Section A (1 Mark)

For calculating the benefit under Entertainment allowance, Salary means,

A. Basic Salary

B. Basic Salary + DA

C. Basic Salary + DA + commission

D. Basic Salary + DA + commission + Bonus

Section B (2 Mark)

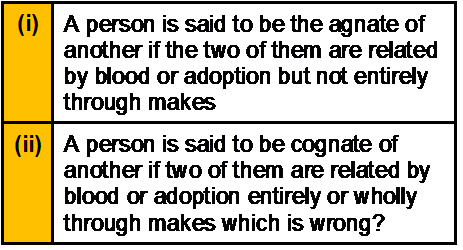

Which one of the following statements is/are correct?

A. (i) only

B. (ii) only

C. Both are wrong

D. None of the above

Section A (1 Mark)

The trust which is empty at creation during life and tranfers the property into the trust at

death is called ____________

A. Special trust

B. Will trust

C. Secret trust

D. Pourover trust

Section B (2 Mark)

Fiscal policy generally has a _______ direct impact than monetary policy on the economy,

and the formulation and implementation of fiscal policy is ______ than that of monetary

policy.

A. More, quicker

B. More, slower

C. Less, quicker

D. Less, slower

Section B (2 Mark)

A bank recently loaned you Rs15,000 to buy a car. The loan is for five years (60 months)

and is fully amortized. The nominal rate on the loan is 12 percent, and payments are made

at the end of each month. What will be the remaining balance on the loan after you make

the 30th payment?

A. Rs 8,611.17

B. Rs 8,363.62

C. Rs14,515.50

D. Rs 8,637.38

Section B (2 Mark)

A bond has a convexity of 57.3. The convexity effect if the yield decreases by 110 basis

points is closest to:

A. –1.673%

B. 0.69%

C. +1.673%.

D. None of the Above

Section A (1 Mark)

Statman (1977) argues that ________ is consistent with some investors' irrational

preference for stocks with high cash dividends and with a tendency to hold losing positions

too long.

A. mental accounting

B. Regret avoidance

C. Overconfidence

D. Conservatism

Section C (4 Mark)

National City Corporation, a bank holding company, reported earnings per share of Rs2.40

in 1993, and paid dividends per share of Rs1.06. The earnings had grown 7.5% a year over

the prior five years, and were expected to grow 6% a year in the long term (starting in

1994). The stock had a beta of 1.05 and traded for ten times earnings. The treasury bond

rate was 7%.

Estimate the P/E Ratio for National City Corporation and the long term growth rate that is

implied in the firm's current P/E ratio.

A. 6.91 and 8%

B. 7.65 and 8.50%

C. 6.50 and 9.25%

D. 8.05 and 10.54%

Section B (2 Mark)

How much interest is paid in the 43rd monthly payment interval of a loan for Rs43 200 if the

loan is amortized at a rate of 9.75% compounded annually over 7 years.?

A. Rs191.30

B. Rs394.41

C. Rs195.25

D. Rs 193.74

Section A (1 Mark)

Which of the Following needs to register as an' Investment Adviser' as per SEBI

Investment Advisor Regulations 2013.

A. Any person who gives general advice on trends in the market and does not specify a particular security or investment.

B. Any Insurance Agent who advises on Insurance Products and is registered by IRDA

C. Any person providing Investment Advice to Clients exclusively outside India

D. Any person who for consideration is engaged in the business of providing “investment advice” to clients in India

Section B (2 Mark)

Consider a one-year maturity call option and a one-year put option on the same stock, both

with striking price Rs45. If the risk-free rate is 4%, the stock price is Rs48, and the put sells

for Rs1.50, what should be the price of the call?

A. Rs. 4.38

B. Rs. 5.60

C. Rs. 6.23

D. Rs. 12.26

Section C (4 Mark)

Read the senario and answer to the question.

Sajan sold 350 shares of a company at Rs. 300 each on 1st March 2010. He purchased 50

shares on 1st May 1979 for Rs. 20 each. The fair market value was Rs. 40 each as on 1st

April 1981. Again on 7 August 1998, he was allotted 50 bonus shares. The fair market

value was Rs. 115 each as on 7th August 1998. He purchased additional 250 shares on

1st April 2009 for Rs. 150 each. Calculate the capital gains on shares sold.

(CII – 1981-82 : 100; 1998-99 : 351; 2008-2009 ; 582; 2009-10; 632)

A. Rs. 59486

B. Rs. 54653

C. Rs. 61180

D. Rs. 54860

| Page 10 out of 103 Pages |

| Previous |