Section B (2 Mark)

A bank has a limited geographic area. It would like to diversify its loan income with loans in

other market areas but does not want to actually make loans in those areas because of

their limited experience in those areas. Which type of credit derivative contract would you

most recommend for this situation?

A. Credit linked note

B. Credit risk option

C. Total return swap

D. Credit swap

Section C (4 Mark)

Read the senario and answer to the question.

Nimita wants to know if she were to meet with an accident and get permanent disability in

the third year of her Term Insurance policy, what amount of the premium due in the fourth

year would be payable by her if the premium being paid towards the policy is Rs. 15,000

with sum assured of Rs. 50 lakh?

A. Rs. 15,000

B. Rs. 12,000

C. Rs. 7,500

D. Nil

Section C (4 Mark)

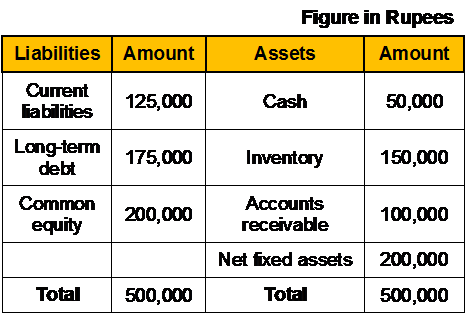

Zoya Ltd has the following Balance sheet for FY 2005-2006:

The Total Sales for the year was Rs. 6,00,000.

The company president believes the company carries excess inventory. Accordingly he

wants the inventory turnover ratio to be 8x and would use the freed up cash to reduce

current liabilities. If the company follows the president’s recommendation and sales remain

the same, the new quick ratio would be:

A. 2.4

B. 3

C. 4.5

D. 1.2

Section A (1 Mark)

As per Hindu succession Act 1956 following person is not considered as a class I heir of

the person who dies intestate

A. Widow

B. Mother

C. Father

D. Son/Daughter

Section B (2 Mark)

Compute YTM of a bond with par value of Rs.1000/-, carrying a coupon rate of 8% and

maturing after 10 years. The bond is currently selling for Rs.850/-.

A. 9.50%

B. 11.50%

C. 10.44%

D. 8.50%

Section A (1 Mark)

______________ is based on a particular (theoretical) lottery game that leads to a random

variable with infinite expected value, i.e., infinite expected payoff, but would nevertheless

be considered to be worth only a very small amount of money.

A. Alias Paradox

B. St. Petersburg Paradox

C. Cramer's Solution

D. The Friedman-Savage Puzzle

Section A (1 Mark)

Which of the following is NOT a major consideration in the asset allocation process?

A. Return requirements

B. Risk tolerance

C. Ease of monitoring progress

D. Time horizon

Section A (1 Mark)

In “Teenage Years” life stage, one learns about ___________

A. Budgeting

B. Earned income

C. How money makes money

D. All of the above

Section A (1 Mark)

A put option on a stock is said to be out of the money if

A. The exercise price is higher than the stock price.

B. The exercise price is less than the stock price.

C. The exercise price is equal to the stock price.

D. The price of the put is higher than the price of the call.

Section A (1 Mark)

Every employer is obliged to ensure that his employees get a safe and secure workplace.

In relation to the risks arising in the workplace which affects the employees, cover is provided through

A. Employees’ Provident fund

B. Workmen’s compensation insurance

C. Employees’ group life insurance

D. Employees’ personal accidents insurance scheme

Section C (4 Mark)

Read the senario and answer to the question.

Which one of the following statements most accurately describes the risk exposure of the

Shankers’ portfolio?

A. The portfolio has excessive market risk.

B. The portfolio should be unaffected by changes in interest rates.

C. The portfolio contains an excessive level of business risk.

D. The portfolio contains excessive purchasing power risk.

Section B (2 Mark)

In 2011-12, an individual receives net building society interest of £792. The equivalent

gross income is:

A. £792

B. £1,320

C. £880

D. £990

| Page 5 out of 103 Pages |

| Previous |