Section A (1 Mark)

Which of the following is the process of enabling personnel to deliver service in manner

that is beneficial to both the organization’s customers and to itself?

A. Training

B. Recruitment

C. Empowerment

D. Accountability

Section C (4 Mark)

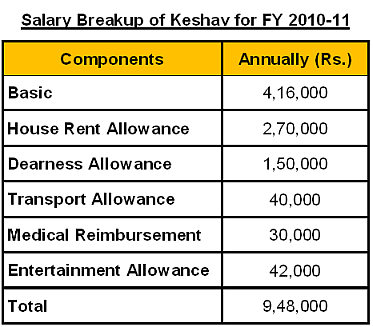

Keshav and Deepti Gohlyan approached you a Chartered Wealth Manager for preparing a

Wealth plan to achieve their financial goals. Keshav Gohlyan, aged 45 years, is working in

Chennai in an MNC, at a managerial level. His wife Deepti, aged 42 years, is working in a

Private Company and has a post-tax income of Rs. 4 lakh p.a. She is expected to retire at

the age of 55 years. Keshav’s gross salary is likely to grow at 7% p.a. and Deepti's gross

salary is likely to grow at 6% p.a. The couple has two children – daughter Yogita, aged 18

years, pursuing her Graduation in Economics, and son Navneet, aged 16 years, studying in

12th standard. Navneet intends to become a Doctor.

Keshav's monthly household expenses are Rs. 40,000 out of which Rs. 8,000 is of

Keshav’s personal expenses, this excludes EMI on loans and Insurance premiums. Keshav

has two siblings Keshav and his family stay with his mother. His father passed away due to

severe heart attack on 15-Dec-2009, at the age of 75 years, leaving a house (Value on

15thDec 2009 Rs. 25 lakh) in which they are currently staying.

Keshav has a term insurance of Rs. 20 lakh (for 20 years); the term expires 5 years from

now. Both are covered under Group Medical Insurance for Rs. 4 Lakh family floater each

provided by their respective employers

Assets

The couple’s assets as on 31-3-2010 are;

1.Cash in Hand Rs. 10,000

2.Bank balance Rs. 50,000

3.Diversified Equity Mutual Fund units at market value Rs. 2.60 lakh

4.Equity Shares at market value Rs. 15.25 lakh

5.Debt oriented Mutual Fund units at market value Rs. 1.65 lakh

6.PPF A/c balance Rs. 4.25 lakh (Keshav), Rs. 3.15 lakh (Deepti), both maturing on1st

April 2016

7.ELSS Mutual Fund units at market value Rs. 75,000

8.A separate house is in the joint name of Keshav and Deepti with 50% ownership of each.

This house has two floors and is let out for rent of Rs. 8,000 p.m. each floor.

Present Market Value of this House is Rs. 70 Lakh1

9.Gold Ornaments at market value Rs. 6.35 lakh

10.Car at market value Rs. 2.60 lakh

11.300 Gold ETF units purchased on 17th Oct 2006 @ 983 per unit

12.National Saving Certificates invested amount Rs. 4 lakh

13.Money back insurance plan of 20 year term with sum assured of Rs. 5 Lakh2

14.Unit linked insurance plan of 10 years with sum assured of Rs. 5 lakh3

1.Keshav and Deepti had jointly taken a housing loan of Rs. 30 Lakh to purchase the

house costing Rs. 37.50 Lakh on 1st April 2003. The pay an EMI of Rs. 16,349 each, EMI

date being last day of the month. The loan is for 15 years at a fixed rate of interest of

10.25%p.a.

2.Annual premium of Rs. 23,750. Paid 16 annual premiums till date before due date. The

policy provides 25% of basic sum assured to insured as survival benefit after 5th, 10th,

15thyears from the start of the policy.

3.Annual premium of Rs. 35,000 p.a.

Liabilities

Housing loan outstanding: Rs. 21.36 Lakh

Goals & Aspirations:-

1.Plan for Navneet’s medical education expenses which is likely to be Rs. 3.50 lakh at

theend of one year from now and increasing thereafter at 8%p.a. during the next 4years.

2.Plan for Yogita’s goal of Post-Graduation degree from abroad which is likely to cost Rs.

10 lakh in present terms required after three years.

3.Create a separate fund to provide every year post-retirement till his lifetime, vacation

expenses amounting to Rs. 50,000 in current terms, such expenses increasing at the rate

of 7% p.a.

