Section A (1 Mark)

Long-term cash flow improvement may not be achieved by

A. Increasing equity capital

B. Reducing capital expenditure

C. Increasing long-term liabilities

D. Reducing long-term debt

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose taxable

income is:

• $92120 in SGD and he is a Singapore citizen

• £ 57482p.a (only Savings Income) and he is a UK citizen

A. £ 6715.80 and 2843.50 SGD

B. £ 22992.80 and 12896.80 SGD

C. £ 26863.20 and 11375 SGD

D. £ 16789.50 and 2310 SGD

Section A (1 Mark)

A type of lease where there is no payment schedule and penalty for a set period of lines.

A. True lease

B. Sub lease

C. Operating lease

D. Skip lease

Section B (2 Mark)

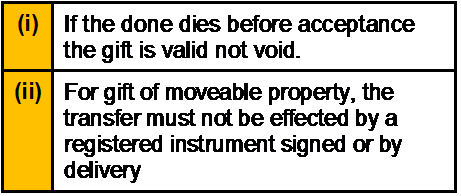

Which of the following statement is/are correct?

A. (i) only

B. (ii) only

C. Both (i) & (ii) are correct

D. Both (i) & (ii) are incorrect

Section A (1 Mark)

Which of the following types of income is received by individuals without deduction of basic

rate tax?

A. Loan interest paid by UK companies

B. Building society interest

C. Patent royalties

D. Bank interest received on a National Savings bank account

Section C (4 Mark)

Read the senario and answer to the question.

Raman’s company has made plans for the next year for a new project. It is estimated that

the company will employ total assets of Rs. 900 lakh, 75% of the assets being financed by

borrowed capital at an interest cost of 6% per year. The direct costs are estimated at Rs.

530 lakh. All other operating expenses are estimated at Rs. 95 lakh. The goods will be sold

to customers at 150% of the direct costs. Income tax rate is assumed to be 30%. Calculate

net profit margin and return on owners’ equity.

A. 12.13%, 44.34%

B. 11.40%, 40.29%

C. 10.75%, 43.37%

D. 13.32%, 42.38%

Section A (1 Mark)

_____________allow investors to increase diversification in direct real estate holdings by

investing in groups of real estate projects.

A. Lease / Tenancy Agreement

B. Aggregation Vehicles

C. High and Best Use of Property

D. Leveraged Equity Position

Section C (4 Mark)

Read the senario and answer to the question.

Portfolio A had a return of 12% in the previous year, while the market had an average

return of 10%. The standard deviation of the portfolio was calculated to be 20%, while the

standard deviation of the market was 15% over the same time period. If the correlation

between the portfolio and the market is 0.8, what is the Beta of the portfolio A?

A. 0.94

B. 1.07

C. 1.31

D. 1.91

Section A (1 Mark)

An investor will take as large a position as possible when an equilibrium price relationship

is violated. This is an example of _________.

A. dominance argument

B. mean-variance efficiency frontier

C. risk-free arbitrage

D. capital asset pricing model

Section A (1 Mark)

A 15 year annuity due has a future value of Rs. 15,00,000/- If ROI is 9 % per annum, then

how much will be each annuity amount ?

A. 35487.98

B. 56487.32

C. 46870.02

D. 47897.12

Section B (2 Mark)

Rakhi purchased a piece of land on 25-4-1979 for Rs.80000. This land was sold by him on

23-12-2011 for Rs.1250000. The market value of the land as on 1-4-1981 was Rs.98000.

Expenses on transfer were 1.5% of the sale price. Compute the capital gain for the

assessment year 2012-13. [CII-12-13: 852,11-12: 785,10-11:711]

A. 562506

B. 461950

C. 539980

D. 710020

Section A (1 Mark)

According to Prospect Theory, investors are more concerned with changes in wealth than

in returns. Prospect Theory suggests that investors:

A. Are Risk Averse

B. Can be loss averse

C. Place more value on gains than on losses of equal than on losses of equal magnitude

D. None of these

| Page 35 out of 103 Pages |

| Previous |