Topic 2: Volume B

Expenditure incurred in carrying out illegal business is—

A. Not allowed as deduction in any case.

B. Allowable as deduction, if gross total income is less than Rs. 5 lakhs.

C. Allowable as deduction in all cases.

D. Allowable as deduction, if income from illegal business is offered to tax.

X Ltd. has failed to remit the tax deducted at source from annual rent of Rs. 6,60,000 paid to Mr. A for its office building. The said rent is

A. fully allowable as a business expenditure

B. not allowable in view of Section 40(a)(I)

C. allowable to the extent of 50%;

D. none of the above

A salaried individual, aged 45 years, was awarded a car of market value Rs. 6,50,000 by his credit card company in a draw on 20th December 2012. There was no TDS by the company. He has total income from salary of Rs. 8,45,000 in the previous year 2012-13. He saved a total of Rs. 1,80,000 under different investment instruments eligible for exemption u/s 80C and Rs. 25,000 was paid by him on 5th January, 2013 towards his health insurance policy. Find his tax liability for AY2013-14.

A. Rs. 2,77,070/-

B. Rs. 2,79,130/-

C. Rs. 2,60,590/-

D. Rs. 78,280/-

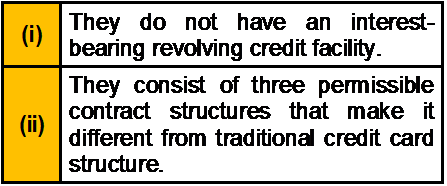

Which of the following statement(s) about Halal Credit Cards is/are correct?

A. Both (i) and (ii)

B. Neither (i) nor (ii)

C. Only (i)

D. Only (ii)

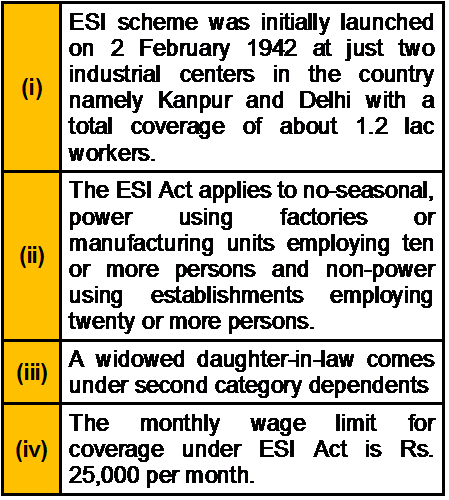

Which of the following statement(s) about Employee State Insurance Act is/are correct?

A. All of the above

B. All except (iv)

C. Only (ii)

D. None of the above

Which of the following is another name for “True Lease”?

A. Pre-Paid Purchase Lease

B. Skip Lease

C. Operating Lease

D. Sub-Lease

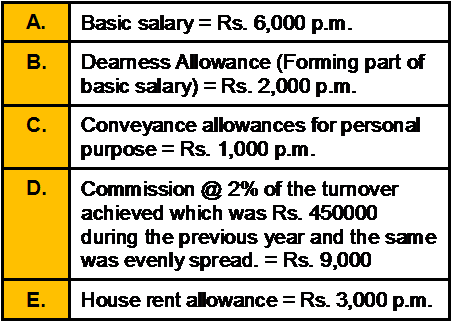

Sudesh Haldia is employed at Delhi as Store Manager in one of the Retail Companies. The

particulars of his salary for the previous year 2006-07 are as under:

The actual rent paid by him is Rs. 2,000 p.m. for an accommodation at Noida till 31-12-

2006.From 1-1-2007 the rent was increased to Rs. 4000 p.m. Compute the taxable HRA?

Tax slab for male / HUF(for AY 2007-08)

Rs. 0 to 100000 — No Income Tax

Rs. 1,00,001 to 1,50,000 — 10%

Rs. 150001 to 2,50,000 — 20%

Rs. 2,50,001 and above — 30%

Note: A surcharge of 10% on income tax amount is payable if total income is exceeding

Rs. 10,00,000 and a 2% education cess is payable on the income tax amount and surcharge.

A. Rs. 16,500

B. Rs. 26,250

C. Rs. 19,125

D. Rs. 31,500

Manish has two house properties. Both are self occupied. The annual value of:

A. Both the house is NIL

B. One house shall be NIL

C. No house shall be NIL

D. Option A with certain condition

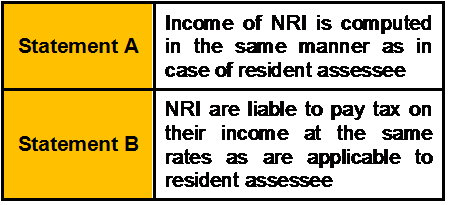

Which of the following statement(s) is/are correct?

A. Statement A is correct

B. Statement B is correct

C. Both statements are correct

D. Both statements are incorrect

Dinesh is entitled to a basic salary of Rs. 5,000 p.m. and dearness allowance of Rs. 1,000 per month, 40% of which forms the part of the retirement benefits. He is also entitled to HRA of Rs. 2,000 per month. He actually pays Rs. 2,000 per month as rent for a house in Delhi. Compute the taxable HRA.

A. Rs. 17,520

B. Rs. 32,400

C. Rs. 18,000

D. Rs. 24,000

Mr Ram aged 53 years has put in 21 years of service in a PSU opts for a voluntary retirement under the company scheme. He has 5 years and 3 months of service left and his last drawn salary is Rs 18,000. He received Rs 10,00,000 as compensation. What would be the taxable part of this receipt?

A. Rs 5,00,000

B. Rs 6,00,000

C. Rs 1,34,000

D. Nil

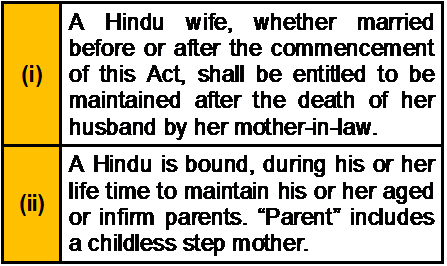

Which of the following statement(s) about Hindu Adoption and Maintenance Act, 1956

is/are correct?

A. Only (i)

B. Only (ii)

C. Both (i) and (ii)

D. Neither (i) nor (ii)

| Page 10 out of 40 Pages |

| Previous |