Section A (1 Mark)

REITs offer all of these, except:

A. An income stream.

B. Price appreciation/depreciation

C. Illiquidity.

D. Professional management.

Section A (1 Mark)

Dividend received by a shareholder from an Indian company the whole of whose income is agricultural income shall be treated as:

A. agricultural income in the hands of shareholder and thus exempt

B. agricultural income and thus exempt but it will be subject to partial integration

C. exempt under section 10(34) but taxable in the hands of the company

D. income taxable under the head income from other sources

Section A (1 Mark)

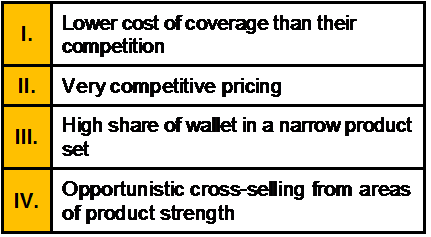

In order to remain competitive, non-core providers need to achieve the following:

A. I,II,III

B. II,III,IV

C. I,III,IV

D. All of the above

Section A (1 Mark)

Debt ratio is

A. Current Cash / Current liabilities

B. Current Assets / Current liabilities

C. Current Liabilities / Current assets

D. Total Liabilities / Net Worth

Section B (2 Mark)

You are considering the purchase of a quadruplex apartment. Effective gross income (EGI)

during the first year of operations is expected to be Rs33,600 (Rs700 per month per unit).

First-year operating expenses are expected to be Rs. 13,440 (at 40 percent of EGI). Ignore

capital expenditures. The purchase price of the quadruplex is Rs. 200,000. The acquisition

will be financed with Rs60,000 in equity and a Rs. 140,000 standard fixed-rate mortgage.

The interest rate on the debt financing is eight percent and the loan term is 30 years.

Assume, for simplicity, that payments will be made annually and that there are no up-front

financing costs.

What is the overall capitalization rate?

A. 9.47

B. 10.56

C. 10.08

D. 12.5

Section A (1 Mark)

A ____________________ tax system places a relatively large tax burden on lowerincome

people and a relatively small tax burden on upper-income people.

A. Proportional

B. Progressive

C. Regressive

D. All of the above

Section A (1 Mark)

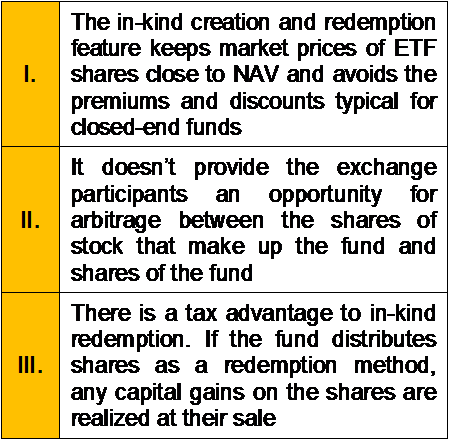

Which of the following is not a Key Benefit of the In-kind process used by the ETFs?

A. Only I

B. Only II

C. Only III

D. None of These

Section C (4 Mark)

Mr. XYZ buys a Nifty Call with a Strike price Rs. 4100 at a premium of Rs. 170.45 and he

sells a Nifty Call option with a strike price Rs. 4400 at a premium of Rs. 35.40.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 4343

• If Nifty closes at 3419

A. 145.95 and -75.05

B. 107.95 and -135.05

C. 149.95 and -154.25

D. 187.50 and 146.25

Section A (1 Mark)

Which of the following is not an essential element of a trust?

A. A trustee

B. A beneficiary

C. An administrator

D. A personal obligation

Section C (4 Mark)

Read the senario and answer to the question.

If the interest on a sum of amount is compounded annually at the rate of 14% per annum

for 3 years, what is the effective continuously compounding rate of interest?

A. 13.10%

B. 16.10%

C. 12.10%

D. 15.10%

Section C (4 Mark)

The current dividend on an equity share of Bharat Limited is Rs.8.00 on earnings per share

of Rs. 30.00. Assume that the dividend per share will grow at the rate of 20 percent per

year for the next 5 years. Thereafter, the growth rate is expected to fall and stabilize at 12

percent. Investors require a return of 15 percent from Bharat’s equity shares. What is the

intrinsic value of Bharat’s equity share?

A. Rs. 415.02

B. Rs. 439.06

C. Rs. 476.79

D. Rs. 478.45

Section A (1 Mark)

Mr. Rajesh was the owner of an uninsured property. But unfortunately the property caught

fire because of which he suffered severe financial losses. The reason Mr. Rajesh suffered

losses as he did not cover:

A. The investment risk

B. The pure risk

C. The speculative risk

D. The dynamic risk

| Page 20 out of 103 Pages |

| Previous |