Topic 2: Volume B

An assessee was allowed deduction of unrealized rent to the extent of Rs. 40,000 in the past although the total unrealized rent was Rs. 60,000. He is able to recover from the tenant Rs.45,000 during the previous year on account of such unrealized rent. He shall be liable to tax to the extent of:

A. Rs. 45,000

B. Nil

C. Rs. 25,000

D. Rs. 35,000

A trust is created by a son, the Settlor, for the survival expenses of his retired parents each having equal beneficial interest. Both husband and wife have separate fixed pension of Rs.35,000 per month and Rs. 20,000 per month respectively. The trust property has generated a net annual value of Rs. 5.12 lakh in the previous year 2012-13. The trustee as well as the Settlor is in the 30% tax bracket. Find the tax payable by the trustee as representative assessee.

A. Rs. 79,100/-

B. Rs. 33,370/-

C. Rs. 1,58,210/-

D. Rs. 70,860/-

Pushkar completed the construction of a house property on 14.8.2008 with borrowed capital of Rs.8,00,000 @ 12%. The loan was taken on 1.4.2006 and is still outstanding. The house was used for his own residence during the entire FY 2012-13. Deduction U/S 24(B) for interest on borrowed capital for PY shall be

A. Rs. 1,50,000

B. Rs.30,000

C. Rs.96,000

D. Rs.1,34,400

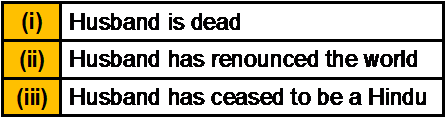

As per Hindu Adoptions and Maintenance Act,1956 a female Hindu can make adoption in

which of the following cases

A. Only (i)

B. (i) and (ii)

C. (i) and (iii)

D. (i),(ii) and (iii)

____________ means excess, increase or addition according to Sharia’ah Terminology. Bahrain has over _________ financial institutions with a wide range of activities including Islamic Insurance.

A. Riba, 30

B. Riba,39

C. Ijarah,30

D. Ijarah,39

For claiming exemption u/s 54G, the assessed shall acquire the new asset within:

A. 2 years from the date of transfer

B. 3 years from the date of transfer

C. one year before or 2 years after the date of transfer

D. one year before or 3 years from the date of transfer

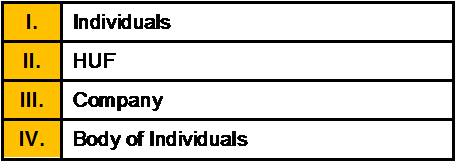

The benefits of exemption of one self occupied house is available to

A. I only

B. I and II only

C. I, II, and III only

D. All of the above

Mukul purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10- 2006 for Rs. 25,00,000/-. Please calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

A. Rs.17,85,129

B. Rs.17,26,175

C. Rs. 17,01,639

D. Rs.17,45,508

The income of any university or other educational institution existing solely for educational purposes and not for the purposes of profit is exempt under clause (iiiad) of Section 10(23C) if the aggregate annual receipts’ of such university or educational institution do not exceed

A. Rs.100 crores

B. Rs.1 crore

C. Rs. 10 crores

D. Rs. 10 lakhs

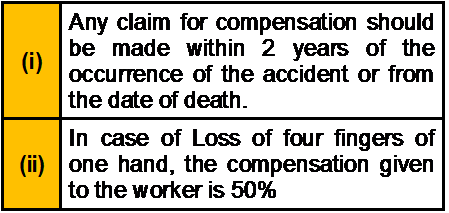

Which of the following statement(s) about Workmen Compensation Act is/are correct?

A. Both (i) and (ii)

B. Only (i)

C. Only (ii)

D. Neither (i) nor (ii)

Gift received is not taxable in hands of

A. Individual

B. HUF

C. Society

D. None of the above

R acquired a property by way of gift from his father in the previous year 1991-92 when its FMV was Rs. 3 lakh. The father had acquired the property in the previous year 1983-84 for Rs. 2 lakh. This property was introduced as capital contribution to a partnership firm in which R became a partner on 10/06/2011. The market value of the asset as on 10/06/2011 was 10 lakh, but it was recorded in the books of account of the firm at Rs. 8 lakh. Compute the capital gain chargeable in the hands of R.

A. Rs. 11,055/-

B. Rs. 7,040/-

C. Nil

D. Rs. 3,075/-

| Page 12 out of 40 Pages |

| Previous |