Topic 2: Volume B

Any income chargeable under the head “Salaries” is exempt from tax under Section 10(6)(viii), if it is received by any non resident individual as remuneration for services rendered in connection with his employment in a foreign ship where his total stay in India does not exceed a period days in that previous year.

A. 90

B. 182

C. 60

D. 120

Bijoy traced a missing person and was awarded a sum of Rs. 35,000. Although there was no stipulation to that effect, such receipt shall be:

A. Casual Income & fully taxable

B. Casual Income & exempt up to Rs. 5000

C. Fully exempt

D. None of the above

Receipts from TV serial shooting in farm house is __________________

A. Non agricultural income

B. Agricultural income

C. Salary Income

D. Business Income

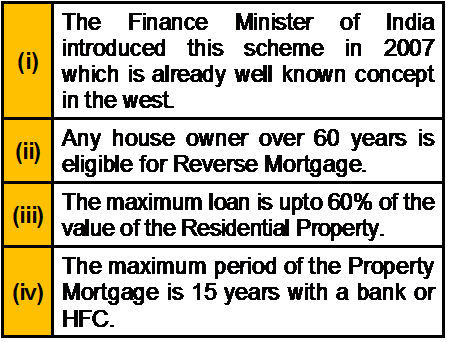

Which of the following statement(s) about Reverse Mortgage Scheme is/are correct?

A. All of the above

B. None of the above

C. Both (i) and (iv)

D. All except (i)

As per Payment of Gratuity Act, Employees are entitled to ___________ terminal wages as gratuity for each year of completed service or part thereof in excess of 6 months. Seasonal employees are entitled to __________ terminal salary for each season of service.

A. 15 days, 15 days

B. 15 days, 7 days

C. 30 days, 30 days

D. 30 days, 45 days

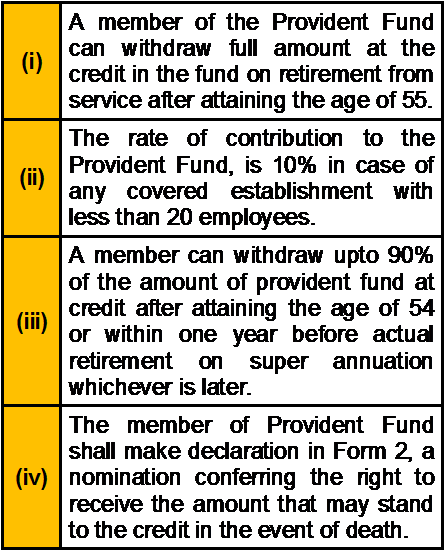

Which of the following statement(s) about Employee Provident fund is/are correct?

A. Only (i) and (iii)

B. Only (ii) and (iv)

C. None of the above

D. All of the above

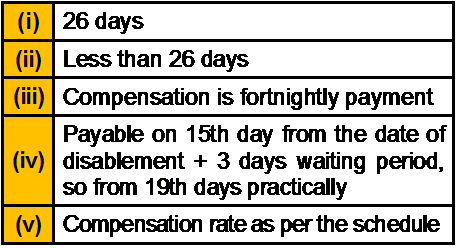

With respect to Workmen’s Compensation Act, if distinction is made on the ground of

duration of incapacity it may extend to

A. Only (i) and (ii)

B. All of the above

C. (i),(ii) and (v)

D. Only (iii) and (v)

Mr. Sumit has worked in a PSU for 14 years 7 months. His Terminal Wages are Rs. 45,000. He wants to know the Gratuity amount payable to him (assuming that he leaves the service today). It is_____________

A. Rs. 3,89,423

B. Rs. 3,50,000

C. Rs. 3,63,462

D. Rs. 3,15,000

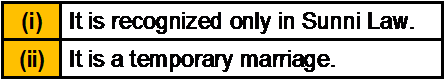

Which of the following statement(s) about Muta Marriage is/are correct?

A. Only (i)

B. Only (ii)

C. Neither (i) nor (ii)

D. Both (i) and (ii)

Your client, a businessman has a house worth Rs. 2.1 crore and a farm house worth Rs. 85 lakh. His business is worth Rs. 10 crore as per last balance sheet. He has two other partners in the business having stakes of 24% each. He has two cars purchased at Rs. 40 lakh and Rs. 20 lakh, the latter being in personal account. The cars have depreciated/market value at Rs. 30 lakh and Rs. 8 lakh respectively. His joint Demat account, wife being primary holder, has stocks worth Rs. 1.65 crore. The business has taken Keymans insurance on his life of value Rs. 1.5 crore. He has himself insured his life for an assured sum of Rs. 1.5 crore. You evaluate your client’s estate in case of any exigency with his life as _____.

A. Rs. 8.20 crore

B. Rs. 9.56 crore

C. Rs. 10.51 crore

D. Rs. 5.73 crore

Mr. Dinesh is transferred to Delhi and is paid a shifting allowance of Rs.20,000 by his employers out of which he spends Rs.18,000 for shifting his family and personal effects. Which of the following is true?

A. The whole of Rs.20,000 is exempt as a casual receipt

B. The whole of Rs.20,000 is exempt under section 10(14)

C. Rs.18,000 is exempt from tax under Section 10(14)

D. Rs.18,000 is exempt as a casual receipt

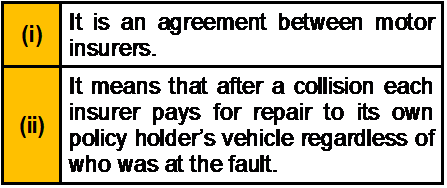

Which of the following statement(s) about ‘Knock for Knock Agreement’ is/are correct?

A. Only (i)

B. Only (ii)

C. Neither (i) nor (ii)

D. Both (i) and (ii)

| Page 14 out of 40 Pages |

| Previous |