4.To accumulate funds for marriage of Navneet and Yogita. For Navneet they will require in

present terms Rs. 10 lakh when he attains 26 years and for Yogita he would require Rs. 15

lakh when she attains 25 years.

5.Build a retirement corpus for expenses in his post-retirement period at 75% of preretirement

expenses at the retirement age of 60 years

Life Expectancy

Keshav: 80 years

Deepti: 78 years

Assumptions regarding long-term pre-tax returns on various asset classes:

1.Equity & Equity MF schemes/ Index ETFs11.00% p.a.

2.Balanced MF schemes9.00% p.a.

3.Bonds/Govt. Securities/Debt MF schemes7.00% p.a.

4.Liquid MF schemes5.50% p.a.

5.Gold & Gold ETF7.50% p.a.

Assumptions regarding economic factors:

1.Inflation: 5.50% p.a.

2.Expected return in Risk free instruments: 6.50% p.a.

3.Real Estate appreciation: 8.00% p.a

Cost Inflation Index

Section A (1 Mark)

_____________ is the transfer of the balance of an existing home loan that you availed at

a higher rate of interest (ROI) to either the same HFC or another HFC at the current ROI a

lower rate of interest.

A. Refinance Loans

B. Balance Transfer Loans

C. Home Conversion Loans

D. Home Extension Loans

Section A (1 Mark)

Mr. Roy is now 45 years old. He has invested Rs. 1,75,000/- in an annuity which will pay

him after 10 years a certain amount p.a. at the end of every year for 10 years. Rate of

interest is 7% p.a. compounded annually Calculate how much he will receive at the end of

every year after 10 years?

A. 48982

B. 344251

C. 49014

D. 48214

Section B (2 Mark)

In order to determine the residential status of an NRI returning to India for permanent

settlement, for the year of return, besides the stay not exceeding 181 days an additional

condition is applicable that of stay not totalling to____________ days or more in relevant

year if his stay in earlier ___________ years totaled to 365 days or more.

A. 90 and 3

B. 60 and 4

C. 180 and 5

D. 180 and 3

Section A (1 Mark)

Wealth Enhancement is _____________

A. Ways to maximize tax efficiency of current assets and cash flows while achieving capital growth and preservation goals

B. Using insurance to ensure wealth is protected

C. Legally structuring the future disposition of current assets to minimize the benefits to chosen beneficiaries

D. None of the above

Section C (4 Mark)

Read the senario and answer to the question.

If Saxena’s debentures have a balance maturity period of 15 years &the coupons are

payable annually, what should be the market valuation of these debentures, if risk free

interest rate is taken as the required IRR?

A. Rs. 10,00,000

B. Rs. 16,38,807

C. Rs. 17,76,980

D. Rs. 7,76,980

Section A (1 Mark)

A loan where the borrower pays interest each period, and repays some or all of the

principal of the loan over time is called a(n) _________ loan.

A. Amortized

B. Continuous

C. Balloon

D. Pure discount

Section A (1 Mark)

Debt Equity Ratio is 3:1,the amount of total assets Rs.20 lac, current ratio is 1.5:1 and

owned funds Rs.3 lac. What is the amount of current asset?

A. Rs.5 lac

B. Rs.3 lac

C. Rs.12 lac

D. None of the above

Section A (1 Mark)

Mortgage loans:

A. Are used to purchase real estate.

B. Are primarily long term.

C. Usually have more than half the balance remaining when the loan is half-way to maturity.

D. All of the above.

Section B (2 Mark)

If a portfolio manager has a good ability to forecast overall market but a poor ability to

select undervalued securities, the following strategy would suit best to him.

A. Concentrate holdings in selected undervalued stocks and shift beta below and above the desired long-term average based on market forecasts

B. Hold a broadly diversified portfolio of stocks and keep beta stable at the desired longterm average

C. Concentrate holdings in selected undervalued stocks and keep beta stable at the desired long-term average

D. Hold a diversified portfolio of stocks and shift beta above and below desired long-term average based on market forecasts

Section A (1 Mark)

_________________makes us throw more good money after money already gone bad.

A. Sunk Cost Fallacy

B. Money Illusion

C. Present-biased preferences

D. Inter Temporal Consumption

| Page 7 out of 103 Pages |

| Previous |