Topic 2: Volume B

Dharampal has let out his house property at monthly rate of Rs. 12000. He has paid Rs.3500 as annual municipal tax. He wants to know the Net Annual value of his house at Bhuj for AY 2011-12. The Municipal value of the house is Rs. 90,000, Fair rent Rs. 1,40,000, Standard rent Rs. 1,20,000. The house was vacant for one month during the previous year 2010-11 and the rent has not changed since then.

A. Rs. 1,40,500

B. Rs. 1,36,500

C. Rs. 1,28,500

D. Rs. 1,32,000

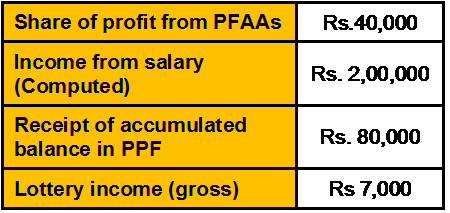

Choose the amount of final tax liability of Mr. Raj for the assessment year 2007-08:

Tax slab for male / HUF(for AY 2007-08)

Rs. 0 to 100000 — No Income Tax

Rs. 1,00,001 to 1,50,000 — 10%

Rs. 150001 to 2,50,000 — 20%

Rs. 2,50,001 and above — 30%

Note: A surcharge of 10% on income tax amount is payable if total income is exceeding Rs.

10,00,000 and a 2% education cess is payable on the income tax amount and surcharge.

A. Rs.17,100

B. Rs.17,442

C. Rs.15,700

D. Rs.16,014

Mr. Subhash Bansal, a marketing manager is employed with IMFB limited. He took an advance of Rs. 1,20,000 against the salary of Rs. 30,000 per month in the month of March 2007. The gross salary of Mr. Adhikari for the assessment year 2012-13 shall be:

A. Rs. 3,60,000

B. Rs. 4,80,000

C. Rs. 2,40,000

D. Rs. 3,80,000

Mr. Sahil has two daughter and is in receipt of education allowance of Rs 200 per month for each of them. What would be the taxable allowance in the hands of Mr. Sahil for the full FY.

A. NIL

B. Rs 1,200

C. Rs 2,400

D. Rs 4,800

As per Muslim Law, if the husband is missing for _________ the wife may file a petition for the dissolution of her marriage. __________ of Dissolution of Muslim Marriages Act provides that that where a wife files petition for divorce under this ground, she is required to give the names and addresses of all persons who would have been the legal heirs of the husband on his death.

A. 7 years, Section 3

B. 7 years, Section 5

C. 4 years, Section 3

D. 4 years, Section 5

In_________ type of arrangement, the mortgagor binds himself to repay the mortgage money on a certain date.

A. Simple Mortgage

B. English Mortgage

C. Usufructuary Mortgage

D. Balloon Mortgage

Mr. Syelwester Andrews, a Resident Indian, has income derived from rubber plantation in Malaysia. It shall be treated as:

A. Agricultural income and hence exempt

B. Agricultural income but taxable under the head Income from Other Sources

C. Exempt as earned outside India

D. Taxable in Malaysia

______________ is the final stage in the process of 'Money Laundering' at the International Level.

A. Integration

B. Placement

C. Layering

D. Transposition

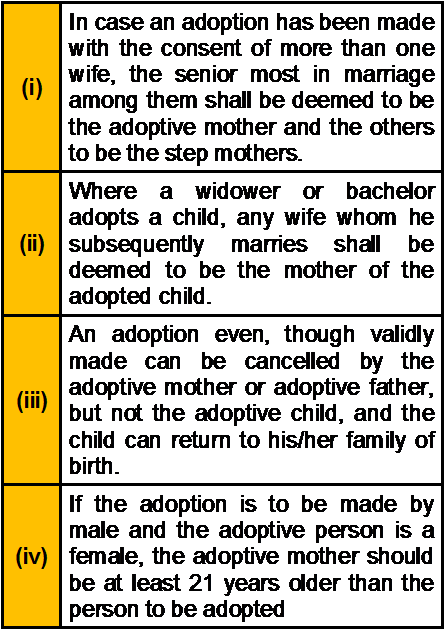

As per Hindu Adoptions and Maintenance Act, 1956, which of the following statement(s)

is/are correct?

A. All of the above

B. None of the above

C. Only (i) and (iv)

D. Only (ii) and (iii)

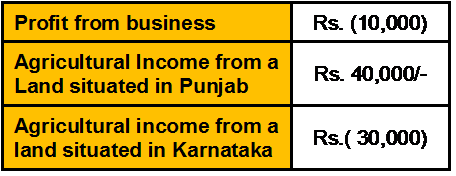

Compute Gross Total income and amount of loss allowed to be carried forward to next

year:

A. Rs. 34,000; Rs. 10,000

B. Rs. 40,000; Rs. 10,000

C. Rs. 40,000; Nil

D. Rs. 40,000; Rs.10,000

As per the Ancient Hindu Law, there are ____________ Vedas. Scholars have determined that ___________ is the oldest of the Vedas.

A. Four, Atharva Veda

B. Four, Rig Veda

C. Three, Atharva Veda

D. Three, Rig Veda

__________ is a arrangement wherein lessee and lessor agree to a payment schedule where for a set period of time, there is no payment and penalty.

A. Skip Lease

B. Pre-Paid Purchase Lease

C. Sub-Lease

D. Operating Lease

| Page 13 out of 40 Pages |

| Previous |