Section A (1 Mark)

You buy a investment plan by investing Rs. 5000/- per month for first 12years what is the

maximum amount you can withdraw from this account for 12 years every month if you want

to have Rs. 500000 at the end of 24 years .The rate of interest is 15% per annum

compounded monthly.

A. 27612

B. 28658

C. 29812

D. 27612

Section C (4 Mark)

Read the senario and answer to the question.

What would be the taxable amount on gratuity received by Jogen, if he would retired from

an organization where employees are not covered under Gratuity Act?

A. Rs. 75,000

B. Rs. 3,50,000

C. Rs. Nil

D. Rs. 69,300

Section A (1 Mark)

Conventional theories presume that investors ____________ and behavioral finance

presumes that they ____________.

A. Are irrational; are irrational”

B. Are rational; may not be rational”

C. May not be rational; may not be rational

D. May not be rational; are rational”

Section B (2 Mark)

According to the put-call parity theorem, the value of a European put option on a nondividend

paying stock is equal to:

A. The call value plus the present value of the exercise price plus the stock price.

B. The call value plus the present value of the exercise price minus the stock price.

C. The present value of the stock price minus the exercise price minus the call price.

D. The present value of the stock price plus the exercise price minus the call price.

Section B (2 Mark)

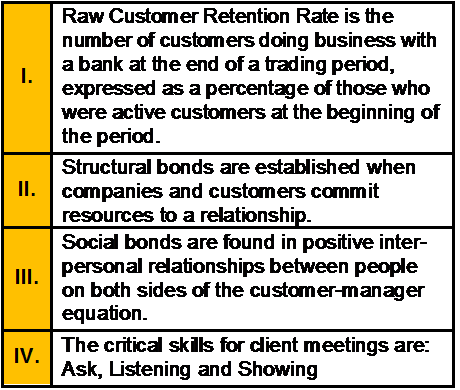

Which of the following statements is / are correct?

A. I, II and III

B. I, III and IV

C. II, III and IV

D. All of the above

Section A (1 Mark)

A European put option can be exercised

A. Any time in the future.

B. Only on the expiration date

C. If the price of the underlying asset declines below the exercise price.

D. Immediately after dividends are paid.

Section A (1 Mark)

The CDO structures which are used by asset management companies, insurance

companies and other investment shops with the intent of exploiting a mismatch between

the yield of underlying securities and lower cost of servicing the CDO structures are

called___________.

A. Market Value Arbitrage CDOs

B. Synthetic Arbitrage CDOs

C. Cash Flow Arbritrage CDOs

D. Synthetic Balance Sheet CDOs

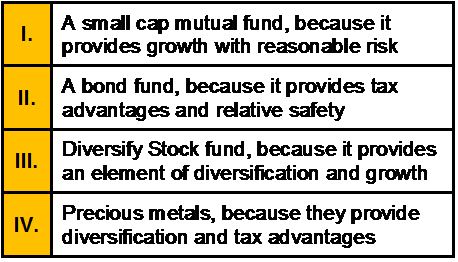

Section C (4 Mark)

Read the senario and answer to the question.

Which types(s) of investment(s), would be consistent with their retirement goal?

A. (I) only

B. (I) and (IV) only

C. (I) and (III) only

D. (II) and (IV) only

Section C (4 Mark)

Mr. Rajesh Rawat deposits Rs. 15,000 per month at the end of the month for 6.50 years in

an account that pays a ROI of 8.80% per annum compounded quarterly. What will be the

amount in the account after 6.50 years?

A. 1571140

B. 1567650

C. 91666

D. 91654

Section B (2 Mark)

In the calculation of rates of return on common stock, dividends are _______ and capital

gains are _____.

A. Guaranteed; not guaranteed

B. Guaranteed; guaranteed

C. Not guaranteed; not guaranteed

D. Not guaranteed; guaranteed

Section C (4 Mark)

Mr. Rajesh constructs a Long Straddle Strategy with one Nifty Call Option having a Strike

price of Rs. 4500 available at a premium of Rs. 122 and one Nifty Put Option with a strike

price Rs. 4500 at a premium of Rs. 85

What would be the Net Payoff of the Strategy?

• If Nifty closes at 4234

• If Nifty closes at 4766

A. -107 and -207

B. 93 and 193

C. 59 and 59

D. 0 and -7

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose taxable

income is:

• $321500 in SGD and he is a Singapore citizen

• £ 35214p.a (only dividends) and he is a UK citizen

A. £ 6715.80 and 2843.50 SGD

B. £ 13431.60 and 6906.25 SGD

C. £ 26863.20 and 11375 SGD

D. £ 11444.55 and 64300 SGD

| Page 18 out of 103 Pages |

| Previous |