Section A (1 Mark)

The most profitable credit card customers for a bank are those that:

A. Use their credit card frequently

B. Pay off any charges incurred within a few days

C. Charge at least Rs 5,000 per year

D. Use their credit card as a source of installment loans

Section A (1 Mark)

According to Michael Porter, there are five determinants of competition. An example of

_____ is when new entrants to an industry our pressure on prices and profits.

A. Threat of Entry

B. Rivalry between Existing Competitors

C. Pressure from Substitute Products

D. Bargaining power of Buyers

Section C (4 Mark)

NCH Corporation, which markets cleaning chemicals, insecticides and other products, paid

dividends of Rs2.00 per share in 1993 on earnings of Rs4.00 per share. The book value of

equity per share was Rs40.00, and earnings are expected to grow 6% a year in the long

term. The stock has a beta of 0.85, and sells for Rs60 per share. (The treasury bond rate is

7%.)

Based upon these inputs, estimate the price/book value ratio for NCH and How much

would the return on equity have to increase to justify the price/book value ratio at which

NCH sells for currently?

A. 0.75 and 17.40%

B. 0.93 and 16.08%

C. 0.85 and 16.50%

D. 0.67 and 18.05%

Section B (2 Mark)

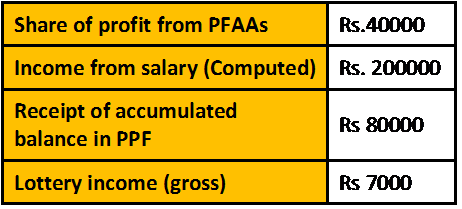

Choose the amount of final tax liability of R for the assessment year 2007-08:

A. 17100

B. 17442

C. 15700

D. 16014

Section B (2 Mark)

How much interest is paid in total on a 3-year loan for Rs27 400? The interest rate is 8.6%

compounded monthly and the payments are monthly?

A. Rs. 3783.95

B. Rs. 3562.05

C. Rs. 3587.58

D. Rs. 62 017.62

Section A (1 Mark)

Which is not the basic ingredient of a valid trust?

A. There must be a trustee

B. There must be a beneficiary or beneficiaries

C. There must be clearly delineated trust property

D. The object of the trust must not be specific

Section C (4 Mark)

Mudra Financial is a large financial firm which owns several mutual funds. The funds are

managed individually by portfolio managers but it has an investment committee that

overseas all of the funds. This committee is responsible for evaluating the performance of

the funds relative to the appropriate benchmark and relative to stated investment objectives

of each individual fund. During a recent investment committee meeting, the poor

performance of Its Equity Funds were discussed. In particular, the inability of the portfolio

managers to outperform their benchmarks was highlighted. The net conclusion of the

committee was to review the performance of the manager responsible for each fund and

dismiss those managers whose performance had lagged substantially behind the

appropriate benchmark.

The fund with the worst relative performance is the Mudra Large Cap Fund which invests in

large cap stocks. A review of the operations of the fund found the following:

• The turnover of the fund was almost double that of other similar style mutual funds

• The fund’s portfolio manager solicited input from her entire staff prior to making any

decision to sell an existing holding

• The beta of the Mudra Large Cap Fund’s portfolio was 65% higher than the beta of other

similar style mutual funds

• The portfolio manager refuses to increase the Capital Goods sector weighting because of

past losses the fund incurred in the sector

• The portfolio manager sold all the fund’s Oil Marketing Companies stocks as the price per

barrel of oil rose above $105. He expects oil prices to fall back to the $80 to $85 per barrel

• No stock is considered for purchase in the Large Cap Fund unless the portfolio manager

has 10 years of financial information on that company.

The underweighting of the Capital Goods sector and selling off Oil Marketing Stocks could

be best described as an example of:

A. Conservatism and Regret Minimization respectively

B. Regret Minimization and Gambler Fallacy respectively

C. Loss Aversion and Representativeness respectively

D. Anchoring & Adjustment and Money Illusion respectively

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose taxable

income is:

• $ 83560 in SGD and he is a Singapore citizen

• £ 73150p.a (only employment) and he is a UK citizen

A. £ 6715.80 and 2843.50 SGD

B. £ 13431.60 and 6906.25 SGD

C. £ 29260 and 11698.40 SGD

D. £ 16789.50 and 2310 SGD

Section B (2 Mark)

Regular collateralized debt obligations (CDO) have been surpassed by:

A. Credit swaps

B. Credit options

C. Total return swaps

D. Synthetic collateralized debt obligations

Section A (1 Mark)

Hedge funds often seek to take advantage of market inefficiencies such as:

A. High transaction costs.

B. Pricing differentials between derivative contracts and the underlying security.

C. Technological developments aiding informational efficiencies.

D. Similar prices in different geographic locations.

Section A (1 Mark)

Nifty is a ………………

A. Hybrid index

B. Equal weighed index

C. Price weighted index

D. Value weighted index

Section A (1 Mark)

The subscription paid into PPF account enjoys the tax benefit under

A. Sec 80D

B. Sec 10

C. Sec 80C

D. Sec 80G

| Page 2 out of 103 Pages |

| Previous |