Section B (2 Mark)

Hybrid plans are

A. Combination of DB & ESOP plan

B. Combination of DB & DC plan

C. Combination of ESOP and Money purchase plan

D. None of the above

Section B (2 Mark)

All of the following are assumptions made by technical analysts except:

A. Changes in trend are caused by shifts in supply and demand relationships.

B. Stock price movements are independent.

C. Security prices tend to move in trends.

D. Supply and demand of securities are determined by various factors.

Section A (1 Mark)

______________are bonds issued by governments that pledge their "full faith and credit,"

including tax revenues, to repayment in US.

A. General Obligation Bonds

B. General Revenue Bonds

C. Revenue Bonds

D. Expenditure Bonds

Section B (2 Mark)

The equity risk premium for the market is 8 percent. Jackson Products has a beta of 0.4.

The real risk-free rate is 2 percent and the expected inflation premium is 5 percent. The

required rate of return for Jackson is __________ percent.

A. 15.4

B. 10.2

C. 7.4

D. 6.7

Section B (2 Mark)

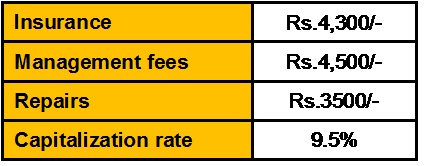

Lalit wants to sell a property for Rs.20 lakhs. He is earning rent from tenant Rs.2,15,000.

He is spending following amounts annually on that property

The value of the property would be:

A. Rs 21, 33,684.21

B. Rs 21, 12,254.24

C. Rs 19, 75,452.15

D. Rs 19, 84,578.29

Section A (1 Mark)

Which of the following is not true about traditional defined benefit plans?

A. A defined benefit plan provides a specified retirement benefit, and is funded based on actuarial assumptions

B. A defined benefit plan provides higher proportionate benefits for key employees when key employees as a group are older than rank and file employees

C. A defined benefit plan provides an individual account for each participant employee

D. A defined benefit plan can provide benefits for service prior to establishment of the plan

Section A (1 Mark)

Assessing client’s level of risk tolerance is done while

A. Making a wealth plan

B. Reviewing a wealth plan

C. Both of above

D. None of the above

Section B (2 Mark)

Which of the following is an assumption of two stage dividend discount model?

A. This model assumes two stages of growth, the first phase in which the growth rate is high and the second phase which represents steady state in which the growth rate is assumed to be stable and is expected to continue for a long-term.

B. This model assumes two stages of growth, the first phase in which the growth rate is low and the second phase which represents steady state in which the growth rate is assumed to be stable and is expected to continue for a long-term.

C. This model assumes two stages of growth, the first phase in which the growth rate is high and the second phase which represents steady state in which the growth rate is assumed to be stable and is expected to continue for next two years.

D. None of the above.

Section B (2 Mark)

In US which form tells your employer all they need to know about your tax-related

allowance information?

A. W-2

B. W-4

C. W-10

D. W-7

Section B (2 Mark)

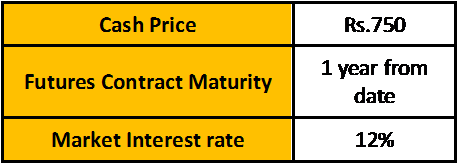

Which of the following is closest to the forward price of a share price if

Dividend expected is 6%?

A. Rs. 795

B. Rs. 705

C. Rs. 845

D. None of these

Section A (1 Mark)

Risk factors in the APT must possess all of the following the characteristics except:

A. Factors must be readily observable in risk/return space.

B. Each factor must have a pervasive influence on stock returns

C. Factors must influence expected return.

D. Factors must be unpredictable.

Section A (1 Mark)

In US How many states do not have a personal income tax?

A. 9

B. 10

C. 11

D. All of the above

| Page 23 out of 103 Pages |

| Previous |