Section A (1 Mark)

Which portion of his property can a muslim normally be guest according to muslim personal

law?

A. One Fourth

B. One Third

C. Half

D. Fully

Section C (4 Mark)

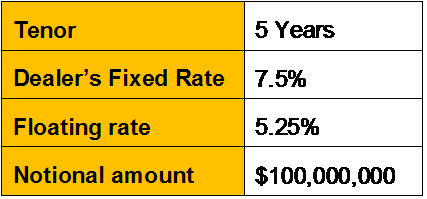

Assume the following;

With this agreement, every 6 months, the transfer of funds takes place between fixed rate

payer and floating rate payer.

What would Net Cash flows after 6-months from the initiation date?

A. $15,50,000 from Fixed-Rate to Floating-Rate Payer

B. $12,75,000 from Fixed-Rate to Floating-Rate Payer

C. $11,25,000 from Fixed-Rate to Floating-Rate Payer

D. $9,75,000 from Floating Rate Payer to Fixed Rate Payer

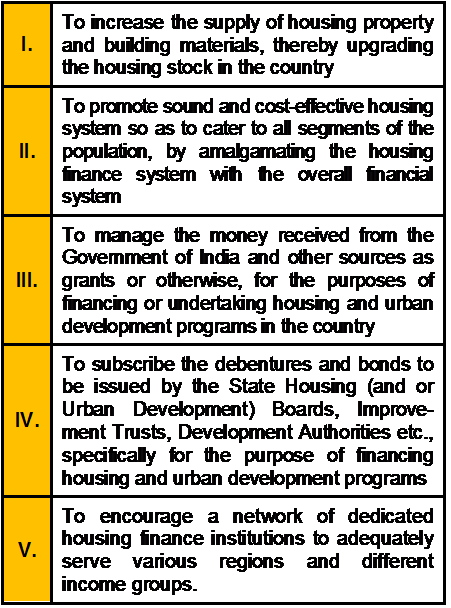

Section B (2 Mark)

Which of the following are the objectives of National Housing Bank in Indian Real Estate

Market?

A. I, II, III

B. II, III, IV and V

C. III, IV and V

D. I, II and V

Section A (1 Mark)

Investments that are difficult to convert to cash are said to have _________

A. High Liquidity

B. Low Liquidity

C. High standard deviation

D. Low standard deviation

Section A (1 Mark)

An aggressive asset allocation would contain larger proportions of __________ than a

conservative allocation.

A. Cash and bonds

B. Bonds and large-cap stocks

C. Small-cap and international stocks

D. Bonds

Section B (2 Mark)

An analyst expects a firm’s earning per share to grow at 8% per year. If the firm now earns

Rs. 3.50 a share, its earnings per share five years from now are expected to be:

A. Rs.4.11

B. Rs.4.90

C. Rs.5.14

D. Rs.5.17

Section B (2 Mark)

As per Double Taxation Avoidance Agreement, the Royalties in Mauritius is charged at:

A. 10

B. 15

C. 20

D. Nil

Section B (2 Mark)

If after the partition of an HUF 2 members became partners in 3 firms on behalf of their

respective HUFs and they also become partners in a fourth firm. The funds were obtained

by means of loans from the other 3 firms. The share incomes of the members from the

fourth firm were assessable as their individual income only.

A. TRUE

B. FALSE

Section C (4 Mark)

Vikas has an investment portfolio of Rs.100000, and a multiplier of 2. The initial portfolio

mix is Rs. 50000 in stocks and Rs. 50000 in bonds. If stock market goes up by 20%, what

should Vikas do under the constant mix policy?

A. He should sell Rs.5000 of stocks and invest it into bonds

B. He should sell Rs.10000 of bonds and invest it into stocks

C. He should buy Rs.20000 of bonds and invest it into stocks

D. He should sell his portfolio equally

Section A (1 Mark)

Which of the following statement is not true?

A. Increases in the market value of a stock generate capital gains when the stock is sold.

B. High P/E stocks should be preferred because they pay larger dividends.

C. The expected return depends on future dividends and future price appreciation.

D. The dividend-growth valuation model depends on dividends and the required rate of return.

Section A (1 Mark)

Which one of the following statements is untrue?

A. Venture capital finance usually refers to start-up capital for companies in their early days

B. A management buyout occurs when a company is dissatisfied with its management team and pays them to leave the company

C. Companies financed by private equity or venture capital may be sold on to another private equity investor or venture capitalist

D. Venture capital projects often fail and the venture capital is lost

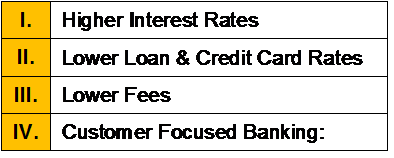

Section A (1 Mark)

Which of the following are the advantages of a Credit Union:

A. I, III and V

B. II, IV and V

C. I, III and IV

D. All of the Above

| Page 3 out of 103 Pages |

| Previous |