Section B (2 Mark)

___________ applies where there are multiple transactions which are inter-related and

cannot be evaluated separately for the purpose of determining arm’s length price of any

one transaction.

A. Comparable Uncontrolled Price Method [CUP]

B. Resale Price Method [RPM]

C. Cost-Plus Method [CPM]

D. Profit Split Method [PSM]

Section B (2 Mark)

According to the efficient markets view, value stocks earn higher expected return than

growth stocks because:

A. Value stocks are riskier than growth stock

B. Value stocks are less risky than growth stock

C. Value stocks have higher expected future payoffs than growth stock

D. Value stocks have lower expected future payoffs than growth stock

Section A (1 Mark)

The quantum of deduction allowed u/s 80U is:

A. Rs. 40,000

B. Rs. 50,000

C. Rs. 60,000

D. Rs 55000

Section A (1 Mark)

A company making an IPO can avail which of the following option?

A. Differential Pricing

B. Price band

C. Green-shoe

D. All of the above

Section C (4 Mark)

A stock ABC Ltd. is trading at Rs. 450. Mr. XYZ is bullish on the stock. But does not want to

invest Rs. 450. He does a Long Combo. He sells a Put option with a strike price Rs. 400 at

a premium of Rs. 1.00 and buys a Call Option with a strike price of Rs. 500 at a premium of

Rs. 2.

What would be the Net Payoff of the Strategy?

• If ABC Ltd closes at 625

• If ABC Ltd closes at 328

A. -114 and 95

B. 124 and -73

C. -144 and 105

D. 320 and 270

Section B (2 Mark)

Total income of an individual including long-term capital gain of Rs. 50,000 is Rs. 1,10,000,

the tax on total income shall be:

A. Rs. 1,020

B. Rs. 2,040

C. Rs. 2,244

D. Rs. 3,240

Section C (4 Mark)

United Healthcare, a health maintenance organization, is expected to have high earning

growth for the next five years and 6% after that. The dividend payout ratio will be only 10%

during the high growth phase, but will increase to 60% in steady state. The return on equity

was 21% in the most recent time period and is expected to stay at that level for the next 5

years. The stock has a beta of 1.65 currently, but the beta is expected to drop to 1.10 in

steady state. (The treasury bill rate is 7.25%.)

Estimate the price/book value ratio for United Healthcare, given the inputs above.

A. 1.57

B. 2.54

C. 2.09

D. 1.95

Section A (1 Mark)

Response of listening falls under which one of the following categories?

A. It can be verbal

B. It can be nonverbal

C. It can be verbal or nonverbal

D. It can neither be verbal nor nonverbal

Section B (2 Mark)

Actual Loss ratio is

A. (Actual Loss + Loss Adjustment Expenses)/ Earned Premium

B. (Actual Loss - Loss Adjustment Expenses)/ Earned Premium

C. (Actual Loss + Loss Adjustment Expenses)/ Number of exposure units

D. (Actual Loss - Loss Adjustment Expenses)/ Number of exposure units

Section C (4 Mark)

OHM Corporation, an environmental service provider, had revenues of Rs209 million in

1992 and reported losses of Rs3.1 million. It had earnings before interest and taxes of

Rs12.5 million in 1992, and had debt outstanding of Rs109 million (in market value terms).

There are 15.9 million shares outstanding, trading at Rs11 per share. The pre-tax interest rate on debt owed by the firm is 8.5%, and the stock has a beta of 1.15. The firm's EBIT is

expected to increase 10% a year from 1993 to 1996, after which the growth rate is

expected to drop to 4% in the long term. Capital expenditures will be offset by depreciation,

and working capital needs are negligible. (The corporate tax rate is 40%, and the Risk free

rate is 7%.)

Estimate the value of the firm.

A. Rs175.45

B. Rs 194.80

C. Rs189.20

D. Rs 155.60

Section C (4 Mark)

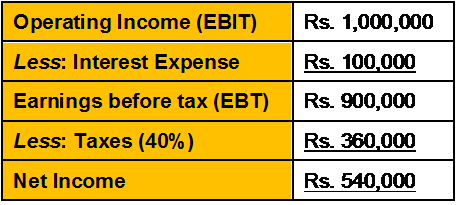

Blair Company has Rs5 million in total assets. The company’s assets are financed with Rs1

million of debt, and Rs4 million of common equity. The company’s income statement is

summarized below:

The company wants to increase its assets by Rs1 million, and it plans to finance this

increase by issuing Rs1 million in new debt. This action will double the company’s interest

expense, but its operating income will remain at 20 percent of its total assets, and its

average tax rate will remain at 40 percent. If the company takes this action, which of the

following will occur?

A. The company’s net income will increase.

B. The company’s return on assets will fall.

C. The company’s return on equity will remain the same.

D. Statements a and b are correct.

Section C (4 Mark)

Suppose you have a two-security portfolio containing Bonds A and B. The market value of

Bond A is Rs. 6,000, and the market value of Bond B is Rs4,000. The duration of Bond A is

8.5, and the duration of Bond B is 4.0. Calculate the duration of the portfolio.

A. 5.3

B. 8.2

C. 6.7

D. 3.56

| Page 44 out of 103 Pages |

| Previous |