Section A (1 Mark)

Financial Independence usually occurs between _______

A. 40-55

B. 55-70

C. 70-85

D. None of the above

Section B (2 Mark)

A property has 120 rooms and each room has a monthly rent of Rs.750. The occupancy

rate throughout the year is 80% and maintenance expenses per year works out to be

Rs.3,00,000. Capitalization rate is 12%. Calculate the value of the property.

A. Rs.45 lacs

B. Rs.47 lacs

C. Rs.46 lacs

D. Rs.44 lacs

Section A (1 Mark)

You buy a investment plan by investing Rs. 5000/- per month for first 12years and Rs.

10000/- per month for next 12 years. If the rate of interest is 15% per annum compounded

monthly . How much amount would you have after 24 years?

A. 21392639

B. 15802741

C. 15909254

D. 31284601

Section C (4 Mark)

Read the senario and answer to the question.

Ms. Deepika is interested in investments in foreign markets. Her brother is working in one

of reputed American company in India and that is offering him some shares under ESOP

scheme. This company is not listed in India. It is listed in New York Stock Exchange. Ms.

Deepika is asking her manager how this transaction will took place for her brother?

A. Her brother cannot invest in American shares as he is working its office situated in India.

B. Her brother can invest in American company but purchasing under ESOP he must be employed in America.

C. Her brother can invest in American ESOP by taking prior approval from the RBI for this.

D. Her brother can purchase shares of foreign companies listed abroad under ESOP without any kind of restriction and he can send remittance without any limit.

Section A (1 Mark)

The two components of EPS are

A. ROA and leverage.

B. Book value per share and leverage.

C. ROE and book value per share.

D. Leverage and profit margin.

Section A (1 Mark)

The eligibility Criteria for Personal Loans Salaried Individuals for Maximum Age of

Applicant at Loan Maturity in case of personal loan is:

A. 58 Years

B. 60 Years

C. 65 Years

D. None of These

Section A (1 Mark)

For a “single income family” priority is on

A. Protecting income via a term plan

B. Investing in commodities to grow wealth

C. Investing in Mutual Funds to grow wealth

D. None of the above

Section C (4 Mark)

Nifty is presently at 2694. Mr. XYZ expects Nifty to fall. He buys one Nifty ITM Put with a

strike price Rs. 2800 at a premium of Rs. 132 and sells one Nifty OTM Put with strike price

Rs. 2600 at a premium Rs. 52.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 2359

• If Nifty closes at 3561

A. 120 and -80

B. -75 and 197

C. 65 and 145

D. -156and 91

Section A (1 Mark)

The premise of behavioral finance is that

A. Conventional financial theory ignores how real people make decisions and that people make a difference.

B. Conventional financial theory considers how emotional people make decisions but the market is driven by rational utility maximizing investors.

C. Conventional financial theory should ignore how the average person makes decisions because the market is driven by investors that are much more sophisticated than the average person.

D. B and C

Section C (4 Mark)

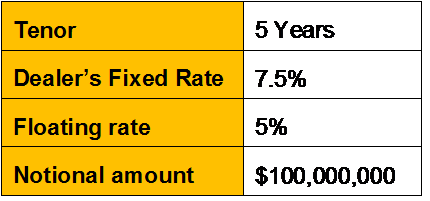

Assume the following;

With this agreement, every 6 months, the transfer of funds takes place between fixed rate

payer and floating rate payer.

What would Net Cash flows after 6-months from the initiation date?

A. $15,00,000 from Fixed-Rate to Floating-Rate Payer

B. $12,50,000 from Fixed-Rate to Floating-Rate Payer

C. $14,50,000 from Floating Rate Payer to Fixed Rate Payer

D. $10,50,000 from Floating Rate Payer to Fixed Rate Payer

Section B (2 Mark)

R acquired shares of G Ltd, on 15/12/1998 for Rs. 5 lakh which were sold on 15/5/2011 for

Rs. 18.50 lakh. Expenses of transfer were Rs. 20,000/-. He invests Rs. 6 lakh in the bonds

of NHAI on 16/10/2011. Compute the capital gain for the assessment year 2012-13.

A. Rs. 1,11,766/-

B. Rs. 76, 345/-

C. Rs. 1,13,423/-

D. Nil

Section C (4 Mark)

Read the senario and answer to the question.

What is the monthly extra saving at beginning required to be done by Raman during his

remaining working period to accumulate his required retirement corpus?

A. Rs. 65,752

B. Rs. 56,995

C. Rs. 63,065

D. Rs. 66,195

| Page 8 out of 103 Pages |

| Previous |