Section B (2 Mark)

Calculate the standard deviation on a portfolio from the following data

A. 14.23

B. 5.15

C. 17.25

D. 11.34

Section A (1 Mark)

In case of non-resident, who is carrying on shipping business, his Indian income shall be

presumed to be:

A. 5% of certain amount received

B. 7.5% of certain amount received

C. 10% of certain amount received

D. 8.5% of certain amount received

Section A (1 Mark)

A(n) _________________________ combines a normal debt instrument with a credit

option. It allows the issuer of the debt instrument to lower its loan repayments if some

significant factor changes.

A. Credit Futures

B. standby letter of credit

C. credit linked note

D. credit swap

Section A (1 Mark)

You buy a investment plan by investing Rs. 5000/- per month for first 12years if the

investment pays Rs. 5000 for the next 12 years and the rate of interest is 15% per annum

compounded monthly. How much amount would you have after 24 years?

A. 9930225

B. 9910232

C. 9802747

D. 9716362

Section C (4 Mark)

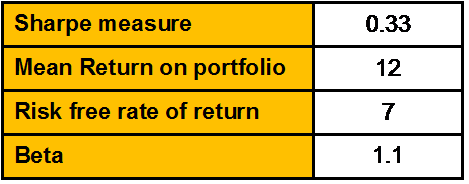

The expected return for the market is 12 percent, with a standard deviation of 20 percent.

The expected risk-free rate is 8 percent. Information is available for three mutual funds, all

assumed to be efficient, as follows:

Calculate the expected return on each of these portfolios respectively.

A. 11%,11.4% and 11.80%

B. 10.70%,11% and 11.25%

C. 9%,9.50% and 10.50%

D. 8.50%,10.50% and 10.80%

Section A (1 Mark)

The tendency, after an event has occured, to think that we knew what was going to happen

beforehand. We overestimate the likeliness that we would have been able to predict the

outcome of a past series of events. Which of the following is most likely consistent with this

bias?

A. Anchoring and Adjustment Bias

B. Framing Bias

C. Confirmation bias

D. Hindsight bias

Section B (2 Mark)

The lesson from the credit crisis of 2007-2009 is that securitized assets and credit swaps

are:

A. Complex financial instruments

B. Difficult to correctly value and measure in terms of risk exposure

C. Possible to set in motion a financial contagion that cannot be easily stopped without active government intervention

D. All of the above are correct

Section A (1 Mark)

In The CAMPARI model of Credit evaluation ‘C’ stands for:

A. Capacity

B. Collateral

C. Character

D. Capital

Section A (1 Mark)

Which of the following industry categories is said to be “bought to be sold?”

A. Cyclical

B. Defensive

C. Growth

D. Countercyclical

Section A (1 Mark)

The proposed Fair Tax would change the U.S. tax system and instead:

A. Institute a national sales tax

B. Institute a single income tax rate for all taxpayers

C. Would only tax the rich

D. None of the Above

Section A (1 Mark)

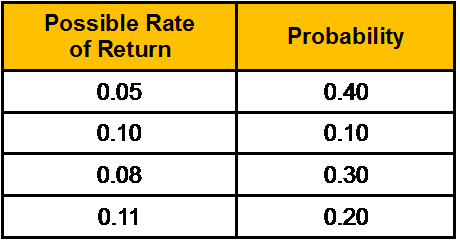

Manish is thinking of acquiring some shares of ABC Ltd. The rate of returns is as follows:

Calculate the expected return on the investments

A. 7.6

B. 9.5

C. 5.2

D. 1.6

Section A (1 Mark)

One of the tax exemption under avoidance of Double Taxation is U/S Sec 10(6)(ii) for

exemption on income received by the diplomats, ambassador, etc

A. TRUE

B. FALSE

| Page 37 out of 103 Pages |

| Previous |