Section C (4 Mark)

Read the senario and answer to the question.

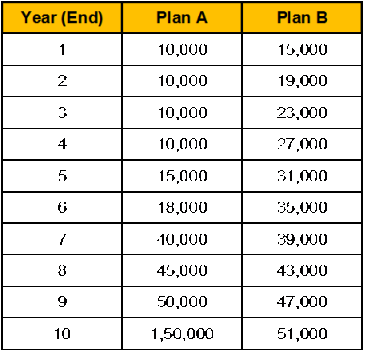

Saxena is considering an attractive investment proposal in which he is being offered two

different cash flow choices at the same initial investment of Rs. 2,00,000. According to you

which one should he opt for assuming Risk Free Interest Rate is the required rate of

return?

A. Plan A should be opted since it has a higher Future Value.

B. Plan B should be opted since it has a lower Present Value.

C. Plan B should be opted since it has a higher Present Value.

D. Plan B should be opted since it has a lower Future Value.

Section C (4 Mark)

Which of the following statements is/are correct?

A. I and II

B. I, II and III

C. III and IV

D. All of the Above

Section B (2 Mark)

If the currency of your country is appreciating, the result should be to ______ exports and

to _______ imports.

A. Stimulate, stimulate

B. Stimulate, discourage

C. Discourage, stimulate

D. Discourage, discourage

Section C (4 Mark)

Read the senario and answer to the question.

Raman has invested Rs. 1,50,000, 30% of which is invested in Company A, which has an

expected rate of return of 15%, and 70% of which is invested in Company B, with an

expected return of 12%. What is the expected percentage rate of return?

A. Rs. 13.17%

B. Rs. 12.90%

C. Rs. 11.59%

D. Rs. 12.57%

Section A (1 Mark)

_______________ reveals that people often focus on short-term financial events to the

detriment of their long-term needs.

A. In Equity Reversion

B. Money Illusion

C. Present-biased preferences

D. Inter Temporal Consumption

Section B (2 Mark)

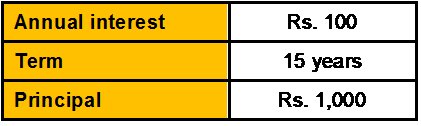

A bond has the following terms:

If you expect the bond to be called at the end of the year, what would be the maximum

price you should pay for the bond if comparable yields are 7 percent?

A. 1012.35

B. 1024.39

C. 1028.04

D. 1016.19

Section B (2 Mark)

Consider the multifactor model APT with two factors. Portfolio A has a beta of 0.75 on

factor 1 and a beta of 1.25 on factor 2. The risk premiums on the factor 1 and factor 2

portfolios are 1% and 7%, respectively. The risk-free rate of return is 7%. The expected

return on portfolio A is __________ if no arbitrage opportunities exist.

A. 13.50%

B. 15.00%

C. 16.50%

D. 23.00%

Section B (2 Mark)

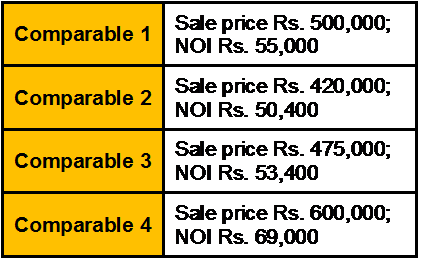

You have been asked to estimate the market value of an apartment complex that is producing annual net operating income of Rs44,500. Four highly similar and competitive

apartment properties within two blocks of the subject property have sold in the past three

months. All four offer essentially the same amenities and services as the subject. All were

open-market transactions with similar terms of sale. All were financed with 30-year fixedrate

mortgages using 70 percent debt and 30 percent equity. The sale prices and estimated

first-year net operating incomes were as follows:

What is the indicated value of the property using direct capitalization?

A. Rs 3,30,000

B. Rs 3,90,351

C. Rs3,75,000

D. Rs 3,57,000

Section C (4 Mark)

Two friends Neeraj and Kapil, both belonging to the 33.66% tax bracket, have invested Rs.

10 lakhs in a debt-based scheme. The scheme is a regular run of the mill, assembly line

product — nothing extraordinary about it.

The scheme has earned a distributable profit of 12%.

Kapil’s financial condition is not good and due to the business losses his assets are to be

auctioned.

Neeraj is working in MNC and getting an annual package of Rs. 18 lakhs. This includes Rs.

270000 as dearness allowance (2/3 forms the part of retirement benefit). He is also earning

an agricultural income of Rs. 54000.His expenses are Rs. 80000 per month.

Neeraj has also taken a housing loan in joint name of his wife Anita and himself. Property is

also in the joint name and their contribution is equal. Annual outflow towards housing loan

in terms of repayment of principal and interest is Rs. 300000. Out of this Rs. 198800 is

toward interest.

Neeraj has also invested an equal amount in a portfolio consisting of securities A and B.

Standard deviation of A is 12.43%; Standard deviation of B is 16.54%; Correlation

coefficient is 0.82

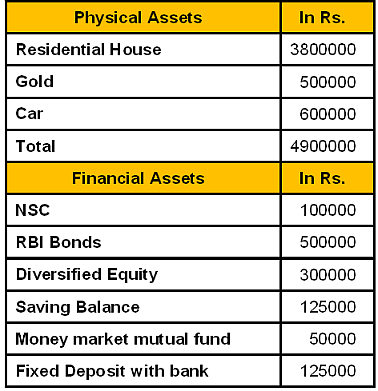

Assets held by Neeraj

Section B (2 Mark)

You buy a share of ABC Ltd for Rs. 20. You expect it to pay dividends of Re.1, Rs.1.10 and

Rs.1.21 in coming three years. Calculate the growth rate in dividend:

A. 5%

B. 6%

C. 8%

D. 10%

Section A (1 Mark)

In ________, the values exchanged by the contracting parties may not necessarily be

equal

A. Aleatory contracts

B. Conditional contract

C. Personal contract

D. Unilateral contract

Section A (1 Mark)

A cognitive heuristic in which people tend to reach conclusions based on the 'framework'

within which a situation is presented; e.g. people are more lokely to recommend the use of

a new procedure if it is described as having a '50% success rate' than a '50% failure rate'.

Which of the following is most likely consistent with this bias?

A. Anchoring and Adjustment Bias

B. Framing Bias

C. Confirmation bias

D. Overconfidence Bias

| Page 30 out of 103 Pages |

| Previous |