Section B (2 Mark)

An investor is bearish about ABC Ltd. and sells ten one-month ABC Ltd. futures contracts

at Rs.5,00,000. On the last Thursday of the month, ABC Ltd. closes at Rs.510. He makes a

_________. (assume one lot = 100)

A. Profit of Rs. 10,000

B. Loss of Rs. 10,000

C. Loss of Rs. 5,100

D. Profit of Rs. 5,100

Section C (4 Mark)

Mr. XYZ sells a Nifty Put option with a strike price of Rs. 4000 at a premium of Rs. 21.45

and buys a further OTM Nifty Put option with a strike price Rs. 3800 at a premium of Rs.

3.00 when the current Nifty is at 4191.10, with both options expiring on 31st July.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3287

• If Nifty closes at 4925

A. 145.95 and -75.05

B. -35.05 and 164.95

C. -181.55 and 18.45

D. 25.05 and 154.25

Section A (1 Mark)

investment plan pays Rs. 1 lac at the beginning of 10th year for 5 years and Rs. 2 lacs for

next 5 years. If the rate of interest is 10% per annum. What will be the present value of this

investment?

A. 362190

B. 371298

C. 383721

D. 396454

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose Taxable

income is:

• $ 1,22,300 in US dollars and he is a US citizen (Heads of the households)

• $ 310000 in SGD and he is a citizen of Singapore

A. 27450.10 USD and 57780 SGD

B. 25220 USD and 52700 SGD

C. 24580.50 USD and 45200 SGD

D. 24580 USD and 14870 SGD

Section A (1 Mark)

In a life insurance contract, offer refers to

A. Proposer paying the first premium

B. Proposer’s application form for insurance

C. Original policy bond

D. Company brochure duly authenticated

Section C (4 Mark)

Tom dies in January of the current year and leaves his wife Jeanne a $50,000 insurance

policy. Jeanne elects to receive the proceeds at $10,000 per year plus interest, for five

years. In the current year, she receives $12,000 ($10,000 plus $2,000 interest).

How much must Jeanne include in her gross income?

A. $2,000

B. $5,000

C. $4,500

D. $4,200

Section A (1 Mark)

Determine the status of X and Y who are the legal heirs of Z

A. Local Athority

B. BOI

C. An individual

D. HUF

Section A (1 Mark)

Which is not the condition for getting superannuation fund approved?

A. All the benefits should be payable only in India

B. Employee should be contributor to the fund

C. Employer should be contributor to fund

D. Funds have to be invested as per income tax rules1962

Section B (2 Mark)

Non-Resident (NR) is __________on Indian Income and ___________on Foreign Income.

A. Non Taxable and Taxable

B. Taxable and Non Taxable

C. Taxable and Taxable

D. Non Taxable and Non taxable

Section A (1 Mark)

The small-firm-in-January effect refers to the phenomenon that portfolios of small-firm

stocks (compared to portfolios of large-firm stocks) have:

A. A tendency to underperform the stock market.

B. High returns in December and January.

C. Abnormal positive returns, primarily in January.

D. Returns in January that are positively correlated with returns in December

Section B (2 Mark)

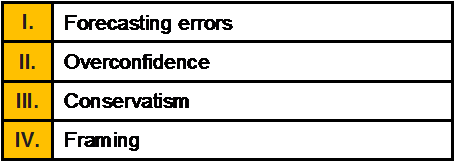

Information processing errors consist of

A. I and II

B. I and III

C. III and IV

D. I, II and III

Section B (2 Mark)

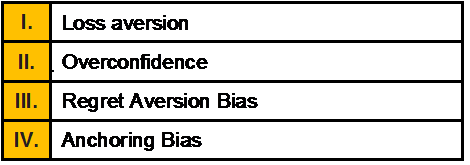

The Sachdeva family includes a financially well-informed couple, both aged thirty-two, and

two children aged four and six. They are financially sound, but were not in the market

during the bull market of the 2003 to 2007 as many of their neighbors were. The couple’s

total income, Rs.12,00,000 which is not expected to grow significantly. They have saved

Rs.15,00,000, which they hope will be the financial foundation from which they will send

their children to college and retire comfortably. The Sachdeva’s suffer from:

A. I and II

B. I, III and IV

C. III and IV

D. I, II and III

| Page 42 out of 103 Pages |

| Previous |