Section A (1 Mark)

A(n) _________________________ guarantees the swap parties a specific rate of return

on their credit asset. Bank A may agree to pay the total return on the loan to Bank B plus

any appreciation in the market value of the loan. In return Bank A will often get LIBOR plus

a fixed spread plus any depreciation in the value of the loan.

A. credit option

B. Total return Swap

C. credit linked note

D. credit swap

Section B (2 Mark)

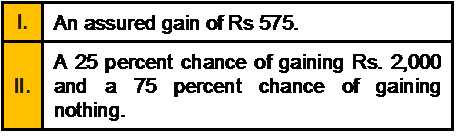

Which of the following two outcomes is an example of Loss Aversion Bias:

A. I

B. II

C. Both of the above

D. None of the above

Section B (2 Mark)

Withholding Tax Rates for payments made to Non-Residents are determined by the

Finance Act passed by the Parliament for various years. The current rates for Dividends

are:

A. 10

B. 15

C. 20

D. 12

Section C (4 Mark)

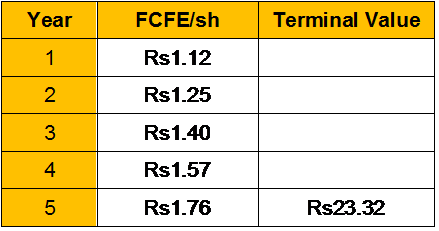

Watts Industries, a manufacturer of valves for industrial and residential use, had the

following projected free cash flows to equity per share for the next five years , in nominal

terms.

The terminal price is based upon a stable nominal growth rate of 6% a year after year 5.

The discount rate, based upon financial market rates, is 14%, and the expected inflation

rate is 3%.

Estimate the value per share, using nominal cash flows and the nominal discount rate.

A. Rs 16.84

B. Rs 31.14

C. Rs 15.95

D. Rs 17.75

Section A (1 Mark)

One aspect of the tax considerations in asset allocation is that

A. Capital gains are often taxed at a higher rate than income.

B. Taxes on capital gains are deferred until the gain is realized.

C. Investors are exempt from taxes on capital gains once they reach age 65.

D. Current income is seldom a significant consideration for an investor in the spending phase of the life cycle.

Section B (2 Mark)

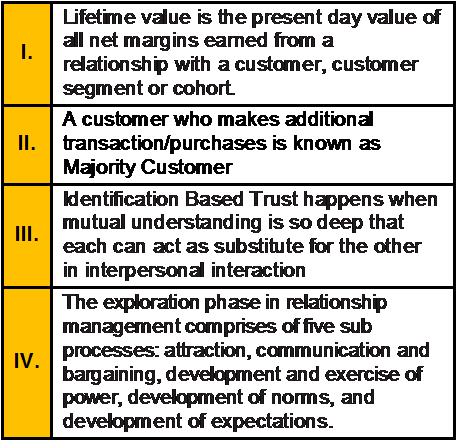

Which of the following statements is/are correct?

A. I, II and III

B. I, III and IV

C. II, III and IV

D. All of the above

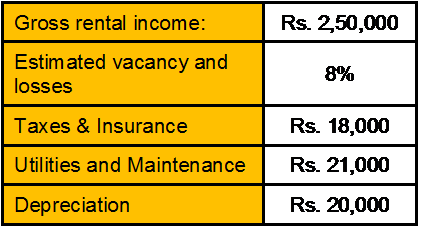

Section B (2 Mark)

Calculate the value at which an office building can be priced from the following information:

A similar building has 8% capitalization rate.

A. Rs. 23,87,500

B. Rs. 19,11,000

C. Rs. 22,93,500

D. Rs. 21,10,000

Section A (1 Mark)

Which of the following is an element of an organization’s internal-environment?

A. Wholesalers

B. Retailers

C. Employees

D. Competitors

Section B (2 Mark)

As per Double Taxation Avoidance Agreement, the Technical Fees in UAE is charged at:

A. 22.5

B. 15

C. 20

D. Nil

Section C (4 Mark)

Read the senario and answer to the question.

Approximately how much amount she must sacrifice to provide the income stream for her

mother?

A. Rs. 19,56,380

B. Rs. 20,62,270

C. Rs. 22,68,460

D. Rs. 24,24,850

Section A (1 Mark)

The two primary tools of a technical analyst are:

A. Level of the market index and volume

B. Economic indicators and level of the market index

C. Price and volume

D. Price and technical indicators

Section C (4 Mark)

Shikha has an investment portfolio of Rs.100000, a floor of Rs.75000, and a multiplier of 2.

So the initial portfolio mix is 50000 in stocks and 50000 in bonds. If stock market goes up

by 20%, what should Shikha do?

A. She should sell Rs.10000 of stocks and invest it into bonds

B. She should sell Rs.10000 of bonds and invest it into stocks

C. She should buy Rs.10000 of stocks and sell Rs.10000 of bonds

D. She should sell his portfolio equally

| Page 31 out of 103 Pages |

| Previous |