Section A (1 Mark)

A call option on a stock is said to be in the money if

A. The exercise price is higher than the stock price.

B. The exercise price is less than the stock price.

C. The exercise price is equal to the stock price.

D. The price of the put is higher than the price of the call.

Section C (4 Mark)

Suppose Sunil visits his favorite coffee shop and encounters his good friend Rohit. Rohit

raves about his stockbroker, whose firm employs an analyst who appears to have made

many recent successful stock picks. The conversation goes something like this:

SUNIL: Hi, Rohit, how are you?

ROHIT: Hi, Sunil. I’m doing great! I’ve been doing superbly in the market recently.

SUNIL: Really? What’s your secret?

ROHIT: Well, my broker has passed along some great picks made by an analyst at her

firm.

SUNIL: Wow, how many of these tips have you gotten?

ROHIT: My broker gave me three great stock picks over the past month or so. Each stock

is up now, by over 10 percent.

SUNIL: That’s a great record. My broker seems to give me one bad pick for every good

one. It sounds like I need to talk to your broker; she has a much better record!

Which of the following biases have been exhibited by Gaurav?

A. Representative bias

B. Sample Size Neglect Bias

C. Framing bias

D. Loss Aversion bias

Section B (2 Mark)

Mr. Murti is working in a reputed company and earning Rs. 4,00,000/- p.a. and is now 50

years old. He has invested Rs. 1,50,000/- in an annuity which will pay him after 5 years a

certain amount p.m. at the beginning of every month for 10 years. Rate of interest is 8%

p.a. Calculate how much he will receive at the beginning of every month after 5 years?

A. 2623

B. 2598

C. 2871

D. 2656

Section A (1 Mark)

_________________ is a method to evaluate a large volume of consumer loans quickly

with minimum labor. This method is a statistical model which predicts whether the

consumer will repay the loan or not.

A. Debt Scoring

B. Credit Scoring

C. Credit Process

D. Debt consolidation

Section B (2 Mark)

NRIs are granted a special benefit by way of an option of being taxed at concessional tax

rate of ________ as regards "investment income" and _______ as regards "long term

capital gains" arising from "specified assets.

A. 20% and 10%

B. 15% and 20%

C. 12% and 10%

D. 10% and 15%

Section B (2 Mark)

Basic Idea of retirement benefit plan is

A. To meet lump sum needs immediately at retirement

B. Provide regular income during retirement plan

C. Take care of inflation

D. All of the above

Section B (2 Mark)

Ram is working in Rashid Enterprises, a proprietorship firm.During his working hours Ram

was injured seriously. Due to this injury Ram was hospitalized for six months. Ram is the

only bread winner of his family. Ms. Rashid, the proprietor of Rashid Enterprises is liable to

pay damages to Ram. Under which of the following policy Rashid can protect himself from this liability?

A. The Directors’ and officers liability policy

B. Key Person Life Insurance Policy

C. Product Liability Insurance

D. Employer’s Liability Insurance Policy

Section A (1 Mark)

Which one of the following statements is false?

A. There is a liquid secondary market trading in private equity investments

B. Private equity is sometimes accused of taking short-term measures to enhance a company’s salability at the expense of its long-term prospects

C. A company may use private equity finance to repurchase its shares and return from public to private status

D. A businessman can use angel networks to source funding capital

Section A (1 Mark)

Which of the following is allowed as deduction from net annual value of a property?

A. Repairs & collection charges

B. Insurance premium

C. Interest on loan borrowed for repairs

D. All the above

Section C (4 Mark)

Belstate reported net income of Rs221 million in 1993 on revenues of Rs8298 million. It

paid out 31% of its earnings as dividends, a payout ratio that is expected to remain level

from 1994 to 1998, during which period earnings growth is expected to be 13.5%. After

1998, earnings growth is expected to decline to 6%, and the dividend payout ratio is

expected to increase to 60%. The beta is 1.15 and this figure is expected to remain

unchanged. The treasury bill rate is 7%.

Estimate the price/sales ratio for Walgreens, assuming its profit margin remains unchanged

at 1993 levels.

A. 0.35

B. 0.275

C. 0.25

D. 0.52

Section B (2 Mark)

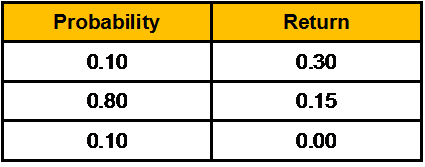

You are given the following set of data on security ABC:

Calculate the expected return on security ABC?

A. 0.12

B. 0.15

C. 0.13

D. 0.14

Section C (4 Mark)

An investor purchased on margin Alpha Computer for Rs. 30/- a share. The stock's price

subsequently rose to Rs. 50/- a share at which time the investor sold the stock. If the

margin requirement is 60 percent and the interest rate on borrowed funds was 7 percent,

what would be the percentage earned on the investor's funds (excluding commissions)?

What would have been the return if the investor had not bought the stock on margin?

A. 108.47%, 52.36%

B. 106.44%, 66.7%

C. 102.23%, 57.39%

D. 95.26%, 47.27%

| Page 34 out of 103 Pages |

| Previous |