Section A (1 Mark)

Which one of the following statements is/are true?

A. Real Estate investment is illiquid.

B. Agricultural land is exempt from wealth tax.

C. Agricultural land is exempt from capital gain tax but however subject to land revenue.

D. All of the above

Section A (1 Mark)

Which of the following is a market anomaly?

A. A relationship between money supply growth and stock prices.

B. A relationship between P/E ratios and subsequent stock returns.

C. Independence of stock price changes.

D. Adjustment of stock prices due to accounting changes.

Section A (1 Mark)

AUM stands for

A. Asset Utilization Model

B. Asset Under Management

C. Area Under Management

D. None of the above

Section A (1 Mark)

Deduction under section 80C shall be allowed:

A. from the gross total income of the individual or HUF

B. from the income from long-term capital gain

C. from the gross total income other than long-term capital gain from any asset and shortterm capital gain on shares sold through recognized stock exchange

D. from the gross total income other than long-term capital gain

Section B (2 Mark)

Dharampal has let out his house property at monthly rate of Rs. 12000. He has paid Rs.3500 as annual municipal tax. He wants to know the Net Annual value of his house at

Bhuj for AY 2011-12. The Municipal value of the house is Rs. 90,000, Fair rent Rs.

1,40,000, Standard rent Rs. 1,20,000. The house was vacant for one month during the

previous year 2010-11 and the rent has not changed since then.

A. Rs. 1,40,500

B. Rs. 1,36,500

C. Rs. 1,28,500

D. Rs. 1,32,000

Section A (1 Mark)

Any property inherited by a female Hindu from her husband or from her father in law, in the

absence of any son or daughter of the deceased shall go to…..

A. Heir of mother

B. Heir of father

C. Heir of Husband

D. Heir of Sister

Section A (1 Mark)

Real Estate market in India is __________

A. Unorganized

B. Highly Organized

C. Is free from government control

D. Offers homogeneous product

Section B (2 Mark)

Markets would be inefficient if irrational investors __________ and actions of arbitragers

were __________.

A. Existed; unlimited

B. Did not exist; unlimited

C. Existed; limited

D. Did not exist; limited

Section B (2 Mark)

Matrix Ltd has a current ratio of 1.6, and a quick ratio equal to 1.2. The company has Rs

20,00,000 in sales and its current liabilities are Rs 10, 00,000. What is the company’s

inventory turnover ratio?

A. 5

B. 5.2

C. 5.5

D. 6

Section B (2 Mark)

As per Double Taxation Avoidance Agreement, the Royalties in UAE is charged at:

A. 22.5

B. 15

C. 20

D. Nil

Section C (4 Mark)

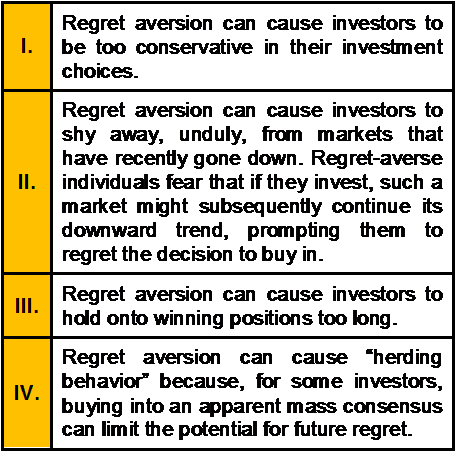

Which of the following statements is/are correct?

A. I and II

B. I, II and IV

C. III and IV

D. All of the Above

Section B (2 Mark)

Conventional theories presume that investors ____________ and behavioral finance

presumes that they ____________.

A. are irrational; are irrational

B. are rational; may not be rational

C. are rational; are rational

D. may not be rational; may not be rational

| Page 19 out of 103 Pages |

| Previous |