Topic 2: Volume B

In context to Hindu Marriage Act, 1955 what is “Sapinda Relationship”?

A. It is with reference to any person extends as far as the third generation (inclusive) in the line of ascent through the mother and, the fifth (inclusive) in the line of ascent through the father.

B. It is with reference to any person extends as far as the third generation (inclusive) in the line of ascent through the father and, the fifth (inclusive) in the line of ascent through the mother.

C. It is with reference to any person extends as far as the second generation (inclusive) in the line of ascent through the mother and, the third (inclusive) in the line of ascent through the father.

D. It is with reference to any person extends as far as the second generation (inclusive) in the line of ascent through the father and, the third (inclusive) in the line of ascent through the mother.

Deduction u/s 80-IC regarding special provisions for enterprices in special catogries states is allowed to the extent of:

A. 100% of profits and gains for ten assessment years

B. 100% of profits and gains for ten assessment years in case of any undertaking or enterprise in the States of Sikkim or North Eastern Region and 50% in case of undertaking in Uttaranchal and Himachal Pradesh

C. 100% of profits and gains for ten assessment years in case of any undertaking or enterprise in the States of Sikkim or North Eastern States and 100% of profits and gains for the first 5 assessment years and 25% (30% in case of companies) for next 5 assessment years.

D. None of the these

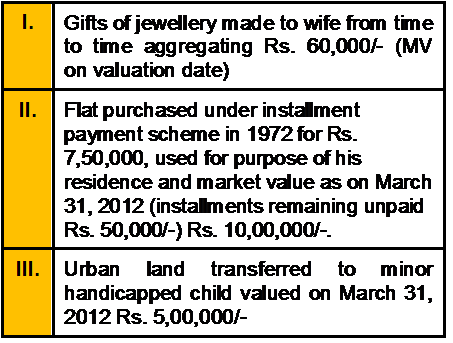

X furnishes the following particulars for the compilation of his wealth-tax return for

assessment year 2012-13.

Calculate the amount on which Wealth Tax is Payable.

A. Rs. 2 lakh

B. Rs. 9.50 lakh

C. Rs. 17 lakh

D. Rs. 9 lakh

The employer had purchased a car for Rs. 3,00,000 which was being used for official purposes. After 2 year 6 months of its use, the car is sold to R, the employee, for Rs. 1,20,000. The value of this perquisite shall be __________.

A. Rs. 72,000

B. Rs. 60,000

C. Nil

D. Rs. 1,23,000

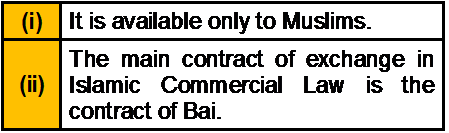

Which of the following statement(s) about Islamic Banking is/are correct?

A. Only (i)

B. Only (ii)

C. Neither (i) nor (ii)

D. Both (i) and (ii)

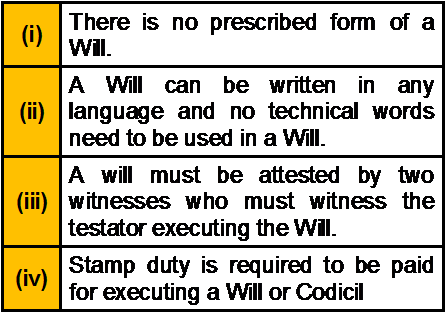

Which of the following statement(s) about Will is/are correct?

A. All except (i)

B. All except (ii)

C. All except (iv)

D. All of the above

Money laundering Process has ____________ stages. The Financial Action Task Force on Money Laundering was formed in __________ by the G7 countries.

A. Three,1989

B. Three,1979

C. Four,1989

D. Four,1989

In case of Loss of Thumb, what is the Percentage of Compensation given (as per Workmen’s Compensation Act)?

A. 20%

B. 25%

C. 30%

D. 50%

Mr. Sumit is an employee of Genesis Ltd. His basic pay is Rs.24,000 p.a., Dearness

Allowance Rs.12,000 p.a; Medical Allowance (fixed) Rs.10,000 p.a.; Conveyance

Allowance Rs.6,000 p.a.; Professional Tax deducted from his salary Rs.1,000 p.a.; Free

lunch provided during office hours valued at Rs.12,000 for a 300-working day year; free

education for two children in a school owned and maintained by the employer – school

tuition fee for both the children is estimated at Rs.18,000 p.a.

What is Net Income of Mr. Sumit and examine whether he is a specified or non-specified

employee?

A. Rs. 51,000; Specified Employee

B. Rs. 50,000 ;Non Specified Employee

C. Rs. 48,000;Specified Employee

D. Rs. 57,000;Non Specified Employee

______________ means a contract in which advance payment is made for good to be delivered later on. ____________ is a special kind of partnership where one partner gives money to the other for investing it in a commercial enterprise.

A. Bai Salam, Mudarabah

B. Bai Salam, Murabahah

C. Bai Muajjal, Musharakah

D. Bai Muajjal,Musawamah

Money-Laundering process has __________ stages.

A. Two

B. Three

C. Four

D. Infinite

Lokesh purchased a flat on 1-4-1996 for Rs. 10,00,000/-. He sells the same flat on 1-10- 2006 for Rs. 25,00,000/-. As a CTEP calculate the Indexed Cost of Acquisition on which capital gain would be calculated. (The CII of year 1995-96 is 281, for year 1996-97 is 305, for year 2005-06 is 497 and for year 2006-07 is 519).

A. Rs.17,01,639

B. Rs.18,46,975

C. Rs.17,68,683

D. Rs.16,29,508

| Page 11 out of 40 Pages |

| Previous |