Topic 1: Volume A

There are ______types of Charitable Trust. Out of these, in ________________ the value of assets are protected against inflation as the payouts vary with the asset value.

A. Two, Charitable Remainder Unit Trust

B. Two, Charitable Remainder Annuity Trust

C. Three, Charitable Remainder Unit Trust

D. Three, Charitable Remainder Annuity Trust

There are__________ methods of Business valuation.Out of these methods,___________ method applies discount rate to determine the valuation of the business.

A. Two, Discounted Cash Flow

B. Three, Discounted Cash Flow

C. Two, Income method

D. Three, Income method

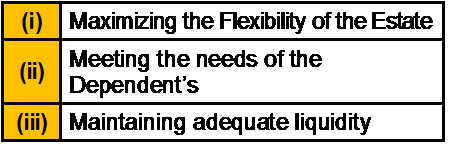

Which of the following comes under Non-Financial Goals of Estate Planning?

A. Both (i) and (ii)

B. Both (ii) and (iii)

C. Only (ii)

D. Only (iii)

There are ______ steps in Selling process. The last step in Selling Process is ____________.

A. Five, Develop and Implement the Plan

B. Five, Service the Plan

C. Eight, Implement the Plan

D. Eight, Service the Plan

________ plan involves only Business assets.

A. Financial

B. Succession

C. Estate

D. Contingency

___________ is the submission of a disputed matter to an impartial person.

A. Mediation

B. Negotiation

C. Arbitration

D. Litigation

A High Net Worth Individual (HNI) should hold at least _______ in liquid financial assets.

A. $1 million

B. $5 million

C. $10 million

D. $50 million

Estate Tax in India is _______

A. Nil

B. 10%

C. 30%

D. Tax Rate depends on the estate value

__________ is an influential person who knows you favorably and agrees to introduce or recommend you to others.

A. Centre of Influence

B. Attorney

C. Commercial Bank Officer

D. Property Agent

___________ is appropriate for donors who want to see their charitable dollars at work during their lifetimes.

A. Bequest

B. Family Foundation

C. Outright gift

D. Charitable Remainder Trust

You are an estate planner. A couple has jointly owned company. They have three children out of which one is disabled. As an estate planner, which Estate planning would you suggest to the couple, so as to enable them to transfer wealth efficiently to their children.

A. Life Insurance Policy

B. Buy Sell Agreement

C. Family Limited Partnership

D. Grantor Retained Annuity Trust

You are an Estate Planner. As part of the Estate Planning process, you require the client to fill up ‘Estate Planning Checklist and Data Gathering form’. The client calls you to understand what are Schedule A and Schedule C attached to the form.You explain to him/her that Schedule A is for _______ and Schedule C is for__________

A. Life Insurance and Qualified Retirement Plan

B. Qualified Retirement Plans and Life Insurance

C. Life Insurance and Marketable Securities

D. Marketable Securities and Life Insurance

| Page 5 out of 40 Pages |

| Previous |