Section A (1 Mark)

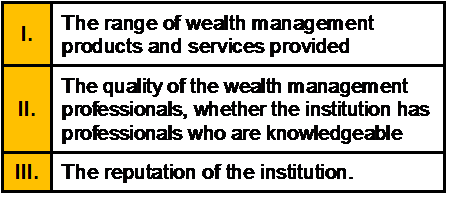

While choosing wealth management firms the criteria a client would consider include is/are:

A. I and II

B. I and III

C. II and III

D. All of the Above

Section A (1 Mark)

Expenditure incurred by an employer on medical treatment and stay abroad of the

employee shall not be taxed in the case of ___________.

A. an employee whose gross total income before including the said expenditure does not exceed Rs. 2 lakhs.

B. an employee whose income under the head “Salaries” exclusive of all monetary perquisites does not exceed Rs. 2 lakhs.

C. an employee whose income under the head “Salaries” exclusive of allnon-monetary perquisites does not exceed Rs. 2 lakhs.

D. all employees irrespective of their amount of gross total income/the amount of income under the head “Salaries”.

Section C (4 Mark)

As a CWM® you recommended Mr. Raj Malhotra to put his money in Asset A offering 15%

annual return with a standard deviation of 10%, and balance funds in asset B offering a 9%

annual return with a standard deviation of 8%. Assume the coefficient of correlation

between the returns on assets A and B is 0.50. Calculate the expected return after 1 year

and standard deviation of Mr. Raj Malhotra’s portfolio.

A. 12.60% and 0.809%

B. 11.67% and 8.75%

C. 12.60% and 8.09%

D. 8.09% and 12.60%

Section B (2 Mark)

The income exemption threshold in respect of income year ending 30 June 2009 is as

follows for an individual with two dependents in Mauritus is:

A. 410,000

B. 3,50,000

C. 2,85,000

D. 3,95,000

Section B (2 Mark)

For calculation of liability of payment of gratuity to an employee on leaving service, the

wage to be taken into account is

A. Average wage earned during the entire service

B. Average wage earned during the last 5 years

C. Last drawn wage

D. None of the above

Section B (2 Mark)

Portfolio A has expected return of 10% and standard deviation of 19%. Portfolio B has

expected return of 12% and standard deviation of 17%. Rational investors will

A. Borrow at the risk free rate and buy A.

B. Sell A short and buy B.

C. Sell B short and buy A.

D. Borrow at the risk free rate and buy B.

Section A (1 Mark)

Liquid assets comprise

A. Certificate of Deposits

B. Money Market Mutual Funds

C. Funds in savings account

D. All of the above

Section B (2 Mark)

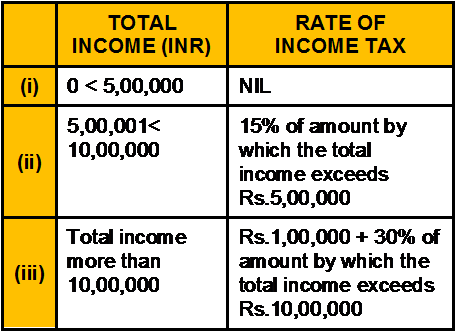

Which of the following statements is/are correct with respect to Resident Very Senior

Citizen i.e. who is of an age of 80 years and above?

A. I and II

B. I and III

C. Only III

D. All of the above

Section A (1 Mark)

A document which is used to hand over the legal powers to sign on legal documents

pertaining to the property to someone other than the owner is called_____________

A. Lease / Tenancy Agreement

B. Will

C. Power of attorney

D. Family Settlement

Section A (1 Mark)

Forecasting errors are potentially important because

A. Research suggests that people underweight recent information.

B. Research suggests that people overweight recent information.

C. Research suggests that people correctly weight recent information.

D. Either A or B depending on whether the information was good or bad.

Section C (4 Mark)

Mr. Peter sells a Nifty Put option with a strike price of Rs. 4000 at a premium of Rs. 21.45

and buys a further OTM Nifty Put option with a strike price Rs. 3800 at a premium of Rs.

3.00 when the current Nifty is at 4191.10, with both options expiring on 31st July.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3800

• If Nifty closes at 4500

A. -81.55 and 18.45

B. -81.55 and 18.55

C. 0 and -81.55

D. -181.55 and 18.45

Section C (4 Mark)

Rate of 15% p.a compounded annually will be equal to ---------------- % per month.

A. 1.25% per month

B. 1.7149% per month

C. 1.17149% per month

D. 1.117% per month

| Page 43 out of 103 Pages |

| Previous |