Section B (2 Mark)

Resident but not ordinary resident (RNOR) is ____________ on Indian Income and

___________ on Foreign Income.

A. Taxable and Non Taxable

B. Non Taxable and Taxable

C. Taxable and Taxable

D. Non Taxable and Non taxable

Section B (2 Mark)

Gold trades at Rs.16000 per 10 gms in the spot market. Three-month gold futures trade at

Rs.16150. One unit of trading is 1kg and the delivery unit for the gold futures contract on

the NCDEX is 1 kg. A speculator who expects gold prices to rise in the near future buys 1

unit of gold futures. Two months later gold futures trade at Rs.15900 per 10 gms. He

makes a profit/loss of ______________.

A. (+)2500

B. (+)25,000

C. (-)2500

D. (-)25,000

Section A (1 Mark)

Retiring early will need

A. Normal saving as planned earlier

B. Accelerated savings to get the goal

C. Delayed savings

D. All of the above

Section C (4 Mark)

In 2011-12, Lily (who is resident and ordinarily resident in the UK for the year) earns a

gross salary from her UK employment of £45,000. PAYE (Pay as you Earn)of £7,600 is

deducted from this income.

She owns a holiday home in France and receives rents of £2,250 for the year. This is the

net figure after withholding tax of 25% has been deducted.

Her income tax payable for the year is:

A. £9,210

B. £1,610

C. £860

D. £410

Section A (1 Mark)

A bank is considering making a loan to Jitesh Desai. Jitesh is a commissioned sales

broker. Some months he earns as much as Rs 1,00,000 and in other months he earns

virtually nothing. Which aspect of evaluating a consumer loan would this be concerned

with?

A. Character and purpose

B. Income level

C. Deposit balance

D. Employment and residential stability

Section A (1 Mark)

Holistic advisory services which cater to specific client segments such as entrepreneurs,

professionals are known as____________________.

A. Universal Banks

B. Family Office

C. Global Investment Banks

D. Wealth management Specialists

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose Taxable

income is:

• $ 85650 in US dollars and he is a US citizen (single individual)

• $ 159000 in SGD and he is a citizen of Singapore

A. 17442.50 USD and 22260 SGD

B. 15860.50 USD and 15680 SGD

C. 16580.50 USD and 16100 SGD

D. 25480 USD and 15870 SGD

Section C (4 Mark)

Asit an industrialist wants to buy a car presently costing Rs. 10,00,000/- after 5 years. The

cost of the car is expected to increase by 10% p.a for the first 3 years and by 6% in the

remaining years. Asit wants to start a SIP with monthly contributions in HDFC Top 200

Mutual Fund. You as a CWM expect that the fund would give an average CAGR of 12% in

the next 5 years. Please advise Asit the monthly SIP amount starting at the beginning of

every month for the next 5 years to fulfill his goal of buying the Car he desires.

A. 1495512

B. 18614.48

C. 20614.48

D. 18311.71

Section A (1 Mark)

Mr. X, partner of M/s XYZ, is assessable as

A. An individual

B. Firm

C. HUF

D. Body of Individual

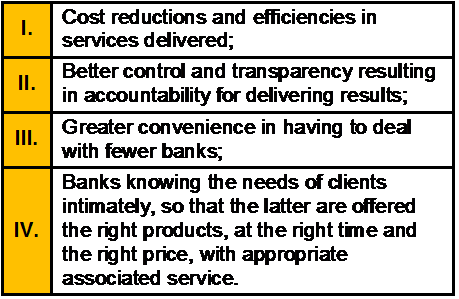

Section A (1 Mark)

Which one of the above statements is/are not a important needs of clients in the context of

relationship management:

A. I and III

B. II

C. III and IV

D. None of the Above

Section C (4 Mark)

Read the senario and answer to the question.

The present household expenses of Mr Bhatia is Rs. 3,00,000 p.a. but if he were to retire

today he would require only Rs. 2,25,000 p.a. Calculate his required retirement corpus if

interest rate is 12% p.a. and inflation rate is 7%.

A. Rs. 1,53,87,451

B. Rs. 1,74,78,345

C. Rs. 1,61,06,405

D. Rs. 1,50,04,378

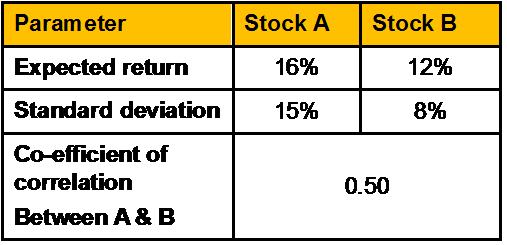

Section B (2 Mark)

From the following data calculate the covariance between stock A and stock B

A. 65

B. 60

C. 54

D. 76

| Page 41 out of 103 Pages |

| Previous |