Topic 3: Volume C

A person purchased certain property in the name of his minor son and subsequently resold it while the son was minor. This sale is ___________________

A. Not void, if the consent of the minor was taken.

B. Is valid if the court permission was taken under Section 8 of the Hindu Minority and Guardianship Act,1956

C. Is valid if the court permission was taken under Section 18 of the Hindu Minority and Guardianship Act,1956

D. Not void, as the Person who is selling is the caretaker of the property.

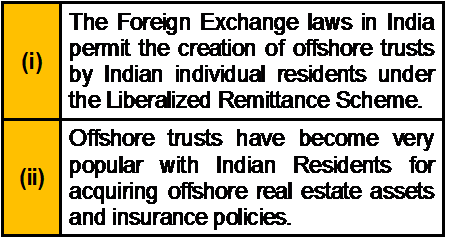

Which of the following statement(s) about Offshore Trust is/are correct?

A. Neither (i) or (ii)

B. Both (i) and (ii)

C. Only (i)

D. Only (ii)

_______________ is a Life Insurance Trust with certain provisions that allows gifts to the trust to qualify for the annual gift tax exclusion.

A. Crummey Trust

B. Constructive Trust

C. Charitable Lead Trust

D. Grantor Trust

Under ______________, deduction (special exemptions) in respect of donations to certain funds, charitable institutions etc. is granted. In order to be eligible under this section, the charitable trust/institutions need to obtain a valid certificate by making an application to them on ____________.

A. Section 80G, Form 10G

B. Section 80GGC, Form 10G

C. Section 80U, Form 10A

D. Section 80CCG,Form 10A

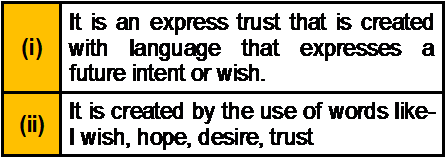

Which of the following statement(s) about Precatory Trust is/are correct?

A. Only (i)

B. Only (ii)

C. Neither (i) or (ii)

D. Both (i) and (ii)

________________ is a popular mode of transfer of property to God or Almighty, under the Mohammedean Law.

A. SheBaitsor Trust

B. Mutawali Trust

C. Dedicated Trust

D. Waqf

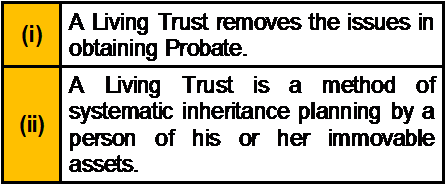

Which of the following statement(s) about Living Trust is/are correct?

A. Both (i) and (ii)

B. Only (i)

C. Only (ii)

D. Neither (i) nor (ii)

Which of the following cannot form a Trust?

A. A Minor

B. An HUF through its Karta

C. Both of the above

D. None of the above

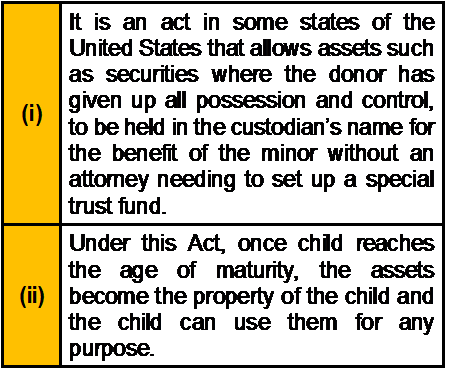

Which of the following statement(s) about Uniform Gifts to Minor Act (UGMA) is/are

correct?

A. Neither (i) or (ii)

B. Both (i) and (ii)

C. Only (i)

D. Only (ii)

Which of the following statement(s) about Wakf is/are correct?

A. Both (i) and (iii)

B. All of the above

C. All except (ii)

D. Both (ii) and (iv)

Which of the following statement(s) about Inheritance Tax is/are correct?

A. Only (i)

B. Only (ii)

C. Neither (i) or (ii)

D. Both (i) and (ii)

If a trust is partner in a firm, the maximum rate of tax applicable is

A. 30%

B. 35%

C. 40%

D. The provisions of maximum rate of income tax would not apply.

| Page 18 out of 40 Pages |

| Previous |