Section A (1 Mark)

_______________ and _______________ mandates are two kinds of service level

contracts

A. Advisory, Discretionary

B. Discretionary, Managed

C. Advisory, Managed

D. None of the above

Section B (2 Mark)

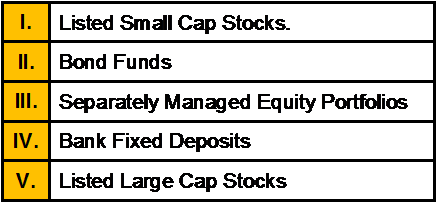

Which of the following investment options would most likely be part of the portfolio of a

Moderate investor?

A. I, III, IV and V

B. II, IV and V

C. I, III and IV

D. II, III and IV

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Bhatia thinks he would require 50 lacs in today’s terms for Neena’s wedding at 25

years of age. What amount he has to save at the end of every month for Neena’s wedding

requirement with a 7% inflation rate and investment earning minimum 12% p.a.

A. Rs. 25,389

B. Rs. 24,315

C. Rs. 25,643

D. Rs. 26,956

Section A (1 Mark)

The difference between the cash price and the futures price on the same asset or

commodity is known as the

A. Basis

B. Spread

C. Yield spread

D. Premium

Section C (4 Mark)

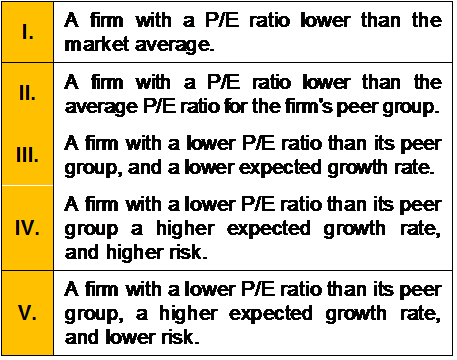

Which of the following would you consider the best indicator of an undervalued firm?

A. I,III and IV

B. II, IV

C. Only V

D. Only III

Section A (1 Mark)

We prefer a sure gain from a much larger gain that is very likely but not certain. This makes

us close winning positions even if we think that they are likely to get even better.

A. Certainity Effect

B. Availability Bias

C. Confirmation bias

D. Overconfidence Bias

Section A (1 Mark)

The income received by the approved superannuation fund on the investments made by

the fund is

A. Exempt from income tax

B. Taxed as the concession rate of 10% of the income

C. Taxed at the hands of employees concerned based on the share of each employee

D. Taxed under Capital Gains Tax depending upon the nature of investment

Section A (1 Mark)

When loans are securitized they are passed on to a ____________who pools the loans

and sells securities.

A. Multi Purpose Vehicle

B. Deemed Entity

C. Special Purpose Entity

D. None of the Above

Section A (1 Mark)

Individuals define risk as:

A. Deviation from some expected return.

B. A cost of investing.

C. A quantitative measure.

D. “Losing money.”

Section C (4 Mark)

Suppose ABC Ltd. is trading at Rs 4500 in June. An investor, Mr. A, shorts Rs 4300 Put by

selling a July Put for Rs. 24 while shorting an ABC Ltd. stock. The net credit received by

Mr. A is Rs. 4500 + Rs. 24 = Rs. 4524.

What would be the Net Payoff of the Strategy?

• If ABC Ltd closes at 4053

• If ABC Ltd closes at 5025

A. 224 and -501

B. -124and -73

C. 74 and 0

D. 147 and 204

Section B (2 Mark)

A bank plans to offer new subordinated notes in the open market next month but knows

that its credit rating is being reviewed by a credit rating agency. The bank wants to avoid

paying sharply higher credit costs. Which type of credit derivative contract would you most

recommend for this situation?

A. Credit linked note

B. Credit option

C. Credit risk option

D. Total return swap

Section A (1 Mark)

In US, how many states do not have a corporate income tax?

A. 4

B. 5

C. 7

D. All of the above

| Page 6 out of 103 Pages |

| Previous |