Section B (2 Mark)

Any income chargeable under the based “Salaries” is exempt from tax under Section

10(6)(viii), if it is received by any non resident individual as remuneration for services

rendered in connection with his employment in a foreign ship where his total stay in India

does not exceed a period days in that previous year.

A. 90

B. 182

C. 60

D. 120

Section C (4 Mark)

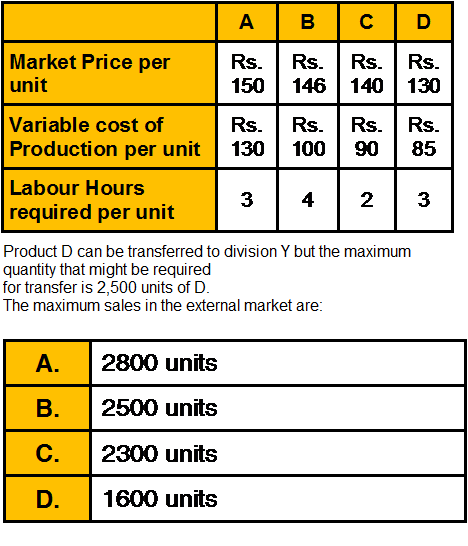

Division Z is a profit centre, which produces four products A, B, C and D, Each product is

sold in the external market also. Date for the period is as follows:

Division Y can purchase the same product at a slightly cheaper price of Rs. 125 per unit

instead of receiving transfer of product D from division Z.

What should be transfer price for each unit for 2500 units of D, if the total labour hours

available in division Z is:

A. 117.25

B. 118.34

C. 132.26

D. 145.12

Section B (2 Mark)

A disadvantage of using swaps to control interest rate risk is that

A. Swaps cannot be written for long horizons.

B. Swaps are more expensive than restructuring balance sheets.

C. Swaps, like forward contracts, lack liquidity.

D. All of the above are disadvantages of swaps.

Section B (2 Mark)

Which of the following statements concerning index funds and actively managed funds is

true?

A. Their performance is about equal.

B. They tend to have an inverse relationship.

C. Actively managed funds tend to outperform index funds.

D. Index funds tend to outperform actively managed funds.

Section B (2 Mark)

The modified duration of a bond is 7.87. The percentage change in price using duration for

a yield decrease of 110 basis points is closest to:

A. –8.657%.

B. 7.16%

C. +8.657%.

D. None of the Above

Section B (2 Mark)

If an investor determines that next year’s earnings estimate is Rs2.00 per share and the

company subsequently falters, the investor may not readjust the Rs2.00 figure enough to

reflect the change because he or she is “anchored” to the Rs2.00 figure. This is not limited

to downside adjustments—the same phenomenon occurs when companies have upside

surprises

Which of the following Biases have been exhibited by the investor?

A. Representative bias

B. Anchoring and Adjustment Bias

C. Framing bias

D. Loss Aversion bias

Section B (2 Mark)

Rahul decides to deposit Rs. 5,000/- every month into an account yielding 12 % per annum

compounded monthly for 20 years. What will be the accumulated value in this account after

20 years and how much amount can be withdrawn from this account every month for a

further period of 20 years of ROI is 8 % per annum compounded monthly?

A. 41384.95

B. 4946276

C. 594523

D. 40230.85

Section C (4 Mark)

Read the senario and answer to the question.

If Mahesh has the option of 3 funds whose details are as below, find Jensen’s index for

fund A, Treynor index for fund B and Sharpe index for the market

A. 0.7%; 2.2; 0.1764

B. 0.5%; 2.2; 0.1764

C. 1%; 2.2; 0.5

D. 1%; 2.2; 0.8

Section A (1 Mark)

Under which of the following categories of General Warranty Deed does the buyer is

guaranteed that the title will be good against third parties attempting to establish title to the

property?

A. Covenant of seisin

B. Covenant against encumbrances

C. Covenant of quiet enjoyment

D. Covenant of further assurance

Section A (1 Mark)

Another name for open-end credit is:

A. Revolving credit.

B. A box of credit.

C. Convenience credit.

D. Installment credit.

Section A (1 Mark)

Ideally, clients would like to invest with the portfolio manager who has

A. A moderate personal risk-aversion coefficient.

B. A low personal risk-aversion coefficient.

C. The highest Sharpe measure.

D. The highest record of realized returns.

Section B (2 Mark)

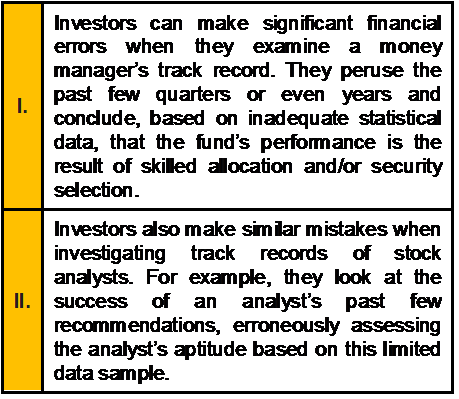

Which of the Following are the Negative Effects of Sample-Size neglect for investors

A. I

B. II

C. Both of the above

D. Neither of the above

| Page 29 out of 103 Pages |

| Previous |