Section B (2 Mark)

Select the CORRECT statement regarding basis risk associated with futures.

A. Basis risk can be completely eliminated.

B. Although the basis fluctuates over time, it can be precisely predicted.

C. The basis must be zero on the maturity date of the contract.

D. A hedge will reduce risk as long as basis fluctuations are positive.

Section A (1 Mark)

A(n)____________________________________________ is where the customer can use

the difference between some percentage of the appraised value of their home and the

mortgage remaining to secure a loan. This loan can be used to fund a college education,

pay for a vacation or pay for home improvements.

A. Home Equity Loan

B. Personal Loan

C. Auto Loan

D. Loan against Shares

Section A (1 Mark)

A(n) _________________________ occurs when two banks agree to exchange a portion

or all of the loan repayments of their customers.

A. credit option

B. standby letter of credit

C. credit linked note

D. credit swap

Section A (1 Mark)

The risk that occurs when the index used for determination of interest earned on the CDO

trust collateral is different from the index used to calculate the interest to be paid on the

CDO trust is known as______________.

A. Basis Risk

B. Yield Curve Risk

C. Default Risk

D. Spread Risk

Section C (4 Mark)

Read the senario and answer to the question.

What will be the taxable amount of Gratuity on his retirement?

A. Rs. 50,000

B. Rs. 17,735

C. Rs. 1,33,462

D. Rs. 3,71,135

Section A (1 Mark)

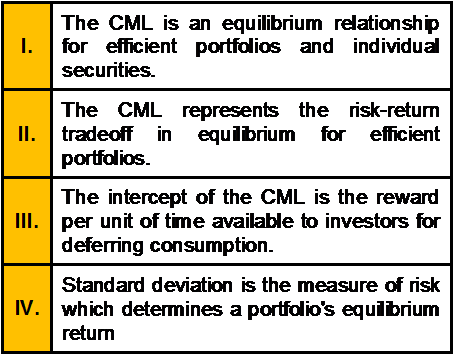

Select the INCORRECT statement regarding the CML

A. I and II

B. Only I

C. Only II

D. III and IV

Section C (4 Mark)

Navin Corporation, a manufacturer of do-it-yourself hardware and housewares, reported

earnings per share of Rs2.10 in 1993, on which it paid dividends per share of Rs0.69.

Earnings are expected to grow 15% a year from 1994 to 1998, during which period the

dividend payout ratio is expected to remain unchanged. After 1998, the earnings growth

rate is expected to drop to a stable 6%, and the payout ratio is expected to increase to 65%

of earnings. The firm has a beta of 1.40 currently, and it is expected to have a beta of 1.10

after 1998. The Risk Free rate is 6.25%.

What is the value of the stock, using the two-stage dividend discount model?

A. Rs27.59

B. Rs 30.06

C. Rs 25.15

D. Rs 27.75

Section B (2 Mark)

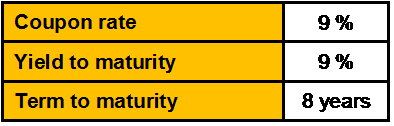

As a CWM you are considering the following bond for inclusion in the fixed income portfolio

of your client:

What will be the duration of this bond? and What will be the effect of the changes on the

duration of the bond if the coupon rate is 6% rather than 9%?

A. 8 years, Increase

B. 7.33 years, Decrease

C. 6.031 years, Increase

D. 7.012 Years, Decrease

Section A (1 Mark)

Technical analysis reflects the idea that stock prices

A. Move upward over time

B. Move inversely over time.

C. Move in trends

D. Move randomly

Section A (1 Mark)

If an investor searches for patterns in security returns by examining various techniques

applied to a set of data, this is known as:

A. Fundamental analysis.

B. Technical analysis.

C. Data mining.

D. Random-walk theory.

Section A (1 Mark)

A 5 year ordinary annuity has a future value of Rs. 1,00,000/-. If ROI is 8 % per annum, then how much will be the amount of each payment ?

A. 17,045.64

B. 16532.23

C. 11000.44

D. 13000.75

Section B (2 Mark)

Mansi needs Rs. 25,000/-, 5 years from now. She would like to make equal payments at

the Begin of each year from now onwards into an account that yields annual ROI @ 7 %

per annum. What should be her annual payments?

A. 6023.43

B. 4050.23

C. 4093.43

D. 4062.87

| Page 21 out of 103 Pages |

| Previous |