Section A (1 Mark)

Which of the following is not a derivative transaction?

A. An investor buying index futures in the hope that the index will go up.

B. A copper fabricator entering into futures contracts to buy his annual requirements of copper.

C. A farmer selling his crop at a future date

D. An exporter selling dollars in the spot market

Section A (1 Mark)

Corrections are often followed by ________.

A. Channel lines.

B. Momentum.

C. Reversals.

D. Consolidation.

Section B (2 Mark)

What an employee should check in his retirement benefit plan offered by the employer?

A. His vesting rights

B. His retirement age

C. His contributory obligations

D. All of the above

Section C (4 Mark)

Suppose Nifty is at 4450 on 27th April. An investor, Mr. A, enters into a short straddle by

selling a May Rs 4500 Nifty Put for Rs. 85 and a May Rs. 4500 Nifty Call for Rs. 122.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 4293

• If Nifty closes at 5158

A. 147 and 157

B. 0 and -451

C. -193 and 107

D. 342 and 517

Section B (2 Mark)

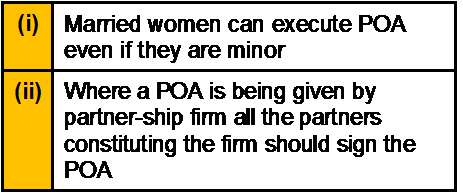

Which of the following statement is/are correct?

A. Only (i)

B. Only (ii)

C. Both of the above

D. None of the above

Section C (4 Mark)

Read the senario and answer to the question.

Mahesh’s company has made plans for the next year. It is estimated that the company will

employ total assets of Rs. 1000 lakh: 50% of the assets being financed by borrowed capital

at an interest cost of 8% per year. The direct costs are estimated at Rs. 500 lakh. All other operating expenses are estimated at Rs. 76 lakh. The good will be sold to customer at

140% of the direct costs. Income tax rate is assumed to be 30%. Calculate net profit

margin and return on owners’ equity.

A. 8.4% & 11.78%

B. 9.4% & 8.88%

C. 8.4% & 6.88%

D. 6.4% & 8.88%

Section C (4 Mark)

Find out the effective quarterly rate for 18% per annum compounded half yearly.

A. 4.403% per Quarter

B. 4.50% per Quarter

C. 9.00% per Quarter

D. 4.44% per Quarter

Section B (2 Mark)

A perspective on decision making based on the assumption that people typically show risk

aversion; hence, when making decisions they view whatever losses may be involved as

more painful than equivalent gains are desirable. We have an irrational tendency to be less

willing to gamble with profits than with losses.

A. Utility Theory

B. Attribution Theory

C. Prospect Theory

D. None of the Above

Section B (2 Mark)

Consider the one-factor APT. The variance of returns on the factor portfolio is 6%. The beta

of a well-diversified portfolio on the factor is 1.1. The variance of returns on the welldiversified

portfolio is approximately __________.

A. 3.60%

B. 6.00%

C. 7.30%

D. 10.10%

Section B (2 Mark)

The two aspects of Regret bias are_____________ and _____________.

A. Error of commission and error of omission

B. Error of remission and error of omission

C. Error of permission and error of commission

D. Error of position and error of commission

Section C (4 Mark)

Maxis Ltd reported Earnings Per Share of Rs 2.10 in 1993, on which it paid dividends per

share of Rs 0.69. Earnings are expected to grow 15% a year from 1994 to 1998, during which period the dividend payout ratio is expected to remain unchanged. After 1998, the

earnings growth rate is expected to drop to a stable 6%, and the payout ratio is expected to

increase to 65% of earnings. The firm has a beta of 1.40 currently, and it is expected to

have a beta of 1.10 after 1998. The Risk Free Rate of Return is 6.25%.

What is the value of the stock, using the two-stage dividend discount model?

A. 26.75

B. 26.5

C. 27.59

D. 35.15

Section B (2 Mark)

The______________ recognizes the commercial reality that even when a transfer pricing

adjustment is made under that sub-section the amount represented by the adjustment

would not actually have been received in India or would have actually gone out of the

country.

A. First proviso to section 92 C(4)

B. Second proviso to section 92C(4)

C. First proviso to section 91 C(4)

D. Second proviso to section 91C(4)

| Page 47 out of 103 Pages |

| Previous |