Topic 2: Volume B

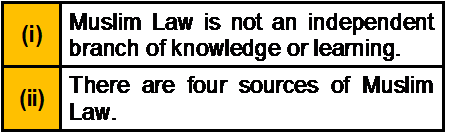

Which of the following statement(s) about Muslim Law is/are correct?

A. Only (i)

B. Only (ii)

C. Neither (i) nor (ii)

D. Both (i) and (ii)

In case of non-resident, who is carrying on shipping business, his Indian income shall be presumed to be:

A. 5% of certain amount received

B. 7.5% of certain amount received

C. 10% of certain amount received

D. 8.5% of certain amount received

Deduction under section 80RRB is allowed to the extent of:

A. 50% of royalty or Rs. 3,00,000 whichever is less

B. 100% of royalty or Rs. 3,00,000 whichever is less

C. 100% of royalty or Rs. 2,00,000 whichever is less

D. 100% royalty or Rs. 5,00,000 whichever is less

Scholarship received by a student was Rs. 2,000 per month. He spends Rs. 15,000 for meeting the cost of education during the year. The treatment for the balance amount Rs. 9,000 is:

A. Taxable

B. A casual income

C. Exempt

D. None of the above

Employees Provident Fund is applicable to firms employing over _______________ employees

A. 20

B. 15

C. 10

D. 25

The interest payable for a housing loan outside India is not allowed as a deduction U/S 24 (1) while computing the income from house property. The given statement is

A. True

B. False

C. Deduction allowed only to the limit of Rs. 1,50,000

D. Deduction not allowed if the total value of the house if more than Rs. 4 million

As per Gift Tax Act of 1958, a gift in excess of _________ received by anyone who is not your blood relative is taxable.

A. Rs.1,00,000

B. Rs.75,000

C. Rs.50,000

D. Rs.30,000

In case of self occupied property, higher deduction u/s24(b) for interest on loan for construction can be claimed if borrowing was made

A. After 1/4/99

B. on or after 1/4/99

C. Before 1/4/99

D. On or after 1/9/2004

Short-term capital gain arising for the transfer of equity shares and units of equity oriented fund shall be taxable

A. at the normal rate

B. at the rate of 20%

C. at the rate of 10% if transferred on or after 1-10-2004

D. at the rate of 10% if transferred on or after 1-10-2004 through a recognized stock exchange & such transaction is chargeable to securities transaction tax

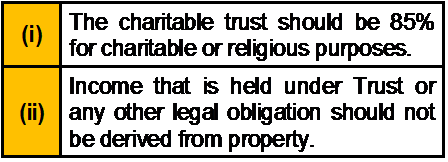

Which of the following is an essential condition for obtaining exemption of the income of a

Charitable Trust?

A. Neither (i) or (ii)

B. Both (i) and (ii)

C. Only (i)

D. Only (ii)

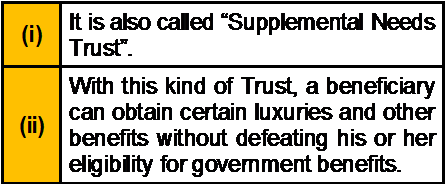

Which of the following statement(s) about “Special Needs Trust” is/are correct?

A. Both (i) and (ii)

B. Only (i)

C. Only (ii)

D. Neither (i) nor (ii)

The Societies Registration Act came into force on _____________________

A. 24th May,1860

B. 24th May,1862

C. 21st May,1860

D. 21st May,1862

| Page 16 out of 40 Pages |

| Previous |