Topic 2: Volume B

What would be the tax liability if tea and snacks are provided in the office after office hours?

A. Nil

B. Nil, if it is upto Rs. 50 per meal

C. Actual amount spent by the employer

D. Nil, if it is upto Rs. 75 per meal

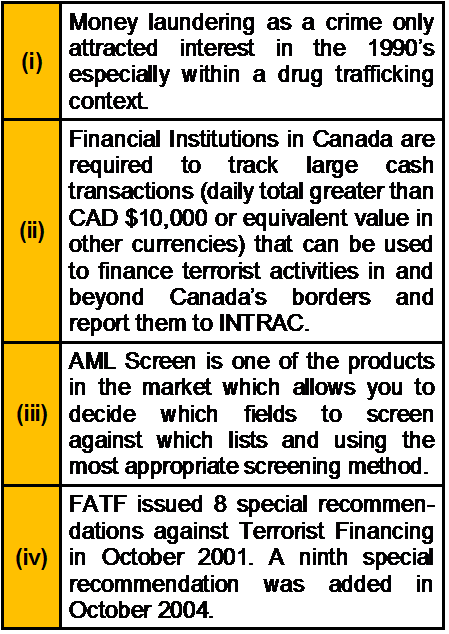

Which of the following statement(s) about Money Laundering is/are correct?

A. All (i),(ii),(iii) and (iv)

B. Only (ii) and (iv)

C. All except (iv)

D. All except (i)

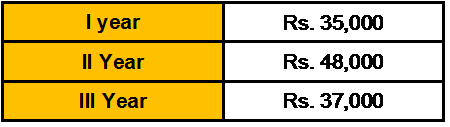

Mr. Pramod Jain (age 40 years) has life interest in a Trust property. The annual income

from Trust property for last three years is as under:

The Trust has spent Rs. 5,000/- per year for collection of the income. The value of life

interest of Re 1/- at the age of 40 is Rs. 10,093/-. The value of the property on the valuation

date is Rs. 5 lakh. Find the value of life interest.

A. Rs. 3.84 lakh

B. Rs. 3 lakh

C. Rs. 3.27 lakh

D. Rs. 5 lakh

There are ______________ sources of Muslim Law. As per Muslim Law, a marriage that is unlawful from it’s beginning is called ____________.

A. Three, Batil Marriage

B. Three, Fasid Marriage

C. Four, Batil Marriage

D. Four, Fasid Marriage

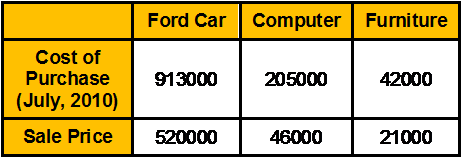

Find out the taxable value of perquisite from the following particulars in case of an

employee to whom the following assets held by the company were sold on 1.8.2012.

The assets were put to use by the company from the day they were purchased.

A. Rs. 82,170

B. Rs. 92,850

C. Rs. 48,800

D. Rs. 53,000

In ____________ the parties have the right to withdraw from the contract as long as the parties do not leave the place of contract. In___________ the buyer could cancel the sale if the seller has sold the goods at price higher than the market price.

A. Khiyar al Royat, Khiyar al Wasf

B. Khiyar al Tayin, Khiyar al Shart

C. Khiyar al Aib, Khiyar-e-Naqad

D. Khiyar-e-Majlis, Khiyar al Ghabn

In context of Hindu Adoptions and Maintenance Act,1956 if a person has more than one wife living at the time of adoption

A. The person cannot make the adoption

B. The consent of only the first wife is necessary

C. The consent of only the last wife is necessary

D. The consent of all the wives is necessary unless the consent of any of them is unnecessary

Mr. Kadam is entitled to a salary of Rs. 25,000 per month. He is given an option by his employer either to take house rent allowance or a rent free accommodation which is owned by the company. The HRA amount payable was Rs. 5,000 per month. The rent for the hired accommodation was Rs. 6,000 per month at New Delhi. Advice Mr. Kadam whether it would be beneficial for him to avail HRA or Rent Free Accommodation. Give your advice on the basis of “Net Take Home Cash benefits”.

A. Avail HRA

B. Rent Free Accomodation

C. Both are Beneficial

D. None of the Above

Which is not the condition for getting superannuation fund approved?

A. All the benefits should be payable only in India

B. Employee should be contributor to the fund

C. Employer should be contributor to fund

D. Funds have to be invested as per income tax rules1962

Vikrant Juneja gifted his house property to his wife in year 2007. Mrs. Juneja then lets out this house @ Rs. 5000 per month. The income from such house property will be taxable in the hands of:

A. Mrs. Juneja

B. Vikrant. However income will be computed first as Mrs. Juneja’s income and thereafter clubbed in the income of Manish.

C. Vikrant, as he will treated as deemed owner & liable to pay tax

D. Anyone amongst both of them, whose income is greater.

The legal heir of the deceased who receives family pension is allowed a standard deduction from such family pension received to the extent of:

A. 1/3rd of such pension subject to maximum of Rs. 20,000

B. 1/3rd of such pension or Rs. 15,000 whichever is less

C. 1/3rd of such pension or Rs. 12,000 whichever is less

D. 1/3rd of such pension or Rs. 12,500 whichever is less

What does CIP stands for?

A. Customer Identification Process

B. Customer Identity Process

C. Customer Identification Procedure

D. Customer Identity Procedure

| Page 15 out of 40 Pages |

| Previous |