Section A (1 Mark)

The __________ is NOT a market anomaly.

A. size effect

B. January effect

C. earnings announcement anomaly

D. accounting changes effect

Section B (2 Mark)

Mr. A purchased certain shares of a company during the financial year 1987-88 for a sum

of Rs.1,50,000/-. A sold the shares during the financial year 2011-12 for Rs.8,10,000/-

when the market is at all time high. Calculate the amount of capital gains. [CII-12-13: 852,11-12: 785,10-11:711]

A. Rs.25000

B. Rs.56511

C. Rs.46180

D. Rs.60569

Section B (2 Mark)

The ________________provides that where the total income of an enterprise is computed

by the AO on the basis of the arm's length price as computed by him, the income of the

other associated enterprise shall not be recomputed by reason of such determination of

arm's length price in the case of the first mentioned enterprise, where the tax has been

deducted or such tax was deductible, even if not actually deducted under the provision of

chapter VIIB on the amount paid by the first enterprise to the other associate enterprise.

A. First proviso to section 92 C(4)

B. Second proviso to section 92C(4)

C. First proviso to section 91 C(4)

D. Second proviso to section 91C(4)

Section C (4 Mark)

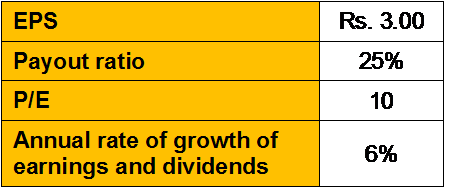

You know the following concerning a common stock:

If you want to earn 10 percent, should you buy this stock? What is the maximum price you

should be willing to pay for the stock?

A. Should Buy, Maximum price Rs. 30

B. Should not buy, Maximum price Rs. 19.88

C. Should buy Maximum Price Rs. Rs. 60.27

D. Should not buy, Maximum price Rs. 22.66

Section B (2 Mark)

In the year to 31 March 2012, A Ltd (which is UK resident) made a UK trading profit of

£100,000. The company's only other income consisted of rents received of £52,500 (net)

from an investment property in Germany. These rents were received net of withholding tax

of 25%. A Ltd has no associated companies.

The credit for double tax relief that will be given in the corporation tax computation for the

year will be:

A. £13,125

B. £17,500

C. £14,000

D. £nil

Section B (2 Mark)

What is the size of the final unequal payment of a loan for Rs15 600 and it has monthly

payments of Rs500? The interest rate is 9.92% compounded quarterly.

A. Rs. 383.11

B. Rs. 380.21

C. Rs. 388.97

D. Rs. 417.27

Section B (2 Mark)

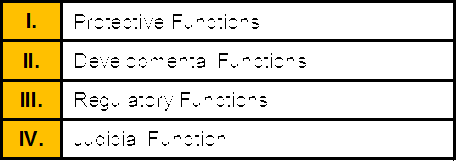

Securities and Exchange Board of India (SEBI) performs three major functions to meet its

objectives these are:

A. I, II, IV

B. I, II, III

C. II, III, IV

D. I, III, IV

Section B (2 Mark)

Equity stock of X ltd. is currently selling at Rs. 35/- per share. The dividend expected next

year is Rs. 2/- per share and the investor’s required return in this stock is 15 % per annum.

If the constant Growth Model applies to X ltd. then calculate the Growth Rate.

A. 11.23%

B. 12.05%

C. 9.28%

D. 10.23%

Section A (1 Mark)

In whose total income, the income of a minor child is included –

A. Parent whose total income is greater

B. Mother

C. Father & Mother both

D. Father

Section B (2 Mark)

Consider the single-factor APT. Stocks A and B have expected returns of 15% and 18%,

respectively. The risk-free rate of return is 6%. Stock B has a beta of 1.0. If arbitrage

opportunities are ruled out, stock A has a beta of __________.

A. 0.67

B. 1

C. 1.3

D. none of the above

Section B (2 Mark)

As per article 11 Double Taxation Avoidance Agreement with UAE, Interest arising in a

Contracting State and paid to a resident of the other Contracting State may be taxed in that

other State. However, such interest may be taxed in the Contracting State in which it arises

and according to the laws of that State, but if the recipient is the beneficial owner of the

interest, the tax so charged shall not exceed:

(a) _______ percent of the gross amount of the interest if such interest is paid on a loan

granted by a bank carrying on a bona fide banking business or by a similar financial

institution; and

(b) _______ percent of the gross amount of the interest in all other cases.

A. 10 and 15

B. 5 and 12.50

C. 20 and 15

D. 12 and 15

Section A (1 Mark)

Deduction under section 80RRB is allowed to the extent of:

A. 50% of royalty or Rs. 3,00,000 whichever is less

B. 100% of royalty or Rs. 3,00,000 whichever is less

C. 100% of royalty or Rs. 2,00,000 whichever is less

D. 100% royalty or Rs. 5,00,000 whichever is less

| Page 25 out of 103 Pages |

| Previous |