Section A (1 Mark)

A review of portfolio should be done when

A. One witnesses a change in micro level factors

B. One witnesses a change in macro level factors

C. One witnesses new products floating in the market

D. All of the above

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose taxable

income is:

• $ 81250 in SGD and he is a Singapore citizen

• £ 67158p.a (only employment)and he is a UK citizen

A. £ 6715.80 and 2843.50 SGD

B. £ 13431.60 and 6906.25 SGD

C. £ 26863.20 and 11375 SGD

D. £ 16789.50 and 2310 SGD

Section A (1 Mark)

An arbitrage opportunity exists if an investor can construct a __________ investment

portfolio that will yield a sure profit.

A. Positive

B. Negative

C. Zero

D. All of the above

Section B (2 Mark)

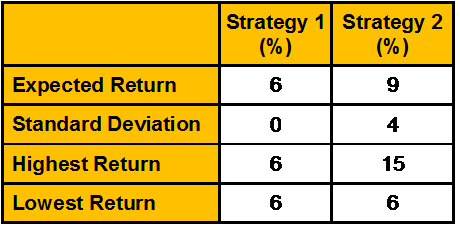

Consider these two investment strategies:

Strategy ___ is the dominant strategy because __________.

A. 1, it is riskless

B. 1, it has the highest reward/risk ratio

C. 2, its return is at least equal to Strategy 1 and sometimes greater

D. 2, it has the highest reward/risk ratio

Section A (1 Mark)

____________ is defined as a dollar per thousand dollars of assessed value of property

and is used to calculate a property owner's tax bill.

A. Mill

B. Tax Burden

C. Assessed Value

D. Progressive Tax

Section A (1 Mark)

Deduction under section 80C to 80U is allowed from:

A. gross total income

B. gross total income exclusive of long-term capital gain

C. gross total income exclusive of long-term capital gain as well as short-term capital gain

D. gross total income exclusive of long-term capital gain from any asset and short-term capital from the transfer of shares and units through a recognized stock exchange

Section B (2 Mark)

You are estimating the value of a small office building. Suppose the estimated NOI for the

first year of operations is Rs100,000. a. If you expect that NOI will remain constant at

Rs100,000 over the next 50 years and that the office building will have no value at the end

of 50 years, what is the present value of the building assuming a 12.2% discount rate?

A. Rs 8,17,078

B. Rs 7,56,125

C. Rs 8,95,154

D. Rs 9,51,254

Section A (1 Mark)

________________ is the most important source of revenue for local governments in US

A. Income Tax

B. Sales Tax

C. Property Tax

D. None of the above.

Section A (1 Mark)

Short-term to medium-term loans repayable in two or more consecutive payments are

known as:

A. Non installment loans

B. Installment loans

C. Residential mortgage loans

D. Nonresidential cash loans

Section C (4 Mark)

Read the senario and answer to the question.

Calculate income from House property for Mr. Keshav for assessment year 2010-11.

A. 67200

B. 46912

C. 82800

D. 7800

Section B (2 Mark)

The Elliot Wave Theory ____________.

A. Is a recent variation of the Dow Theory

B. Suggests that stock prices can be described by a set of wave patterns

C. Is similar to the Kondratieff Wave theory

D. A, B and C

Section A (1 Mark)

In “CAMPARI” Model, R stands for:

A. Refinance Terms

B. Resale Terms

C. Repayment Terms

D. Revision Terms

| Page 45 out of 103 Pages |

| Previous |