Topic 2: Volume B

Which of the following is allowed as deduction from net annual value of a property?

A. Repairs & collection charges

B. Insurance premium

C. Interest on loan borrowed for repairs

D. All the above

Saptarshi acquired shares of G Ltd. on 15.12.98 for Rs. 5 lacs which were sold on 14.6.11

for Rs. 19 lacs.

Expenses on transfer of shares Rs. 40,000. He invests 8 lacs in the bonds of Rural

Electrification. Corporation Ltd. on 16.10.2011. Compute capital gain for the assessment

year 2012-13.

A. Rs 7,41,766

B. Nil

C. Rs 11,18,234

D. Rs 12,45,745

Compulsory audit of account is required u/s 44AB of IT, if the total sales/ turnover exceeds _______

A. Rs. 10,00,000

B. Rs. 40,00,000

C. Rs 60,00,000

D. Rs. 1,00,00,000

Compulsory maintenance of account is required u/s 44AA of IT, if the gross receipt/ total sales exceed _______

A. Rs. 5,00,000

B. Rs 10,00,000

C. Rs 15,00,000

D. Rs 40,00,000

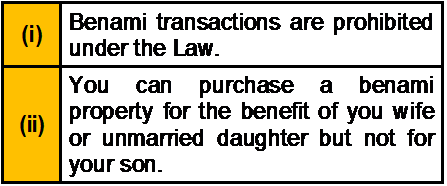

Which of the following statement(s) about Benami Transaction is/are correct?

Exhibit:

A. Only (i)

B. Only (ii)

C. Neither (i) nor (ii)

D. Both (i) and (ii)

Incase of Divorce by mutual consent, on the motion of both the parties made not earlier than __________ after the date of the presentation of the petition and not later than____________ after the said date, if the petition is not withdrawn in the meantime, court shall, on being satisfied on all grounds pass a decree of divorce declaring the marriage to be dissolved with effect from the date of the decree.

A. 6 months, 12 months

B. 6 months,18 months

C. 12 months, 18 months

D. 12 months, 24 months

X owns a piece of land situated in Varanasi (Date of acquisition : March 1, 1983, Cost of acquisition Rs. 20,000/- value adopted by Stamp duty authority at the time of purchase Rs. 45,000/-).On March 30, 2012 the piece of land is transferred for 4 lakh. Find out the capital gains chargeable to tax if the value adopted by the Stamp duty authority is 5.5 lakh. X does not dispute it. [CII-12-13: 852,11-12: 785,10-11:711]

A. Rs. 4,05,963/-

B. Rs. 3,45,963/-

C. Rs. 3,80,963/-

D. Rs. 4,15,963/-

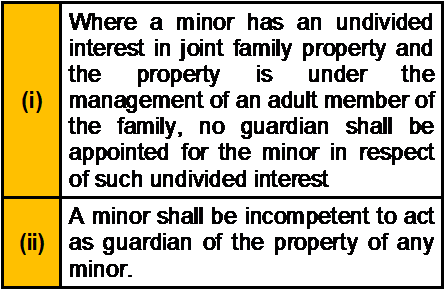

Which of the following statement(s) is/are incorrect?

A. Only (i)

B. Only (ii)

C. Both (i) and (ii)

D. Neither (i) nor (ii)

Deduction under section 80QQB is allowed in respect of royalty income to:

A. an individual who is an author of a book

B. an individual who is resident in India and who is an author of a book

C. an individual who is resident in India and who is either an author of a book or a joint author of the book

D. None of these

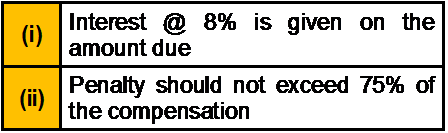

Which of the following statement(s) about ‘Doctrine of Subrogation’ is/are correct?

A. Only (i)

B. Only (ii)

C. Neither (i) nor (ii)

D. Both (i) and (ii)

As per Workmen’s Compensation Act, in case there is default in paying compensation.

A. Only (i)

B. Only (ii)

C. Neither (i) nor (ii)

D. Both (i) and (ii)

If the adoption is by a male and the person to be adopted is a female, the adoptive father should be at least _______________ older than the person to be adopted. In case, the adoption is by female and the person to be adopted is a male, the adoptive mother should be at least_________ older than the person to be adopted.

A. 21 years, 21 years

B. 18 years, 18 years

C. 21 years, 18 years

D. 18 years, 21 years

| Page 9 out of 40 Pages |

| Previous |