Section B (2 Mark)

Ashish is bullish about HLL which trades in the spot market at Rs.210. He buys 10 threemonth

call option contracts on HLL with a strike of 230 at a premium of Rs.1.05 per call.

Three months later, HLL closes at Rs. 250. Assuming 1 contract = 100 shares, his profit on

the position is ___________.

A. Rs. 18,950

B. Rs. 19,500

C. Rs. 10,000

D. Rs. 20,000

Section A (1 Mark)

Which one of the following has not caused the huge growth in hedge funds and private

equity?

A. Financial institutions looking for a better rate of return

B. The freedom of hedge fund managers to use innovative methods of investing to increase returns

C. Tough financial regulations which promote greater investment and therefore better returns

D. Private investors seeking better returns

Section B (2 Mark)

A project should be considered if the Profitability Index is

A. Less than 1

B. More than 1

C. More than to 0.5

D. None of the above

Section C (4 Mark)

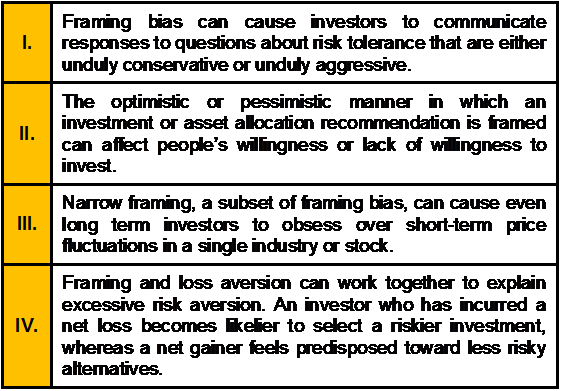

Which of the following statements is/are correct?

A. I and II

B. I, II and IV

C. III and IV

D. All of the Above

Section B (2 Mark)

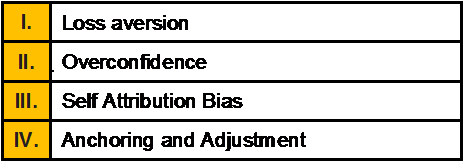

Mr. Jatin is a single forty nine year-old pharmaceutical executive earningRs25,00,000 per

year. He lives extravagantly, occasionally spending more than his income, but has saved

approximately Rs. 15,00,000. His primary investment goal is to donate Rs30,00,000 to his

alma mater, but cannot obtain life insurance. Mr. Jatin exhibits the following biases:

A. I and II

B. I and III

C. III and IV

D. I, II and III

Section A (1 Mark)

Quicker attention and resolution of complaints lead to ________

A. High profits

B. Low cost

C. Favorable word of mouth

D. Stronger customer relationship

Section B (2 Mark)

Number One Flight Stock currently sells for Rs53. A one-year call option with strike price of

Rs58 sells for Rs10, and the risk free interest rate is 5.5%. What is the price of a one-year

put with strike price of Rs58?

A. Rs. 10.00

B. Rs. 12.12

C. Rs. 16.00

D. Rs. 11.97

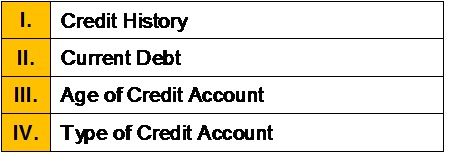

Section A (1 Mark)

The factors contributing to a Credit Score are :

A. I, III and IV

B. II and IV

C. I and III

D. All of the Above

Section A (1 Mark)

In order to have confirmation of a major market trend under the Dow Theory, the

A. Industrial and utility averages must confirm each other

B. Transportation and utility averages must confirm each other.

C. Utility average must lead the transportation average

D. Transportation and industrial average must confirm each other.

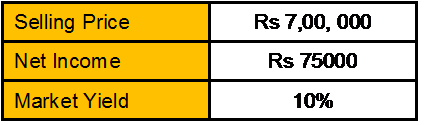

Section B (2 Mark)

From the following data in respect to the property price, calculate the value of the property

for your client Mr. Nitin Sharma, as per the capitalization rate.

A. Rs. 7,50,000

B. Rs. 7,70,000

C. Rs. 7,07,500

D. Rs. 7,04,545

Section C (4 Mark)

Read the senario and answer to the question.

Saxena bought agricultural land in notified urban limits of Mumbai on 15-June-1996 for Rs.

6 lakh and had been using the same for agricultural purposes. However the land was

compulsorily acquired by the Government on 15-July-2003 and the compensation fixed

was Rs. 25 lakh. Out of this, Rs 10 lakh was received by Saxena on 15-Jan-2005 and the

balance on 06-Apr-2005. Saxena was not satisfied with the compensation and filed a suit in

the court. The compensation was enhanced by Rs 8 lakh which was received on 25-Mar-

2008. Which one of the following statement regarding capital gains arising from these

transactions is correct:

A. The entire enhanced compensation of Rs. 8 Lakh shall be taxable.

B. The entire enhanced compensation of Rs. 8 Lakh shall be exempt.

C. The entire original compensation of Rs. 25 Lakh shall be exempt.

D. Rs. 10 lakh from original compensation is exempt, while Rs. 15 lakh is taxable.

Section B (2 Mark)

Consider the single factor APT. Portfolio A has a beta of 0.2 and an expected return of

13%. Portfolio B has a beta of 0.4 and an expected return of 15%. The risk-free rate of

return is 10%. If you wanted to take advantage of an arbitrage opportunity, you should take

a short position in portfolio _________ and a long position in portfolio _________.

A. A, A

B. A, B

C. B, A

D. B, B

| Page 48 out of 103 Pages |

| Previous |