Section A (1 Mark)

Which of the following is NOT one of the phases of the life-cycle theory of asset allocation?

A. Accumulation phase

B. Consolidation phase

C. Taxation phase

D. Gifting phase

Section B (2 Mark)

Lokesh purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10-

2006 for Rs. 25,00,000/-.As a CWM® calculate the Indexed Cost of Acquisition on which

capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305,

for year 2005-06 is 497 and for year 2006-07 is 519).

A. 17,01,639

B. 18,46,975

C. 17,68,683

D. 16,29,508

Section C (4 Mark)

Yogesh Jain is a Chartered Accountant by profession and a very disciplined investor he

has started investing from today in an account Rs. 1,00,000 every year (beginning of year)

and plans to increase his contribution by 10% every year. If the ROI he gets is 15% per

annum compounded half yearly calculate the corpus he would be able to accumulate in 25

years.

A. 47379847

B. 52117831

C. 48763660

D. 44330600

Section A (1 Mark)

Customer service facilitation includes EXCEPT:

A. Divert attention of customer

B. Resolve problem

C. Improve efficiency

D. Provide full information

Section A (1 Mark)

_____________ is defined as the transfer of services to private enterprise in US.

A. Capital Spending

B. Attrition

C. Privatization

D. Decrements

Section A (1 Mark)

Stock broker’s human capital is _________ to stock market as compared to a school

teacher

A. Less sensitive

B. Sensitive at par

C. More sensitive

D. No correlation

Section A (1 Mark)

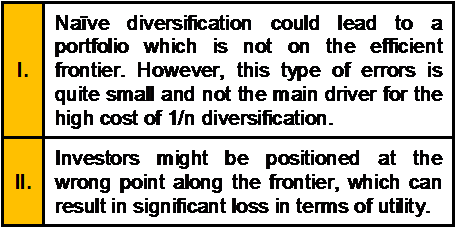

Which of the following statements is/are correct with respect to naïve diversification?

A. Only I

B. Only II

C. Both of the above

D. None of the Above

Section A (1 Mark)

The APT is based on the:

A. Law of averages.

B. Law of attraction.

C. Law of accelerating return.

D. Law of one price.

Section C (4 Mark)

Read the senario and answer to the question.

Assume Reena retires at the age of 60 years and invests her salary at 8% p.a.What will be

the future value of Reena’s salary at the time of her retirement if she saves her entire

salary?

A. Rs. 242 lakh

B. Rs. 273 lakh

C. Rs. 514 lakh

D. Rs. 485 lakh

Section B (2 Mark)

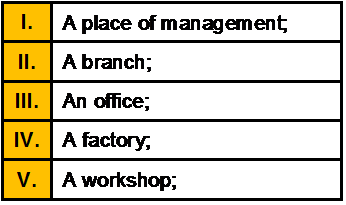

The term “permanent establishment” includes especially:

A. I, II and III

B. II and III

C. III and IV

D. All of the Above

Section B (2 Mark)

A client has a minor child she is concerned about what might happen if she was to die

while the child was still young and unable to sensibly handle a sizeable in heritance one

solution could be to draft her will so that the child receives the asset once reaching age 21

this is an example of

A. A discretionary trust

B. A testamentary trust

C. An inter vivo trust

D. A family trust

Section A (1 Mark)

Which of the following statements regarding debit and credit card liability is correct?

A. A credit card carries more risk of loss to the cardholder.

B. A debit card carries more risk of loss to the cardholder.

C. There is no cardholder liability if either type of card is lost.

D. The Government insures losses on credit but not debit cards.

| Page 13 out of 103 Pages |

| Previous |