Section B (2 Mark)

What is the projected sale price of an apartment building that produces an annual net cash

flow Rs. 120,000, if we set a projected capitalization rate at 7%?

A. Rs. 17, 14,286

B. Rs. 1,28,400

C. Rs. 1,92,694

D. Rs. 1,68,306

Section A (1 Mark)

Company J and Company K each recently reported the same earnings per share (EPS).

Company J’s stock, however, trades at a higher price. Which of the following statements is

most correct?

A. Company J must have a higher P/E ratio.

B. Company J must have a higher market to book ratio.

C. Company J must be riskier.

D. Company J must have fewer growth opportunities.

Section A (1 Mark)

Which of the following is true regarding the resistance level?

A. It tends to develop due to profit taking.

B. It is the level at which a significant decrease in demand is expected.

C. It is the level at which a significant increase in supply is expected.

D. It usually develops after a stock reaches a new low.

Section B (2 Mark)

The expected market return 16 percent. The risk-free rate of return is 7 percent, and AB

Co. has a beta of 1.1. The risk premium is

A. 7 percent.

B. 9.9 percent.

C. 9 percent.

D. 10.3 percent

Section A (1 Mark)

A person saves Rs. 5,000/- every quarter for 9 years @ 15 % per annum compounded

Quarterly. What amount would he be having after 9 years ?

A. 372543.34

B. 348321.32

C. 468443.41

D. 3,68,443.41

Section C (4 Mark)

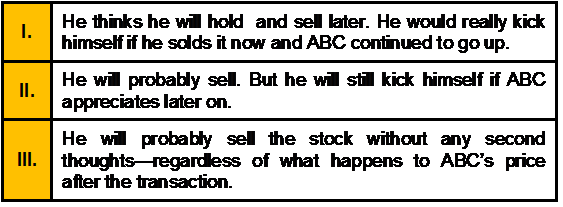

Suppose that an investor makes an investment in Stock ABC and that over the next 12

months ABC appreciates by 10 percent. He then thinks of selling ABC for normal portfolio

rebalancing purposes, but then come across an item in the, The Economic Times that

sparks new optimism: Could ABC climb even higher?

Which answer describes the likeliest response from an investor with regard to exhibiting

Regret Aversion Bias, given ABC’s recent performance and this new information?

A. I and II

B. I or II

C. II and III

D. All of the Above

Section B (2 Mark)

Which of the following statements is correct?

A. Acquiring customers is on tenth the cost of retaining customers

B. Retaining customers is same as the cost of acquiring new customers

C. Retaining customers is on fifth the cost of acquiring new customers

D. Retaining customers is on tenth the cost of acquiring new customers

Section A (1 Mark)

The strategies of convertible arbitrage, emerging markets, equity market neutral and fixed

income arbitrage are categories of which alternative investments class?

A. Managed Futures

B. Commodities

C. Hedge Funds

D. Private Equity

Section B (2 Mark)

The expected market return is 16 percent. The risk-free rate of return is 7 percent, and BC

Co. has a beta of 1.1. Their required rate of return is

A. 17.6 percent.

B. 16.0 percent.

C. 16.9 percent.

D. 23.0 percent.

Section A (1 Mark)

Family Offices provide _____________

A. Specialist advice and planning

B. Investment Management

C. Administration

D. All of the above

Section A (1 Mark)

The principle that people do not buy or rent real estate, but judge properties as different

sets of benefits and costs is called

A. The principle of supply and demand.

B. The principle of an efficient market.

C. The principle of comparative sales.

D. The principle of substitution.

Section B (2 Mark)

Payback period is

A. Time required to recover the operating cost

B. Time required for cash flows to recover cost of investment and opportunity cost

C. Time required for cash flows to recover the cost of investment

D. None of the above

| Page 17 out of 103 Pages |

| Previous |