sponsor of a Mutual Fund is like a promoter of a company

A. True

B. False

“Early accumulation” life stage is normally during ______

A. 12- 19 years

B. Our 20s

C. 30-40

D. 30-40

X Ltd. has failed to remit the tax deducted at source from annual rent of Rs. 6,60,000 paid to Mr. A for its office building. The said rent is

A. fully allowable as a business expenditure

B. not allowable in view of Section 40(a)(I)

C. allowable to the extent of 50%;

D. none of the above

Criminals use ______ to camouflage money flow from criminal activities and pass it off as regular legal money flows.

A. Money Laundering

B. Smuggling

C. Drug Trafficking

D. Pay Pal

| Page 11 out of 86 Pages |

| Previous |