Section A (1 Mark)

A market timing approach that increases the proportion of funds in stocks when the stock

market is expected to be rising, and increases cash when the stock market is expected to

be falling is a:

A. Strategic asset allocation

B. Tactical asset allocation

C. Portfolio optimization

D. Liquidity expectation timing

Section C (4 Mark)

Mr. Vinay, aged 36

years is working in a company, at a managerial level, and has an income of Rs. 40,000

p.m. comprising of Basic salary and DA as on 31/03/2008. His other allowances amount to

Rs. 18,000 p.m. He would retire at the age of 60 years. His wife Reena, aged 32 years, is

working in a High School and has a post-tax income of Rs. 2,76,000 per annum. Mr. and

Mrs. Vinay have two daughter Deepika, aged 10 years and Rekha, aged 5 years.

Mr. Vinay’s father died of heart attack, 5 months back, at the age of 72 years, leaving a

house (Value as on date Rs. 30 lakh) in which Vinay is staying at present and other assets

worth Rs. 20 lakh (shares of large cap companies worth Rs. 10 lakh, Fixed deposit in post

office of Rs. 5 lakh and Bank FD of Rs. 5 lakh) in Vinay’s mother’s name. His mother 63

years old is disabled and fully dependent on Vinay, he being the only child of his parents.

Vinay has to keep an attendant for his mother, round the clock.

The Assets of the Couple are:

1.Cash in HandRs. 18,000

2.Bank balanceRs. 40,000 (Vinay) Rs. 25,000 (Reena)

3.JewelleryRs. 400000 (Reena)

4.Money Market Mutual FundRs. 3,00,000 (Vinay)

5.Shares

?ICICI Bank 200 shares bought at Rs. 1000 per share,

?Infosys 150 shares bought at Rs. 1700 per share

?Reliance Communication 350 shares bought at Rs. 350 share.

6.Debt oriented mutual FundsRs. 2,00,000

7.PPFRs. 5,00,000 (Vinay), Rs. 4,00,000 (Reena)

8.House in the joint name of Vinay and Reena with 50% ownership of each. This house

has two floors and is let out for Rs. 9,000 pm for each of the floors. Present value of this

house is Rs. 60,00,000.

Vinay and Reena had taken a housing loan of Rs. 15,00,000 each. Of this Rs. 10,00,000 is

pending on each name. They are presently paying an EMI of Rs. 20,000 each, Rate of

interest being 10.75% p.a.

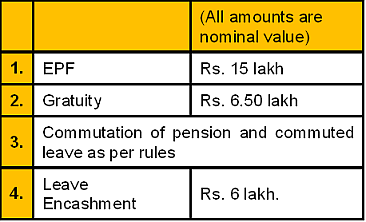

The Retirement Benefits of Vinay after 15 years hence, are expected to be as follows:

Vinay has taken a term insurance of Rs. 30 lakh for 20 years, which is expiring 5 years

from now. He has no other insurance. Vinay’s monthly household/ living expenses are Rs.

50,000. This excludes EMI on loans but includes all other expenses including expenses on

his mother’s care.

Vinay expects Deepika to get married 12 years hence for which likely expenditures in

today’s term is 15 lakh.

Vinay’s salary is likely to grow at 7% pa and Reena’s salary is likely to grow at 6% p.a. Risk

free rate of interest is 8% pa and inflation is 6% p.a. Long term growth on Equity/Equity

based MF is taken as 15% p.a.

Section C (4 Mark)

Read the senario and answer to the question.

For the purpose of World Tour Nimita has an option to use her investments in PPF A/c.

She would contribute maximum permissible amount on the 1st working day of April every year till its due maturity as well as in all years of the extension of account for a 5-year term

after its due maturity. She wants to use half of the PPF account proceeds for the proposed

world tour. You estimate the adequacy of such amount, the same is _____________.

A. Short by Rs. 44,200

B. In excess by Rs. 1,05,400

C. Short by Rs. 44,200

D. In excess by Rs. 52260

Section B (2 Mark)

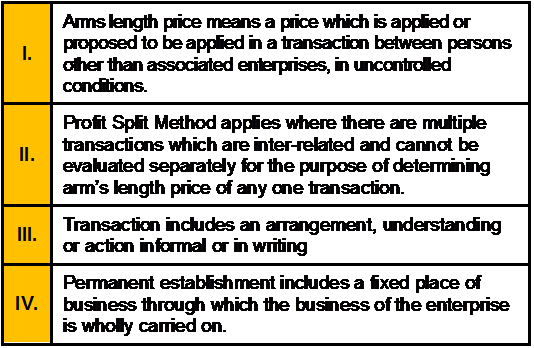

Which of the following statements with respect to Transfer Pricing is/are correct?

A. I, II and III

B. I and II

C. II, III and IV

D. I, III and IV

Section A (1 Mark)

A cognitive heuristic in which a decision-maker relies upon knowledge that is readily

available rather than examining other alternatives or procedures. Which of the following is

most likely consistent with this bias?

A. Anchoring and Adjustment Bias

B. Availability Bias

C. Confirmation bias

D. Overconfidence Bias

Section B (2 Mark)

The arbitrage pricing theory (APT) and the CAPM both assume all except which of the

following?

A. Investors have homogeneous beliefs

B. Investors are risk-averse utility maximizers.

C. Borrowing and lending can be done at the rate RF.

D. Markets are perfect.

Section B (2 Mark)

In 2011-12, an individual receives a net dividend of £648. The equivalent gross income is:

A. £720

B. £810

C. £648

D. £6,480

Section A (1 Mark)

Which of the following is an advantage of a credit scoring model?

A. Credit scoring models rely on the evaluation of an experienced credit officer

B. Credit scoring models are immune from charges of discrimination

C. Credit scoring models never make mistakes

D. Credit scoring models can handle a large volume of applications in a short period of time

Section A (1 Mark)

The demand for insurance tends to be inelastic because of

A. Statutory requirements

B. Financial prudence

C. Business transaction requirements

D. All of the above.

Section A (1 Mark)

The covariance of the market returns with the stocks returns is 0.007. The standard

deviation of the market is 7% and standard deviation of stock’s return is 10%. What is the correlation coefficient between stocks and market returns?

A. 0.5

B. 0.91

C. 1

D. 1.25

Section A (1 Mark)

A zero-investment portfolio with a positive expected return arises when _________.

A. An investor has downside risk only

B. The law of prices is not violated

C. The opportunity set is not tangent to the capital allocation line

D. A risk-free arbitrage opportunity exists

Section A (1 Mark)

Mansi deposits Rs. 50,000/- in a bank account which pays interest @ 10 % per annum.

How much can be withdrawn at the beginning of each year for 5 years if first withdrawal is

6 years from now?

A. 20242.42

B. 22242.42

C. 31242.42

D. 21242.42

| Page 50 out of 103 Pages |

| Previous |